Bitcoin occupies a dominant and foundational spot in the cryptocurrency market. Introduced in 2009 by a person or group of persons with the pseudonym, ‘Satoshi Nakamoto’, Bitcoin was the first cryptocurrency making it the ground-breaking and original digital currency, which laid the basis for the whole cryptocurrency ecosystem.

Highly considered by many as “digital gold”, Bitcoin has undergone significant evolution since its creation which has drawn the attention of a lot of trading experts, investors and newbies.

It is important to understand that predicting the accurate future price of Bitcoin or any other cryptocurrency is difficult given various factors. Several experts and analysts provide varying opinions on Bitcoin’s future price while focusing on different factors to arrive at these predictions.

In Thailand, a group of crypto traders are merging astrological beliefs with technical analysis to generate predictions. Like we mentioned earlier, this exercise which involves predicting the exact future price of Bitcoin is shrouded with challenges and could pose as a misleading factor especially for crypto novices and also cause financial holdups among members.

Below are some common mistakes traders/investors frequently make while trying to correctly predict Bitcoin’s price, and how this information will assist you in making more informed investment decisions going forward.

Misuse or Relying Solely on Technical Analysis

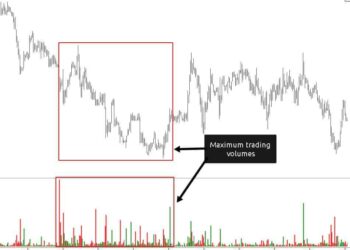

While technical analysis is valuable as it divides historical price data and trading volumes to extract potential trends, solely depending on it or misusing it can be a problem. The extreme concentration on short-term analysis, which although can be valuable, can also overshadow essential long-term trends and fundamental factors which might form Bitcoin’s price.

Sidelining fundamental analysis is another common mistake. Notwithstanding its value and usefulness, technical analysis should not exist on its own. It must be merged with fundamental analysis, which investigates into inherent factors like economic circumstances and relevant news, providing a more inclusive market viewpoint.

Exaggerating chart patterns whereas neglecting other indicators might ignore crucial market insights given the subjective nature of chart patterns. Irrespective of the fact that technical indicators are of great value as mentioned above, largely depending on them can be quite destructive owing to their lagging nature, indicating market shifts after the event.

Bitcoin’s market is also affected by fundamental factors, and an all-encompassing approach is essential for accurate predictions.

Overemphasizing the Past

Overemphasizing the past performance of Bitcoin’s price is another common mistake. Several traders and investors dig into historical data, with the hope that if an event transpired in the past, it can ensue again. Assumptions such as this fail to take into account the multifaceted dynamics that affect Bitcoin’s price.

The valuable insights that historical data provides is but one piece of the entire puzzle. Many factors ranging from global policy changes, technological advancements, changes in public sentiments and wider economic climates all play a part in influencing the price of Bitcoin. This means that depending entirely on just historical data can blur the bigger picture, highlighting the need for an all-inclusive, discerning strategy in price prediction.

The Perils of Social Media’s Pull

The rise of social media has entwined public sentiment with cryptocurrency markets, particularly Bitcoin. influential figures and media channels play a vital role in determining market sentiment, resulting to inflated confidence or doubt about Bitcoin’s future price.

Studies have revealed that there is a strong connection between trending tweets and cryptocurrency’s market behavior, underlining the effect of social media on price movements. Sentiment examination further confirms how public emotions, shaped by media and influencers, can predict Bitcoin’s market position.

The opinions of influential figures, spread across posts and articles, can initiate market insights and, by extension, Bitcoin’s price. This emotional push and pull, strengthened by media and influencers, can distort accurate price predictions. This situation makes it vital for investors, especially beginners, to distinguish between grounded insights and clamor of social media.

This calls for a balanced method, that takes into consideration multiple sources and evades hype-driven sentiments, is important for accurate Bitcoin price prediction.

The Risks of Reactive Trading

The unpredictable nature of Bitcoin’s market usually prompts reactive trading decisions, motivated by the hopes of snatching short-lived profit opportunities. This spontaneous move without an inclusive approach can lead to defective predictions and possible financial setbacks.

Consider the influence of regulatory announcements or broad economic shifts on Bitcoin. These can drive investors into a frenzy, either pulling them in or pushing them away quickly, thus changing market dynamics. The market’s short-term order book, where immediate buy and sell intentions are recorded can indicate its impulsive nature.

However, exclusively relying on this for predictions would lead to the failure of capturing the wider market mood and trends. Summarily, spontaneously going after sporadic substantial price moves without understanding the genesis of the moves or broader market climate can mislead price predictions.

It is advisable to follow a grounded and well-informed approach in a bid to discern Bitcoin price movements, rather than one influenced by brief market tremors as the well-informed approach guards against pointless financial pitfalls.

Complexities of ML and DL

Machine learning (ML) and deep learning (DL) technologies have affected Bitcoin price predictions by increasingly filtering forecasts through data analysis. However, there is a downside to these advanced tools. They often result to erroneous forecasts and financial delays when misinterpreted or misused.

A common slip-up is overlooking sample dimension implication, with some strategies barely focusing on intensifying accuracy while deserting the crucial role that sample dimension plays in effective ML-based Bitcoin price forecasting. Matching ML models with suitable data is vital to avoid inaccuracies.

The unpredictable nature of Bitcoin further introduces difficulty. Using ML models without accepting this unpredictability can lead to erroneous predictions. Accomplishing high predictive accuracy while utilizing ML and DL technologies involves a profound understanding of the fundamental principles, appropriate model selection associated with data, and a complete acknowledgment of Bitcoin’s integral price volatility.

The Road Ahead

Every evolution usher in new waves, which needs to be studied in order to effectively navigate through. As Bitcoin rises in popularity, the expedition ahead needs careful navigation and understanding.

Welcoming technological innovations is essential, but engaging them astutely is vital. The problem here lies in the way we handle and steer through these. They are of value but can be destructive when misused, it is therefore important to evaluate their impacts thoughtfully. Instead of reactive trading, you should make decisions based on knowledge and strategy.

The first step to avoiding these mistakes is being aware of them. Bitcoin traders should prioritize risk management, adhering to crypto trading rules, conduct thorough research, avoid impulsive decisions that are based off of social media buzz and continuously learn to improve their trading skills.

The challenges posed by these mistakes calls for some sort of complementary strategy. This should be seen in the investors or trader’s ability to merge technology with understanding. One should pay close attention in order to avoid getting tangled up in hype, and focus on an encompassing approach.

Due to the volatile nature of Bitcoin, one needs to exercise flexibility, carefulness and also consider various variables before jumping into any decision. Tread with care, proper and well-grounded research, and make accuracy your motto while making predictions.