In the field of economics, the ideas of fungible and nonfungible tokens have been around for quite some time. Even before the time of the Roman Empire, objects that resembled coins were being traded. These objects were apparently used as tokens in brothels or gaming establishments.

Tokens, referred to as “Abbot’s money”, were utilized during the Middle Ages by English monasteries as a payment method for services rendered by individuals from other countries.

It was common practice for merchants trading in the British Isles and North America to use fungible tokens between the 17th and 19th centuries. These tokens represented a pledge that could be redeemed for goods during periods when state coins were in short supply.

In recent times, fungible tokens that could be exchanged for real money were introduced into arcade games and slot machines found in casinos.

Tokens of similar nature are also employed in services such as automatic car washes, parking garages, and public telephone booths.

Tokens continue to represent something tangible (physical) or intangible (non-physical, such as a service) within their respective ecosystems, despite the advent of cryptocurrencies and other decentralized ledger technologies.

Fungible tokens are digital currencies like Bitcoin that can be transferred on a blockchain (BTC). Tokens that are non-fungible are data units that each represent a distinct digital asset that is then stored on the blockchain and verified there.

What are the types of tokens that are available?

In the realm of cryptocurrencies, there is the potential for there to be tokens for any kind of service or product. For instance, coins such as Bitcoin and Litecoin (LTC) are examples of payment tokens. These tokens are used to pay for transactions in the digital world.

Holders of utility tokens are granted access to goods and services that are powered by blockchain technology.

Traditional assets, such as stocks and shares, can be represented on the blockchain in the form of digital tokens known as security tokens.

Both fungible and nonfungible tokens are discussed in this article; these two categories of tokens are the most distinct from one another.

What is a fungible and nonfungible token?

Tokens that are fungible and nonfungible can each be understood better if one is familiar with the concept of fungibility that is used in economics.

The only distinction is that crypto tokens express their fungibility property via a code script rather than a physical document.

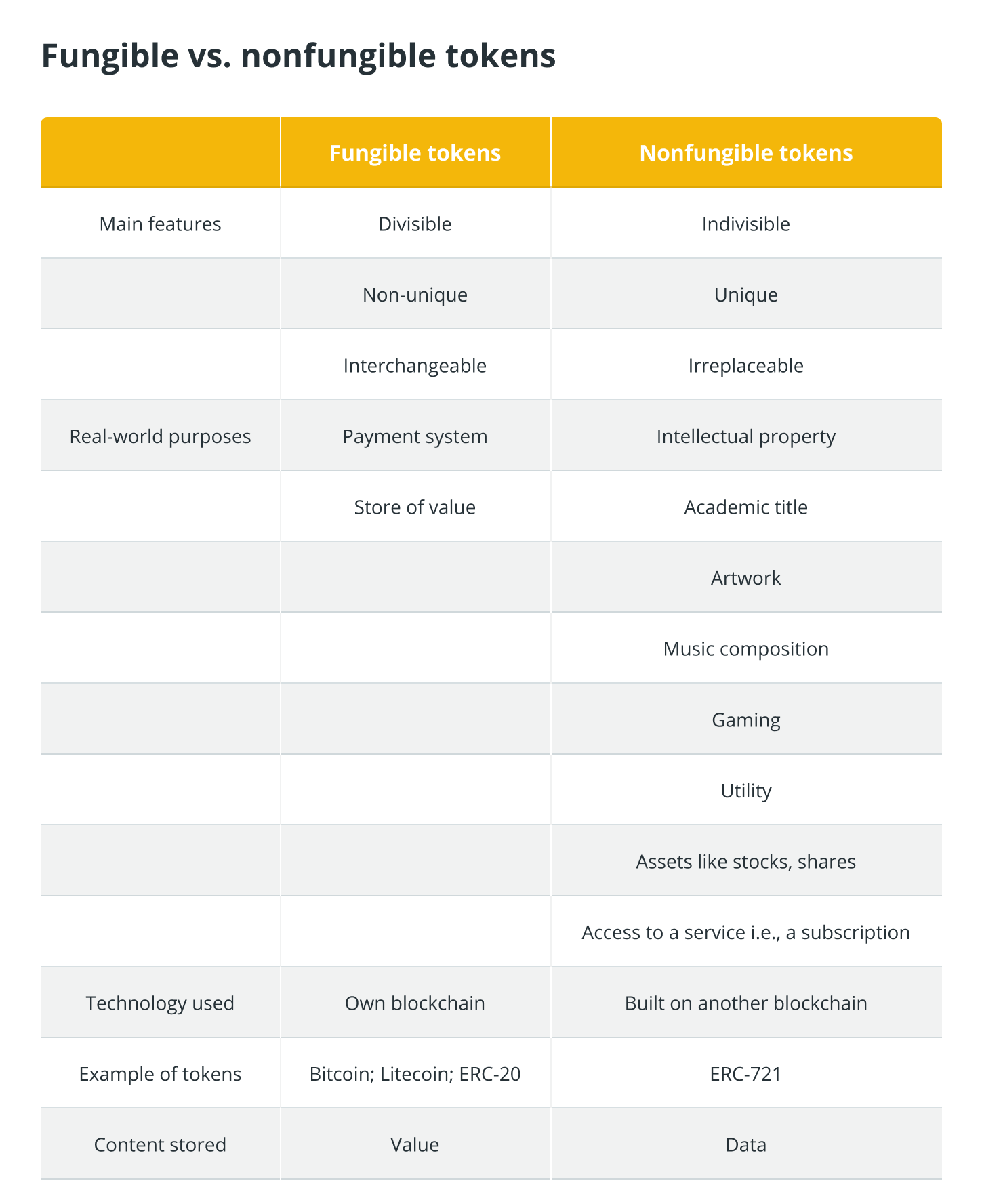

Fungible tokens or assets are divisible and non-unique. For instance, fungible currencies include fiat currencies like the dollar: The value of a dollar bill in New York City is identical to that of a dollar bill in Miami.

Tokens that are fungible can also take the form of cryptocurrencies such as Bitcoin. There is no difference in the value of one bitcoin based on where it was issued.

On the other hand, nonfungible assets are singular in nature and cannot be divided into parts. They ought to be regarded as a form of title or deed to the ownership of an item that is one of a kind and cannot be replicated.

A flight ticket is a nonfungible example because the data that makes up the ticket cannot be used to create another ticket of the same kind. Due to the fact that a house, a boat, or a car are each unique, they are examples of nonfungible physical assets.

The same holds for nonfungible tokens, which represent one singular and non-divisible item, whether a picture or intellectual property and can be either tangible or immaterial. The underlying technology that makes it possible to easily demonstrate ownership of an intangible digital item is called a blockchain.

The content that fungible assets and nonfungible assets store is the primary factor that differentiates these two types of assets. Non-fungible tokens, such as academic titles or artworks, are used to store data, in contrast to fungible tokens, which are used to store value.

How are tokens different from cryptocurrencies, precisely?

Cryptocurrencies and crypto tokens are two different types of digital assets, but they are both based on blockchain technology. Cryptocurrencies, on the other hand, are digital payment coins that come with their own blockchains.

The cryptocurrencies Bitcoin, Ether (ETH), and Litecoin are all examples of digital assets that run on their respective blockchains. You could think of them as fungible crypto tokens that store value or serve as a medium of exchange for purchasing or selling goods.

On the other hand, crypto tokens are created on a separate blockchain. Tokens built on Ethereum include examples such as Uniswap, Chainlink, and the ERC-20 standard.

What Are Fungible And Nonfungible Tokens In A Blockchain?

Tokens in a blockchain are typically referred to as crypto tokens. These tokens represent digital units of value that have been developed on existing blockchain networks. Tokens are built on blockchains by companies to serve various purposes, including transferring value, providing access to subscription services, and even voting.

On the Ethereum blockchain, the first fungible tokens were created and given the designation ERC-20. They establish the standards that make it possible for developers to create applications for various purposes.

The era of initial coin offerings, which helped boost an industry worth nearly $15 billion between 2016 and 2018, built its fortunes on ERC-20 tokens. This era occurred between 2016 and 2018.

Since 2012, when the idea of coloured coins was introduced for the first time within the Bitcoin blockchain, nonfungible tokens have existed.

As an alternative to the construction of additional blockchains known as sidechains, coloured coins make it possible to attach metadata, or additional information regarding the particular data that was used, to Bitcoin transactions.

There is a possibility that coloured coins will represent real-world assets that will be traded on the Bitcoin blockchain. However, coloured coins are linked to a contract outside of the blockchain and require trust to function.

A consensus must be reached among the members of the group that a predetermined number of these coins represent an entirely different value. In that case, they can potentially use these “designated” coins to transact in that value.

The satoshis, used as digital tokens, are small fractions of bitcoin. These satoshis are “coloured in” or marked with the information that links the coins to physical assets.

In the world of cryptocurrencies, coloured coins did not end up having that much of an impact. They were mainly used to create and trade artworks like “Rare Pepe” digital cards on Counterparty, a peer-to-peer trading platform built on top of Bitcoin’s blockchain.

Additionally, the very first nonfungible tokens were created on the Ethereum blockchain. These tokens were designed to identify a product, service, or person uniquely.

Some NFTs are built on the Tron and EOS blockchains, which host voting tokens. The possible applications are infinite for this type of token, from collectible items like artworks and musical creations to lottery tickets to concert and sporting event seats.

NFTs can even be marketplaces for storing academic titles and digital identities on the blockchain since they’re easily traceable and verifiable.

There is a widespread misunderstanding regarding NFTs, specifically that people consider them to be artworks exclusively as a result of the phenomenal market growth they experienced in 2020 and 2021. NFTs, on the other hand, already had a significant application within the gaming industry many years before the arts started using them.

The first instance of CryptoKitties was discovered on the Ethereum blockchain in the year 2017. The game was the first example of a non-virtual asset (NFT) being used in the real world within the cryptocurrency space. It became the most prominent example of a decentralized application running on the Ethereum protocol.

The ERC-721 is a different standard than the ERC-20 that is used to identify non-fungible tokens (NFTs) within the Ethereum blockchain.

How do NFTs work, and how do you create one?

Nonfungible tokens can be created and stored in a public blockchain that is open and accessible to anyone. While the items they represent are verifiable and trackable, the owner of the cryptocurrency can remain unknown.

From a technical perspective, NFTs are minted through smart contracts that assign ownership and manage the transferability of the NFTs. The process of minting new coins involves a few steps, including generating a new block, validating the data, and recording it on the blockchain.

Further information on how to create a nonfungible token is available here.

How to Buy or Sell a Nonfungible Token.

NFTs are a form of digital proof of ownership that can be purchased or sold on the internet. They can be used for any item. Transactions can take place in cryptocurrency exchanges or in online marketplaces such as Rarible, Nifty Gateway, or OpenSea, to name a few of the available options.

The owner of an item can choose to sell it at a predetermined price or hold an auction to determine the final price, just like on eBay.

The first thing you need to do is purchase a cryptocurrency such as Ether and register for one of the various platforms that are available. After that, the user must move that cryptocurrency to a cryptocurrency wallet compatible with the tokens.

MetaMask, Trust Wallet or Coinbase Wallet are all compatible with ERC-721 tokens. Other blockchains that allow NFT transactions include Binance Smart Chain, Tezos, Polkadot, EOS and Tron.

However, users are responsible for ensuring that the collectible platform of their choice is compatible with the blockchain that they have selected. After successfully connecting the wallet to the platform, you can upload a picture or file containing the NFT.

Platforms like MakersPlace also allow users to create NFTs. Still, they have first to register and become a listed artist before they can work on it.

Grimes, Paris Hilton, and Snoop Dogg are just a few examples of famous people who have contributed to the rise in popularity of non-fungible tokens by publicly announcing their involvement in the space.

What are the benefits and drawbacks of using nonfungible tokens?

Pros

After their work has been purchased for the first time, artists can submit a claim to NFTs to receive royalties on future proceeds.

The breakthrough that has occurred in the art world is the possibility of claiming such future gains, and it is this possibility that has encouraged many artists to turn to this new digital marketplace.

Users only need to perform the action of activating a particular function on the blockchain. The procedure allows a profit percentage to be paid to the artwork’s creator every time the NFT is sold or changes ownership.

For the first time, with blockchain technology, artists and content creators have the opportunity to monetize their production, and they can do it without the assistance of a third party, like an agent.

Because physical galleries and auctions are no longer a part of the equation, it is now possible for artists to turn to the digital world for transactions that are easier to access and run more smoothly.

Cons

In the same way that a photograph can be duplicated, digital photos can also be copied, with the duplicate that is downloaded looking exactly the same as the original.

The possibility of creating infinite reproductions of artworks has sparked confusion and scepticism in the audience of artistic scenes.

Suppose individuals are able to download thousands of copies of the original; in this scenario, what is the point of paying high prices for the original?

From a closer perspective, it becomes clear that digital artworks are precisely like traditional art masterpieces.

It is possible for someone to create an unlimited number of copies of the Mona Lisa, but there can only be one original.

The question is, what then grants ownership of the original asset in the crypto world?

The nonfungible token, a cryptographic digital signature, assigns ownership of the original piece to someone. Ownership of the work can be verified and transferred on a blockchain.

The future of NFTs

As the world becomes increasingly digitized, NFTs can represent a viable solution for tokenizing ownership and property.

Both fungible and nonfungible tokens allow proper digitization and storage of real-world assets while keeping them safe at the same time.

The value of the NFT market reached $2.5 billion during the first half of the year 2021. When one considers the exorbitant price at which some of the artworks are being offered for sale, this should not come as a surprise.

Digital artist Beeple sold “Everydays: the First 5000 Days” for $69.3 million through a Christie’s auction. Meanwhile, Twitter CEO Jack Dorsey auctioned an NFT of his first tweet, which sold for $2.9 million.

NFTs are about to usher in a revolution that will improve the way people interact with one another and will facilitate transactions across multiple digital markets.

However, because of their status as collectibles, NFTs are investments that are driven more by demand than by fundamentals.

The astute investor can benefit from the more robust fundamentals offered by assets such as Bitcoin and Ether, which base their value on technological advancements and economic adoption.

On the other hand, people’s interest in the sector and how much they are willing to pay for an NFT drive the price of an asset, ultimately determining the future of the entire market.

Summary

In economics, the ideas of fungible and nonfungible tokens have been around for quite some time. Cryptocurrencies and crypto tokens are two different digital assets, but they are both based on blockchain technology. Additionally, the very first nonfungible tokens were created on the Ethereum blockchain.

The ERC-721 is a different standard than the ERC-20 that is used to identify non-fungible tokens (NFTs) within the Ethereum blockchain.

NFTs are a form of digital proof of ownership that can be purchased or sold on the internet.

Grimes, Paris Hilton, and Snoop Dogg are just a few examples of famous people who have contributed to the rise in popularity of non-fungible tokens by publicly announcing their involvement in the space.

After their work has been purchased for the first time, artists can submit a claim to NFTs to receive royalties on future proceeds. For the first time, with blockchain technology, artists and content creators have the opportunity to monetize their production, and they can do it without the assistance of a third party, like an agent.

From a closer perspective, it becomes clear that digital artworks are precisely like traditional art masterpieces.

As the world becomes increasingly digitized, NFTs can represent a viable solution for tokenizing ownership and property.

Both fungible and nonfungible tokens allow proper digitization and storage of real-world assets while keeping them safe at the same time.