How alternative financial products, such as decentralized finance (DeFi), can assist people with low incomes, there is no doubt that the deeply ingrained ideas of financial stability that centralized finance once held were thrown into disarray as a result of the Great Financial Crisis of 2008–2009.

The economic crisis had a widespread impact, as it was felt all over the world as banks and businesses failed, stock markets crashed, and international trade shrank.

Satoshi Nakamoto initially created Bitcoin in 2009 as a direct reaction to the Great Financial Crisis. This event served as a catalyst for the growth of decentralized financial systems.

Bitcoin (BTC) provides regular people with access to a financial system that operates on the basis of decentralized consensus rather than centralized fiat currency.

The financial crisis brought into sharper focus the harsh reality that even the most well-established banking systems in the world are susceptible to collapse under certain conditions.

A modern financial system that was already fragile and favoured financial elites was shown to have even more cracks, which brought attention to the growing necessity of decentralizing financial transactions.

Bitcoin was one of the first legitimate options available to the public and was instrumental in the birth of cryptocurrency. Centralized financial systems were bypassed entirely.

How is DeFi different from traditional finance?

Decentralized finance, also known as “DeFi,” gives individuals access to financial products through a distributed blockchain network, in contrast to traditional finance, which is dependent on centralized governance. Traditional finance is also referred to as “finance.”

People are able to access transactions through an immutable public record of transactions when using DeFi, which eliminates the requirement for a third party to act as a middleman, such as a bank or a brokerage firm.

The fundamental concept behind DeFi is the democratization of the financial system through the replacement of centralized institutions (such as banks) with peer-to-peer relationships that do not call for the involvement of intermediaries.

Imagine the following to get a sense of the profound impact that DeFi will have on the world: In theory, the financial services that are currently available to us, such as loans, savings accounts, insurance, and a variety of other options, could one day be provided by a blockchain network rather than by banks.

People are currently able to engage in many of the financial transactions that were previously only available through banks. These include lending and borrowing money, earning interest, purchasing insurance, trading assets and derivatives, and a variety of other financial dealings.

The primary distinction lies in the fact that transactions can be completed much more rapidly and do not need to involve a third party or the paperwork that is typically associated with conventional forms of finance.

Traditional financial systems’ control over the public’s money, financial services, and financial products can be eliminated through the use of DeFi.

DeFi is built on top of encrypted distributed ledgers, and participation is open to anyone (i.e., you can use the blockchain network and decentralized finance platforms to make payments, borrow, invest and even lend your funds regardless of who you are and your location).

It primarily operates on Ethereum, which enables programmers to continue developing a wide variety of financial platforms that are both secure and effective.

The following are some of the primary advantages that decentralized finance has over conventional finance:

• People keep their money in safe digital wallets rather than keeping it in banks

• DeFi eliminates the steep fees levied by banks and other financial institutions in exchange for their services

• DeFi is permissionless, which means that anyone with internet access can use it without securing approval from a central authority

• The transfer of money can be completed in a very short amount of time.

The influence of DeFi is extremely significant. To get a sense of how significant its impact is, one need only consider how decentralized finance is displacing traditional banking for the underbanked population. There are currently more than two billion people in the world who do not have bank accounts.

According to Statista.com, nations whose economies are less stable have higher percentages of their populations that are not banked. The majority of the time, less developed financial systems also inspire mistrust in the general population, which further drives up the percentage of people who are unbanked.

However, even first-world countries like the United States have a population that does not have access to banking services, and the most common reason given for this is a lack of financial resources.

When it comes to fees and charges, opening an account and other aspects of financial services are frequently priced quite high (such as credit card memberships, withdrawal fees, bank checks and the like).

As a result of this, it is easy to comprehend why customers with low incomes might be unable to find an option within traditional financial systems that is suitable for them.

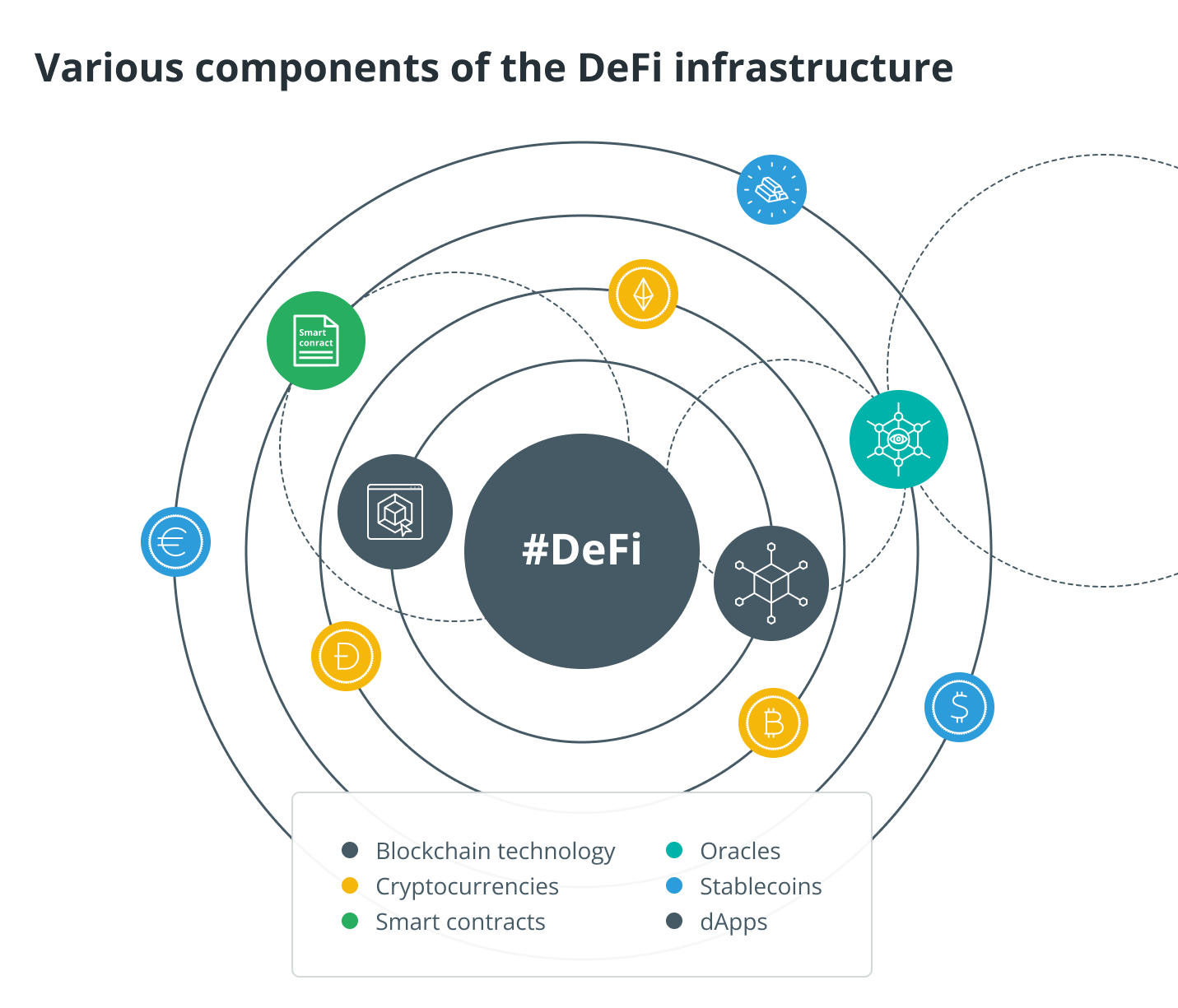

The following elements make up the DeFi infrastructure:

• Blockchain technology is the foundation of DeFi; it is a digital ledger of transactions that is distributed across the entire network. Because of this, the data that is stored on the blockchain is extremely difficult to hack or change.

• Cryptocurrencies are decentralized digital currencies that use cryptography for both their security and their transfer between users. One example of this is bitcoin.

• Smart contracts are an essential part of decentralized finance because they enable the creation of rules that can be applied to any kind of transaction. This is the part of the DeFi protocol where clauses from traditional agreements can be transferred.

• Oracles are data from an external source that are fed into blockchains with smart contracts that need to be carried out under certain conditions. These smart contracts are designed to automate certain business processes.

• Stablecoins are a subcategory of cryptocurrencies that keep their value proportional to that of a reference asset (such as gold, the U.S. dollar, or the euro), thereby ensuring price stability for investors.

• Decentralized applications, also known as DApps: These are software applications that run on platforms that support smart contracts and are essential to DeFi.

How can DeFi help the low-income population?

So how exactly can DeFi help those who do not have access to traditional banking? By giving billions of people access to a system that enables them to manage their finances and conduct transactions in a safe manner, cryptocurrency has the potential to transform the global economy.

Financial freedom with DeFi

To be financially free requires, at its most fundamental level, to have access to various financial services that can assist one in the management of their personal finances.

Many people with lower incomes may not qualify, according to the standards of traditional finance systems, to take out loans, make investments, or even open accounts in their own names.

Banks almost never offer customers with low incomes financial products and services that are tailored to meet their needs.

The requirements imposed by traditional institutions are typically very stringent, including high credit scores, high fees, and high incomes.

This inaccessibility further inhibits the ability of those with low incomes to grow their money, thereby creating a loop that stacks the odds against the unbanked at each step.

Decentralized finance, as opposed to traditional finance, which is inherently biased toward the wealthy, promotes equal access to financial products in a safe setting. Traditional finance is skewed towards the elite.

As cryptocurrency and traditional financial systems continue to collide, the social repercussions of decentralized financial systems are becoming increasingly obvious and are taking shape right in front of our very eyes.

It would appear that DeFi is successful in reversing inequality across the board by providing a diverse range of financial services, conducting transactions in a transparent manner, and making its platform accessible via a permissionless network.

DeFi makes financial services more democratic and accessible to the general public.

People are able to conduct secure financial transactions without the need for any kind of centralized monitoring thanks to the infrastructure provided by blockchain technology.

This is something that cannot be provided by traditional finance because the very infrastructure of centralized finance requires guarantees (such as collateral in the case of a loan) before they can provide their services. Traditional finance cannot provide this because of this requirement.

Transactions are validated using a decentralized and publicly accessible ledger when using the blockchain technology. This ledger is accessible to everyone on the network and maintains an unchangeable record of all the transactions that have taken place.

Because of this, the system is safeguarded against instances of fraud and corruption even in the absence of an authoritative third party that can monitor or serve in the capacity of a gatekeeper for the network.

The entry requirements for traditional banking institutions’ various financial services are rendered obsolete by the distributed ledger technology, or blockchain.

The unbanked now have access to opportunities and products that were not previously available to them, such as loans and investments, thanks to decentralized finance (DeFi).

Because there is no requirement for a financial investment to provide a loan through DeFi, it is now possible for individuals to make microloans and microinvestments (which refer to smaller loans and investments offered by individuals).

The infrastructure mitigates the need for just one single entity to take on the risk of financing by dividing the risk up and distributing it across the individual investors who are funding the loan.

For instance, a business owner in a developing nation who does not have access to traditional banking services can use a decentralized lending pool to solicit financial backing for his cryptocurrency venture from investors all over the world.

The opportunities with DeFi

There are a variety of interesting possibilities available for investments in DeFi, but the following are the most common ones:

Digital asset trading

Peer-to-peer marketplaces are what are known as decentralized exchanges (abbreviated as DEXs), and they allow users to trade cryptocurrencies directly with one another.

They make it possible to conduct financial transactions without the involvement of intermediaries such as banks, brokers, or others. Ethereum is the backend for a number of well-known decentralized exchanges (DEXs), including Sushiswap, Uniswap, and 0x.

Lending protocols

Peer-to-peer lending platforms that are decentralized, such as Compound (COMP) and Aave (AAVE), give users the ability to borrow money by using cryptocurrency assets as collateral. They also have the option of lending their cryptocurrency to other users in exchange for interest rates that are significantly higher than those offered by traditional financial institutions.

Yield Farming

The cryptographic staking of assets in non-custodial DeFi protocols can be accomplished through yield farming. Users have the option of earning either a fixed or variable interest rate when they do so. This can be accomplished through the use of protocols such as Vesper and Enzyme, or through the manual search for protocols that offer high returns, followed by the transfer of assets to a platform in order to earn high rewards.

The coming together of the community and the money

Throughout the entirety of this article, the primary question that has been addressed is how communities, particularly those with lower incomes, can benefit financially from DeFi.

How can we be sure that those at the top of the financial system won’t try to use the blockchain technology for their own advantage? It is a given that traditional financial institutions will, as crypto continues to gain mainstream acceptance, look for ways to diversify their product offerings, and this is something that is already happening.

The coming together of these two “worlds” has, in any case, been a long time in the making. On the other hand, the hope is that due to the very nature of DeFi, the population with low incomes will have equal access to financial services, which is something that traditional finance has been unable to offer for as long as anyone can remember.

Investing opportunities that were once reserved for the wealthy are now open to people from all walks of life as a result of the development of DeFi. There has been a complete about-face on the part of major financial institutions, which formerly opposed cryptocurrencies but are now open to using them, even if they do so in secret:

People now have incredible opportunities to take control of their finances outside of the realm of traditional finance thanks to developments in the technologies that underpin decentralized finance (DeFi), blockchain, and smart contracts. These innovations are continually being improved upon.

As an illustration, certain online credit and mortgage marketplaces have already begun to accept cryptocurrency as collateral.

Instead of interest rates being regulated by centralized authorities such as governments, central banks, federal reserves, etc., they are regulated by the market itself, which means that interest is paid in cryptocurrency and adjusted based on the demand in the market.

Artificial intelligence (AI) and the Internet of Things (IoT) are examples of exponential technologies that are being utilized in the development of regulatory projects to address the vulnerabilities of these technologies to tax schemes and money laundering.

People now have the ability to invest in large-scale international projects thanks to DeFi. Tokens and smart contracts are now viable options for large-scale project financing in a variety of industries, including real estate, infrastructure, technology, and climate change. This levels the playing field and makes it possible for regular people, rather than just the wealthy elite, to take advantage of investment opportunities.

Even companies that list their shares on major stock exchanges like the London Stock Exchange, the Tokyo Stock Exchange, the New York Stock Exchange, and BOVESPA (the Brazilian stock exchange) will soon begin issuing tokens that function as “shares in shares.”

Because they can be obtained through DeFi, the stock market is significantly more open to investors coming from a wide range of different backgrounds.

Many large decentralized NFT marketplaces enable users to trade goods and services with one another. Some examples of these marketplaces include Open Sea, BAYC, and the Crypto Punks Larva Labs.

Tools of DeFi: Smart contracts and DApps

Smart contracts

Contracts that run automatically on blockchains are referred to as smart contracts. They become active once particular terms agreed upon by the buyer and the seller have been satisfied.

These conditions, which can also be thought of as the terms of an agreement between both parties, are written into the code of the contract.

The unbanked population may be able to access financial services through the use of smart contracts, which would not otherwise be available to them through traditional finance. One example of a use case for smart contracts is the establishment of a loan agreement between two parties involved in microfinancing.

A borrower who does not meet the requirements for a loan from a conventional institution has the option of turning to the technology behind digital ledgers in order to gain access to funds directly from a number of investors. In this scenario, the terms of the loan are defined and monitored by a smart contract.

It is also possible for proprietors of small businesses located in low-income areas to do away with the requirement that they use the payment solutions offered by large banks and intermediaries. It is possible to conduct peer-to-peer payments and transactions safely and expediently with the assistance of smart contracts.

Decentralized apps (DApps)

Decentralized applications, also known as DApps, can also be built using smart contracts. DApps operate on a peer-to-peer network, which is the primary distinction between them and traditional apps despite the fact that they perform functions that are comparable to those of traditional apps (like blockchain).

Examples of financial services that can be facilitated by DeFi DApps include lending and borrowing, which centralized financial institutions more commonly offer. Additionally, they make it easier for individuals in low-income areas to conduct peer-to-peer transactions and gain access to financial services.

Kenyans are now able to convert cryptocurrency to fiat currency through a project called Kotani Pay, which is supported by the UNICEF Innovation Fund (even if they do not have a smartphone).

Another example is the digital wallet called Leaf Wallet, which was developed to provide access to digital financial services for people living in areas with limited resources and refugees.

In accordance with UNICEF, “Even without a personal banking history, institutional financial literacy, a passport, or a smartphone, Leaf helps people save money, send money to other people, receive money, exchange money, and pay money directly to and from their phone.”

How to get involved with DeFi?

If you are interested in learning more about the opportunities provided by DeFi but are unsure how to get started, the following guidelines can help:

Obtain a cryptocurrency wallet.

A digital “wallet” is referred to as a “crypto wallet,” and it is used to store cryptocurrency so that it can be used in DeFi protocols. You are free to use any wallet you like; however, it is imperative that you safeguard both your public and private keys. These will let you get back into your wallet and retrieve your money.

Popular options include MetaMask and Coinbase Wallet, as well as Argent. For instance, MetaMask is a wallet for Ethereum that can be financed with additional Ethereum.

In addition to that, you will have access to an exchange where you can trade DeFi coins. You will have access to a variety of different DeFi protocols and be able to take part in them if you have a wallet.

Buy coins

The next thing you will need to do is purchase coins for the DeFi protocol that you plan to use. Considering that the majority of DeFi protocols run on Ethereum, it is recommended that you invest in ETH or ERC-20. You can also use Bitcoin if you have it, but you will first need to exchange it for an ETH version such as Wrapped BTC. If you already have Bitcoin, you can use that instead.

Trade digital assets

You have three options for your cryptocurrency at this point: you can either lend it out, invest it, or put it in a decentralized exchange (DEX).

• You could lend out your cryptocurrency and become a “yield farmer,” which means that you’ll be earning the governance tokens awarded to those who lend out their cryptocurrency.

• Investing in DeFi projects is also an option, but you should only consider this choice if you are willing to take on risk. You have the option of investing in ventures such as Yearn Finance (YFI) or Aave.

•You also have the option of putting your money into a DEX (like Uniswap). DEXs give users the opportunity to become market makers and earn fees for their services.

However, keep in mind that the cryptocurrency market is fraught with danger due to the prevalence of con artists and fraudsters. When entering into agreements, exercise extreme caution, and make it a point to conduct thorough research before joining any pool or platform.

Look into stablecoins

TrueFi, which is a DeFi protocol for uncollateralized lending, is another alternative to consider if you do not want to take the chance of having to deal with the price swings of the underlying assets. It allows participants to earn high yields on loans while also offering high returns on stablecoins as an investment option.

What lies ahead for DeFi

The rise of cryptocurrencies and decentralized forms of finance will likely continue to have an impact on financial services in the not too distant future. Even now, the effects of decentralized finance and cryptocurrency becoming more mainstream are being felt widely, and more and more traditional institutions are getting on board with the whole idea of decentralization. This could be good news for a lot of people, especially those who do not have access to traditional banking services.

The concept of providing people with low incomes with a wider range of financial services that are easier to access is becoming a reality thanks to DeFi.

The introduction of DeFi will likely pave the way for the introduction of even more ground-breaking opportunities for people, particularly those with lower incomes, to achieve financial freedom and independence.

As a result of this, the issue of scalability, as well as the security of the system, needs to be investigated and improved continuously.

When it comes to the general public, it is always to one’s advantage to educate oneself about the comings and goings in the cryptocurrency industry, particularly if one hopes to make intelligent investments.

Our website makes it much simpler for you to keep up with the most recent market prices, news, and trends. In addition, our website gives you access to a large number of free resources, tips, and how-to guides relating to cryptocurrency in general.