Coinbase has announced its plan to launch spot crypto trading on its international platform. This development marks a significant milestone for the company and the broader cryptocurrency industry, as it expands the accessibility and liquidity of digital assets on a global scale.

Coinbase, founded in 2012, has emerged as one of the most prominent and trusted cryptocurrency exchanges in the world. The platform has gained widespread adoption due to its user-friendly interface, robust security measures, and diverse range of supported cryptocurrencies. With a strong presence in the United States, the decision to expand its international exchange offerings underscores Coinbase’s commitment to serving a global customer base.

The introduction of spot crypto trading on Coinbase’s international exchange is poised to provide users with the ability to buy and sell a wide array of digital assets directly. Spot trading refers to the purchase or sale of cryptocurrencies for immediate delivery, as opposed to trading futures or other derivative products. By offering spot trading, Coinbase aims to cater to the growing demand for direct access to digital assets, enabling users to engage in real-time transactions with ease.

Impact on Global Crypto Markets

The launch of spot crypto trading on Coinbase’s international exchange is expected to have several implications for the global crypto markets:

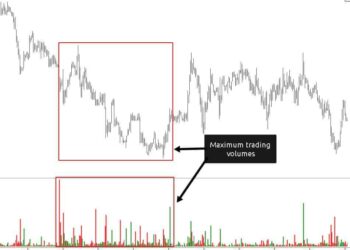

- Increased Liquidity: With expanded spot trading capabilities, the liquidity of various cryptocurrencies is likely to improve, fostering a more efficient and vibrant market environment.

- Enhanced Market Access: Users in international markets will gain access to a broader selection of digital assets, empowering them to diversify their portfolios and participate in a range of trading opportunities.

- Market Validation: Coinbase’s initiative to introduce spot trading internationally signals a growing recognition of the legitimacy and potential of cryptocurrencies within the traditional financial landscape.

As Coinbase extends its spot trading services to international users, the company will need to navigate a complex regulatory landscape. Compliance with diverse regulatory frameworks across different jurisdictions will be crucial to ensuring a seamless and secure trading experience for customers. Coinbase’s commitment to upholding regulatory standards and fostering transparency will be pivotal in sustaining trust and confidence among global users.

The expansion of spot crypto trading on Coinbase’s international exchange reflects the company’s forward-looking approach to driving innovation and accessibility within the cryptocurrency space. As digital assets continue to gain traction as a legitimate asset class, Coinbase’s efforts to broaden its global offerings are poised to contribute to the ongoing evolution of the crypto ecosystem.

In conclusion, the launch of spot crypto trading on Coinbase’s international exchange represents a significant advancement in the accessibility and liquidity of digital assets on a global scale. With its established reputation and commitment to compliance, Coinbase is well-positioned to shape the future of cryptocurrency trading for users around the world.

This article has provided an overview of Coinbase’s international exchange expansion and its potential impact on the global crypto markets, shedding light on the regulatory considerations and future outlook associated with this development. As the cryptocurrency landscape continues to evolve, Coinbase’s strategic initiatives are indicative of the ongoing maturation and integration of digital assets within the broader financial ecosystem.