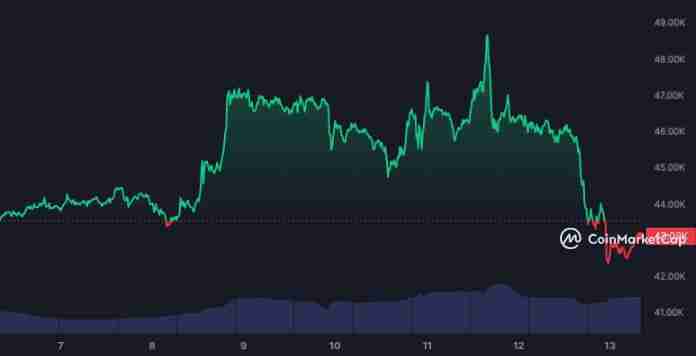

In recent weeks, Bitcoin (BTC) has experienced increased volatility, prompting concerns among investors about the possibility of a significant downturn. Analysts and market experts are closely monitoring various factors that could contribute to Bitcoin falling below the crucial $42,000 support level. Let’s explore some of the key reasons behind this apprehension.

1. Market Sentiment and Speculative Trading:

The cryptocurrency market is highly influenced by investor sentiment, which can be particularly volatile. If a negative sentiment gains momentum, it can lead to panic selling and trigger a cascading effect, causing Bitcoin’s price to plummet. Speculative trading practices, often fueled by market sentiment, can exacerbate price swings and contribute to a potential decline.

2. Regulatory Developments:

Cryptocurrency markets are significantly affected by regulatory developments globally. Any announcements or changes in regulations, especially those with the potential to impact the adoption and use of Bitcoin, can lead to uncertainty and market turbulence. Investors tend to react strongly to regulatory news, and adverse developments could contribute to a bearish trend.

3. Technical Analysis Indicators:

Technical analysis plays a crucial role in predicting market trends, and some indicators are suggesting potential bearish signals for Bitcoin. Traders often analyze moving averages, support and resistance levels, and other technical indicators to make informed decisions. If these indicators point towards a weakening market, it could lead to a sell-off and drive Bitcoin’s price below the $42,000 mark.

4. Macro-Economic Factors:

Bitcoin is often considered a hedge against traditional financial market risks. However, macro-economic factors such as inflation rates, interest rates, and overall economic stability can influence investor behavior. If economic uncertainties lead investors to seek safer assets, Bitcoin might experience increased selling pressure, contributing to a decline in its price.

5. Market Liquidity and Volume:

Liquidity and trading volume are critical factors in determining the stability of any market. A lack of liquidity or a significant drop in trading volume can make it easier for large sell orders to impact the price negatively. Traders are closely watching for any signs of decreasing liquidity and trading activity, as these could be early indicators of a potential downturn.

6. External Shocks and Global Events:

Cryptocurrency markets are not immune to external shocks and global events. Unexpected geopolitical events, economic crises, or unforeseen developments in traditional financial markets can create a ripple effect that reaches the cryptocurrency space. Traders and investors are on high alert for any events that could trigger widespread market uncertainty.

7. Market Corrections and Profit-Taking:

Bitcoin has witnessed impressive price gains over the past few months, and a correction is a natural part of market cycles. Traders who have accumulated profits may decide to take some gains off the table, contributing to selling pressure. If a significant number of investors opt for profit-taking simultaneously, it could lead to a decline in Bitcoin’s price.

In conclusion, while Bitcoin has shown resilience and remarkable growth, the current market conditions warrant caution. The confluence of negative sentiment, regulatory uncertainties, technical indicators, macro-economic factors, liquidity issues, external shocks, and profit-taking could potentially drive Bitcoin below the crucial support level of $42,000. Investors are advised to stay vigilant, diversify their portfolios, and carefully monitor market developments to make informed decisions in these uncertain times.