Exchange-Traded Funds (ETFs) have become popular investment vehicles, providing investors with exposure to various asset classes. Among the myriad of ETF options available, Bitcoin ETFs and Gold ETFs stand out as intriguing choices. While both offer exposure to alternative assets, they differ significantly in terms of underlying assets, market dynamics, and risk factors. This article explores the distinctions between Bitcoin ETFs and Gold ETFs, shedding light on key aspects that investors should consider.

Underlying Assets

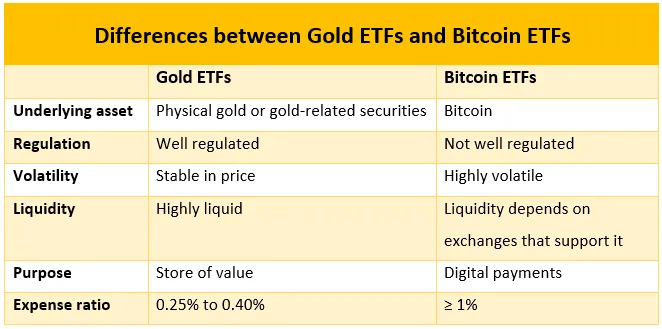

The most apparent difference lies in the underlying assets that these ETFs track. Gold ETFs, as the name suggests, are tied to the price of physical gold. Investors in Gold ETFs indirectly own a portion of the gold held in a vault by the fund, benefiting from the price movements of the precious metal.

On the other hand, Bitcoin ETFs track the price of Bitcoin, the leading cryptocurrency. Investors in Bitcoin ETFs do not own the actual cryptocurrency itself but hold shares in the ETF, representing a stake in the fund’s Bitcoin holdings. This fundamental distinction reflects the contrasting nature of physical commodities like gold and digital assets like Bitcoin.

Market Dynamics

Gold has been a traditional store of value for centuries, often considered a safe-haven asset during times of economic uncertainty. Gold ETFs tend to attract investors seeking stability and a hedge against inflation. The market dynamics for gold are influenced by factors such as geopolitical events, economic downturns, and fluctuations in the US dollar.

Bitcoin, as a relatively new asset class, operates in a digital realm and is known for its price volatility. attract a different breed of investors, often those seeking exposure to the potential high returns offered by the cryptocurrency market. Market dynamics for Bitcoin are influenced by factors such as regulatory developments, technological advancements, and overall sentiment within the crypto community.

Risk Factors

While both types of ETFs present unique opportunities, they also come with their own set of risks. Gold, being a physical commodity, is subject to factors such as mining supply, geopolitical risks, and changes in industrial demand. Economic downturns can affect the demand for gold, impacting its price.

Bitcoin, on the other hand, is a digital asset with its own set of risks. Regulatory uncertainty, market sentiment, and technological vulnerabilities can significantly impact the price of Bitcoin. The relatively short history of cryptocurrencies adds an element of unpredictability to the market, making Bitcoin ETFs appealing to risk-tolerant investors.

Regulatory Setting

Regulatory considerations play a crucial role in the investment setting for both Bitcoin and Gold ETFs. Gold ETFs are well-established and have been around for decades, with a regulatory framework that is familiar to many investors. Regulatory bodies closely monitor these funds to ensure transparency and investor protection.

Bitcoin ETFs, on the other hand, have faced a more complex regulatory journey. The developing nature of the cryptocurrency market has led to ongoing discussions and debates regarding the approval of Bitcoin ETFs by regulatory authorities. Investors in Bitcoin ETFs should stay abreast of regulatory developments, as changes in the regulatory setting can impact the fund’s operation and market dynamics.

Conclusion

In the realm of ETFs, the choice between Bitcoin ETFs and Gold ETFs boils down to individual investment objectives, risk tolerance, and market outlook. Gold ETFs appeal to those seeking stability and a traditional store of value, while Bitcoin ETFs attract investors intrigued by the potential of the dynamic cryptocurrency market.

Understanding the differences between these two types of ETFs is essential for making informed investment decisions. As with any investment, thorough research, diversification, and consideration of one’s financial goals are crucial. Whether opting for the time-tested allure of gold or venturing into the digital frontier with Bitcoin, investors should approach ETFs with a clear understanding of the unique characteristics and risks associated with each asset class.