What is Ripple (XRP)?

Ripple (XRP) is a cryptocurrency token that was developed with the goal of moving transactions away from centralized databases that are controlled by financial institutions and toward a more open infrastructure, all while significantly reducing transaction fees. Because they are trustless, instant, and inexpensive, XRP transactions offer several benefits that make them attractive for international transactions.

The cryptocurrency, introduced in 2012, has one of the most ambitious goals currently being pursued in the cryptocurrency space. The XRP Ledger, the piece of software that enables the use of XRP, has proposed a new way of operating blockchains, which its proponent claim is better suited for processing transactions.

Anyone can contribute computing power, validate transactions, and secure the software that runs Bitcoin using this decentralized ledger. On the other hand, the XRP Ledger only permits a subset of network participants to participate in the validation of transactions and the protection of the network. More than 150 of these participants are actively participating in the network, and they are referred to collectively as the Unique Node List. But does XRP have a decentralized structure?

At the time of the product’s launch, a total of one hundred billion XRP tokens were pre-mined and subsequently gifted or given away to a variety of individuals, businesses, and members of the general public. Because only a few entities controlled a significant portion of the available coins at the time, this development led to concerns regarding the cryptocurrency’s decentralization.

To add fuel to the fire, the involvement of XRP in the market is dependent on a for-profit company called Ripple, which, to this day, functions as the primary player in the XRP ecosystem. This further complicates the situation. As a significant holder of XRP tokens, Ripple not only contributes to the upkeep of the XRP Ledger but also plays a pivotal role in the progression of the ledger itself.

In this article, we will talk about Ripple’s cryptocurrency, XRP, as well as its functionality, how to mine XRP, how to invest in Ripple, XRP wallets, and how Ripple compares to Bitcoin.

How does Ripple (XRP) work?

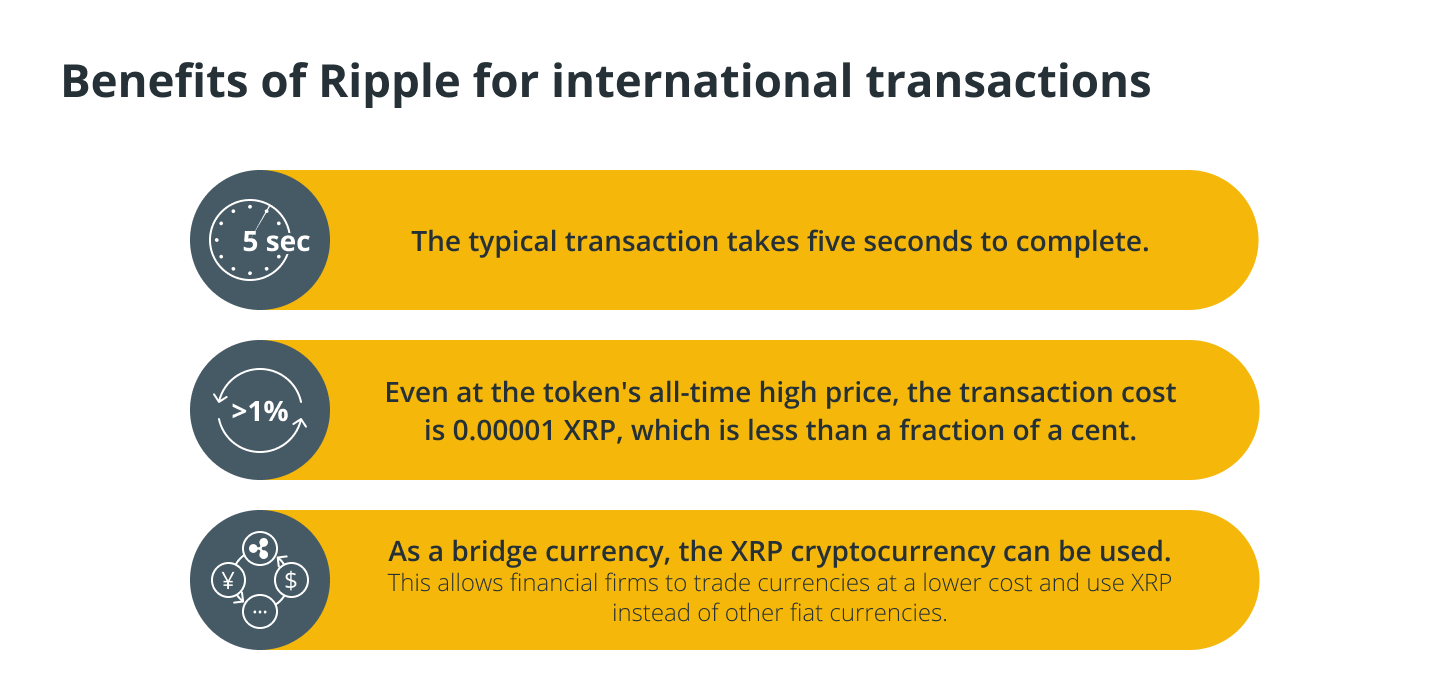

Ripple’s blockchain infrastructure, known as RippleNet, has been designed with the intention of facilitating fast, easy, and inexpensive international financial transactions between banks. Consequently, it is a workable alternative to the prevalent international payments system that the majority of banks are currently utilizing, known as the Society for Worldwide Interbank Financial Telecommunication. Those who engage in international transactions can take advantage of Ripple’s many advantages, including the following:

The XRP cryptocurrency makes use of a consensus system that includes several servers owned by banks in order to perform transaction verification. The proposed transactions are compared by the validators to the most recent version of the XRP Ledger, which allows the validators to determine whether or not the proposed transactions are valid. In order for a transaction to be validated, it needs to receive approval from the vast majority of validators.

RippleNet offers a wide variety of options for making payments across international borders for companies and other types of financial institutions. The following are included in this category:

The history of Ripple (XRP)

The history of Ripple (XRP)

The majority of cryptocurrencies can be traced back to a single defining individual or organization as the original creator of the cryptocurrency. For example, a person going by the alias Satoshi Nakamoto developed the cryptocurrency known as Bitcoin (BTC). The history of XRP is complicated because a number of different people were involved in the development of both the technology that underpins it and the business entities that have contributed to its expansion.

The creation of XRP is frequently attributed to the co-founders of OpenCoin: Jed McCaleb (who also founded Mt. Gox), Arthur Britto (who assisted in the development of the XRP Ledger), and Chris Larsen (who founded several fintech firms). However, despite the fact that they were notable individuals in the area, there were also other people involved.

These individuals include David Schwartz, currently serving as Ripple’s chief technology officer and contributing to the writing of the initial Ripple whitepaper, and Stefan Thomas, who was a previous chief technology officer for Ripple.

The distinctions between Ripple and XRP

The terms “Ripple” and “XRP” are frequently used interchangeably in a number of stories and articles. But do they refer to the same thing? Or, what exactly is the XRP? And what exactly is its connection to Ripple?

It is essential to understand clearly that the following are not the same: Ripple is a for-profit company that helps promote and develop XRP, the software behind it (the XRP Ledger), and a variety of other transaction-focused projects. XRP is the name of the cryptocurrency that Ripple helps develop. The company is adamant that the two organizations exist independently of one another.

On its website, Ripple refers to XRP as being “faster, less costly, and more scalable” than any other digital asset. The XRP Ledger is what “powers innovative technology across the payments space” according to this company. The following is how the company explains its involvement with XRP:

“The primary focus of Ripple’s development efforts is on technology that will facilitate the release of new uses for XRP and revolutionize global payment systems. Additional XRP-related use cases are also being investigated by third parties.

In September 2012, a company that would later be known as Ripple was established under the name OpenCoin. This was one year after work had initially begun on the XRP Ledger. OpenCoin changed its name to Ripple Labs in 2013, and the company didn’t settle on just using the Ripple moniker until 2015. The XRP Ledger was formerly known as the Ripple Open Payments System. Later on, it was rebranded as the Ripple Consensus Ledger. Finally, it was renamed the XRP Ledger.

After the XRP Ledger was fully operational, the people behind it concluded that they should give 80 billion tokens to a private company so that it could work with the cryptocurrency community to provide support. Ripple, the company that made a claim, stated that it had been selling XRP in a methodical manner and using the proceeds to “incentivize market maker activity to increase XRP liquidity and strengthen the overall health of XRP markets.”

Initially, the ticker symbol for “ripples” or “Ripple credits” was XRP; however, over the course of time, these names were changed to simply XRP in order to reduce the likelihood of confusion.

How to mine XRP

Ripple (XRP) is generated by a crypto ledger that operates in a manner analogous to that of blockchain technology. This ledger is federated by networks of financial institutions and payment processors.

Even though it is true that miners are unable to mine Ripple (XRP), it is technically possible to do so using other cryptocurrencies. For instance, one can mine other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), and then swap the mined cryptocurrency for Ripple (XRP) through exchanges. This is one of the most realistic approaches to mining XRP and is also one of the most difficult.

Ripple (XRP) VS Bitcoin (BTC)

Ripple (XRP) and Bitcoin are not directly competing with one another because they were developed to accomplish different goals. Bitcoin is the most accessible cryptocurrency because it enables anyone, regardless of jurisdiction, to trade or carry BTC anywhere on the planet. This makes Bitcoin the most popular cryptocurrency. XRP operates more like a specialized tool for settling international transactions at prices lower than those of typical fiat currency and at significantly faster speeds.

Because Bitcoin has the potential to be openly traded as a true store of value, the general public has the ability to exert a greater amount of influence over any artificial rules and market predictions. The use case for XRP is not based on price; rather, it primarily depends on the collaboration between Ripple and various financial institutions.

What exactly is the purpose of Ripples and what is it used for?

Ripple was founded with the intention of collaborating with the XRP community to expand the use cases for the cryptocurrency. Over time, it developed a number of services that made it possible for cryptocurrencies to be used in international financial transactions. At one point, remittance giants like MoneyGram were using Ripple’s products before their partnership came to an end.

RippleNet “offers connections to hundreds of financial institutions around the world via a single API and makes moving money faster, cheaper, and more reliable,” according to the company’s website. This offering brings together all of the company’s previous offerings that were related to XRP.

RippleNet removes users’ requirement to pre-fund their accounts by providing a service known as On-Demand Liquidity. This service uses XRP as a source of liquidity during international transactions. RippleNet is used by major remittance companies as well as financial institutions such as Santander, Bank of America, SBI Remit, American Express, and Banco Rendimento.

In a nutshell, the XRP-powered solution that Ripple has developed assists network members in processing payments with real-time settlement, thereby improving both payment efficiency and certainty. It is possible to source liquidity on demand using XRP, which also helps reduce the amount of money that must be held in nostro accounts in order to process international transactions.

Ripple is also a financial backer of the Interledger Protocol, which is a software platform with the mission of making it easier to transfer value between cryptocurrency ledgers and traditional bank ledgers. The use of XRP is not necessary to participate in the Interledger Protocol; however, it is possible for it to be linked to the XRP Ledger.

Lastly, XRP uses RippleX, a platform that enables software engineers and business owners to incorporate blockchain technology into their applications by providing them with tools and services built on top of the XRP Ledger. As is the case with many other cryptocurrencies, XRP can also be used directly on the chain.

How does the XRP Ledger manage to be so effective?

How does the XRP Ledger manage to be so effective?

The fact that the average transaction fee for XRP is $0.0013927 might be surprising to users who have experience with other cryptocurrencies. The average transaction fee on Bitcoin and Ethereum, the top two cryptocurrencies by market capitalization, has frequently reached two digits, with all-time highs exceeding $50. This is in contrast to the transaction fee on Litecoin, which rarely exceeds one digit.

The XRP Ledger is not a Bitcoin blockchain network fork, but it uses some of that network’s features. These features include the use of public and private cryptographic keys, the use of a public ledger, and the requirement for digital signatures on transactions.

On the other hand, it does not depend on a proof-of-work (PoW) consensus algorithm that is supported by specialized computing hardware. Instead, it is based on a network of “unique nodes” that efficiently agree on which transactions can be processed throughout the network. This network is the key to its success. A Federated Byzantine Agreement consensus mechanism is utilized on networks that make use of permissioned servers. These servers are responsible for the upkeep of a one-of-a-kind Node List.

Transactions are considered to have been efficiently validated according to the rules of the XRP Ledger if 80% of these distinct nodes agree that the transaction in question was lawful. The XRP Ledger uses a naturally more trusted design than other cryptocurrencies, which has led to some concerns regarding its level of decentralization and permissionlessness. [Cryptocurrency]

Each new “ledger version” added to the XRP Ledger is analogous to a block added to the Bitcoin blockchain in that it stores the complete state of all balances on the XRP network. As a direct consequence of this, servers are able to synchronize with the network in a matter of minutes.

How to put XRP to use

By simply creating a wallet, users of Bitcoin, Ethereum, and a multitude of other cryptocurrencies are able to use the cryptocurrencies. The same is true for XRP, with the exception that new wallet addresses require a minimum of 20 tokens before they can be booked. It is recommended that new users of XRP select a single wallet rather than committing to multiple addresses in order to avoid incurring additional costs than are necessary.

On the market, you can choose from a few different kinds of wallets that are suitable for use with the XRP network. The majority of users choose to store their tokens on the cryptocurrency exchanges where they bought them in order to avoid the cost of 20 XRP, which is handled by the exchanges themselves. However, keeping one’s money on a trading platform comes with several risks, including the possibility that the platform will be hacked or the coins will be frozen.

An XRP wallet is a piece of software that can be used by investors to store XRP outside of a cryptocurrency exchange. Wallets that allow users to retain control over their private keys are strongly recommended for reasons related to data security. The alternative, which is typically a web-based wallet with control over its users’ private keys, additionally incurs operational costs.

You will need to acquire XRP, which can be done on the majority of the leading cryptocurrency exchanges, in order to get your hands on a wallet before you can move your funds into one. Ripple was sued by the United States Securities and Exchange Commission in 2020 regarding the alleged sale of $1.3 billion in unregistered securities, which referred to the company’s sales of XRP. As a result of this lawsuit, XRP was delisted from a number of different platforms in 2020.

Ripple keeps up a page titled “XRP Markets,” on which users can view information such as where the token is listed and how much volume it sees. After successfully purchasing XRP on an exchange, users can transfer the funds to their personal wallets or maintain them on the trading platform. On exchanges, selling XRP is also a simple task, especially on those that have a significant volume of daily trading activity.

Understanding XRP’s value

Understanding XRP’s value

At the time of launch, a total of 100 billion XRP tokens were pre-mined, and the XRP Ledger software ensures that this limit is never exceeded; no additional tokens will ever be produced. Ripple has deposited the majority of the tokens that are left over after distributing 55 billion of them to its users on its forums and using the remainder to fund its technological advancement and development.

On the XRP Ledger, transactions do not incur the traditional fees associated with conducting a transaction; rather, the sender is required to forfeit a small amount of XRP for each transaction. Despite the fact that this makes XRP a deflationary currency, it is estimated that “it would take at least 70,000 years to destroy all XRP” at the current rate of destruction. In addition, costs and prices may be altered per the fluctuating supply of XRP.

The use of XRP by financial institutions connected to RippleNet is thought by some investors to have the potential to significantly boost demand for the cryptocurrency. Proponents of XRP argue that the price of the cryptocurrency will continue on an upward price trajectory as demand increases and its supply decreases slightly.

The price of the cryptocurrency reached $3.55 during the bull market in 2017, the same year that Ripple placed 55 billion XRP in an escrow system based on the XRP Ledger. Each month, the escrow holding these tokens is broken and they are released. There is currently selling pressure against XRP due to a number of factors, most of which are anticipated to become irrelevant in the near future. The release of tokens from escrow by Ripple has resulted in XRP sales, which will end when Ripple decides to alter its strategy or when the SEC orders it to do so.

Keep in mind that one of Ripple’s co-founders, Jed McCaleb, who left the company in 2014 to work on competitor Stellar (XLM), was given 9 billion XRP as a reward for his role in the development and founding of the company. This is an important consideration to take into account. The business owner disclosed on XRP Talk, a community forum devoted to investors in XRP, that he plans to sell his XRP as soon as he gets his hands on it.

McCaleb’s XRP tokens are delivered to him on a predetermined schedule in conjunction with the release of the funds from escrow. While he does sell the majority of the tokens he obtains and adds selling pressure to the price, he has also donated a portion of his tokens to charitable organizations such as GiveDirectly and Literacy Bridge. These organizations are among the recipients of his donations.

How can I purchase Ripple (XRP)?

To make use of XRP, one must first acquire the asset through either purchase or receipt. Purchases of XRP can be made through a variety of different channels, including centralized exchanges, peer-to-peer (P2P) investments, or decentralized exchanges, depending on the individual’s preference (DEXs).

When using a centralized cryptocurrency exchange to buy XRP, the process typically involves sending fiat currency (such as USD, EUR, JPY, and so on) to the exchange in the form of a bank transfer first, and then using those funds to buy XRP. On a number of cryptocurrency exchanges, customers can use their credit cards to purchase digital assets as an additional payment option. In addition, depending on the exchange you use, you may be able to purchase XRP by exchanging other cryptocurrencies, a practice known as crypto-to-crypto pairings (such as XRP for Bitcoin).

A person can make a P2P purchase by arranging to meet a friend or family member who already possesses XRP in order to buy the asset directly from them. Check to see if the person in question has XRP in their possession.

Due to the fact that XRP is a token that is built on its own distributed ledger, it is important to note that XRP cannot be purchased on DEXs such as SushiSwap, Uniswap, or 1inch at this time (called XRPL). The XRP Ledger incorporates a fully functional exchange, where users can trade issued currencies for XRP or with one another, and users can also trade XRP for other cryptocurrencies.

Is purchasing XRP a wise financial move?

The rule that cryptocurrencies are highly volatile is something for which XRP does not make an exception. If you think Ripple’s expansion will continue, then even a small investment in XRP could be profitable for you. Investing in Ripple is riskier than buying stocks, but if the company is successful, you could end up with a significant fortune. Always remember that investing is done at your own risk!

At the same time, it is easy to recognize Ripple’s potential. It has the potential to take the place of an ineffective and antiquated international system for the transfer of money. The fact that it has connections to banks is a positive sign. And any favourable changes in its legal position could result in a price hike, providing investors with profits from the increased value of their investment. Therefore, you should stop asking yourself, “Should I purchase XRP?” First complete your research, and only then start taking any action.