What are NFTs, and how do they work?

Nonfungible tokens, also known as NFTs, are a type of digital asset that can represent a variety of different things, including art, music, and videos. NFTs, despite the fact that they can be used to buy and sell digital artwork, can also be used to represent assets that exist in the real world.

A non-fungible token (NFT) is a form of digital or physical evidence that verifies the authenticity of the asset it represents.

Why is it so important to demonstrate originality? Because everything that can be found in the digital world can be copied, and there is no cap on the number of times that this can be done.

Despite this, there is only one original of any digital asset, just like there is only one original of anything that exists in the metaphysical world. For instance, “Starry Night,” which was painted by Vincent van Gogh, has probably been reproduced millions of times by this point.

The well-known painting can be found on a variety of products, including mugs, art prints, magazines, digital art, and more. And yet, there is still just one original painting in the whole world.

It is the painting that van Gogh did in France in 1889, and that is currently being shown at the Museum of Modern Art in New York City. Van Gogh’s original artwork will always be the most valuable, despite the fact that it has been copied so frequently and that billions more copies will almost certainly be produced in the future.

In a similar manner, non-fungible tokens (NFTs) add value to assets by demonstrating their uniqueness amidst a sea of copies.

This article will explain how to invest in non-financial assets, as well as the various risks and potential returns associated with investing in non-financial assets.

How are NFTs purchased and sold?

NFTs are frequently bought and sold over the internet with cryptocurrencies and are generally programmed with the same underlying software as most cryptocurrencies. NFTs can be purchased and sold online.

In spite of the fact that they have been around for a very long time, non-fungible tokens (NFTs) are currently in high demand because buying and selling artworks using them is becoming increasingly common.

Reuters reports that sales of non-fungible tokens surpassed $25 billion in 2021 and show no signs of slowing down any time in the near future.

People who are unfamiliar with non-fungible tokens may wonder what the big deal is, particularly regarding digital artworks that can be viewed, screenshotted, and downloaded online.

For instance, Beeple’s “EVERYDAYS: The First 5000 Days” was recently auctioned off at Christie’s for $69.3 million, but the work can be viewed for free on the artist’s website.

Collectors place a high value not only on the acquisition of NFT artwork as an investment but also on the very possession of the original works themselves.

In common parlance, digital “bragging rights” have a lot of value, particularly among collectors. This is because NFTs come equipped with their own authentication mechanisms built right in.

NFTs are applicable to more than just works of art, too. Gamers and collectors now have the opportunity to become the permanent owners of in-game objects and other one-of-a-kind assets and make money off them.

In virtual worlds such as The Sandbox and Decentraland, players have the opportunity to build and run businesses, such as casinos and theme parks, from which they can profit.

They also have the ability to sell digital items, such as avatars, costumes, and in-game money, on a secondary market if they collect these things while playing the game.

How to invest in NFTs

You may be wondering how to invest in NFTs now that you have a better understanding of what they are, but first, you need to know how to invest in them.

The purchase of NFTs is not as straightforward as the purchase of ether (ETH), the native cryptocurrency of the Ethereum blockchain.

Additionally, you won’t be able to buy or sell NFTs on cryptocurrency exchanges; therefore, you’ll need to look in other places.

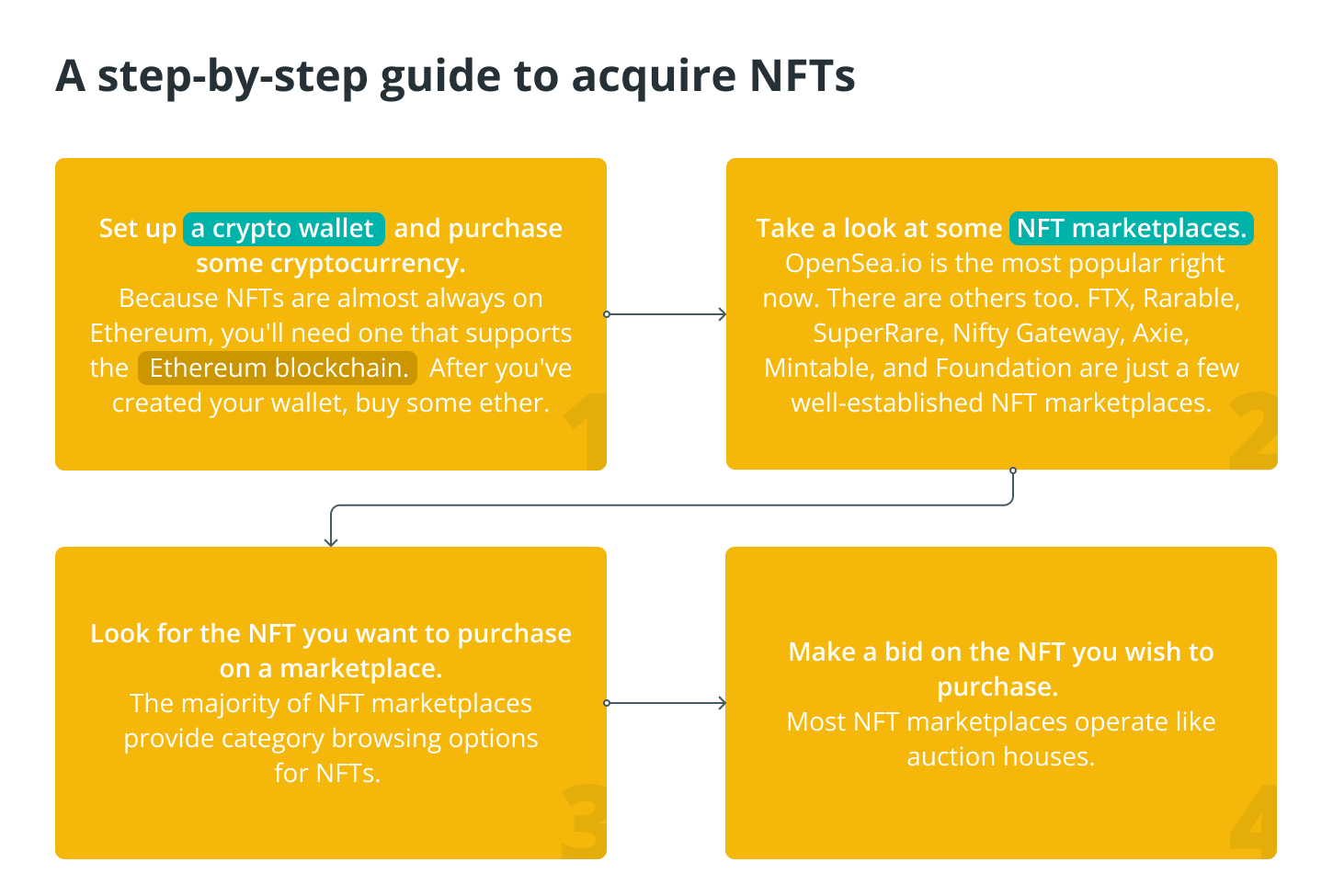

The following is an in-depth walkthrough of the process that must be followed in order to acquire these digital tokens:

When it comes to purchasing NFTs, another thing that you need to be wary of is the gas fees. If this is your first time using Ether for financial transactions, you should be aware that it has an additional gas fee, which is the amount of money that must be paid in order for the transaction to be finalized.

If the gas fees are high, you might want to hold off on purchasing NFTs for a while, given that some buyers have found that the amount they paid for the NFT exceeded the amount they paid in gas fees.

If you are not interested in buying NFTs directly, another option for you to invest in them is to do so through a venture capital fund that invests in both NFTs and crypto infrastructure.

Be aware, however, that in order to pursue the venture capital route, you will first need to acquire the status of an accredited investor.

If you don’t have accreditation, you can still investigate other opportunities, such as purchasing an exchange-traded fund that is concentrated on NFTs, such as the Defiance Digital Revolution ETF, which invests in NFT stocks, blockchain technology, and cryptocurrency. This is one example of a potential route to take.

Read our guide on how to buy and sell nonfungible tokens if you require additional information of a more in-depth nature.

What are the advantages of NFTs?

Authenticity

The fact that non-fungible tokens are one-of-a-kind is what drives the benefits of using such tokens. Because of the one-of-a-kind characteristics of each token, it is physically impossible to produce a fake NFT, as was stated earlier. As a result of the fact that NFTs are generated on the blockchain, each one is connected to a separate record.

The purchasers have the peace of mind of knowing that they are not getting a knockoff but rather a genuine article. The issuers of NFTs have the option of deciding to print only a certain number of tokens, thereby reducing the available supply and driving up the value of each token.

Ownership

The ability to demonstrate ownership is the primary benefit offered by non-fungible tokens. The fact that NFTs are stored on a blockchain makes it easier to establish ownership using a single account.

In addition, they are indivisible, which means it is impossible for them to be split up between several different owners.

On the other hand, the ownership advantage of NFTs ensures that buyers will never need to be concerned about purchasing counterfeit NFTs.

Some people believe that it would be easy to steal NFTs by simply taking a picture of them and then selling or giving them away.

Even though it is possible to have a copy of a non-financial asset (NFT), this does not give the same rights as actually possessing the underlying asset.

For instance, even if you download a picture of a Monet from the internet, that does not make you the owner of the painting.

Content Ownership

The fact that NFTs provide content creators with full ownership of their works is among the most significant benefits offered by these tokens.

Content creators frequently encounter issues with platforms that hoard profits and limit their earning potential when they use traditional publishing models.

For example, digital artists who publish their content on these platforms make money off of the advertisements that are displayed to the fans of the artists.

However, not all of this money is given to the artist in the form of royalties or other payments. Instead, some of it is contributed to the platform. Sometimes, the platform receives the majority of the profit, if not the entire amount.

The requirement that content creators transfer ownership of their work to the platforms they use to publish their work can be circumvented with the assistance of non-fungible tokens (NFTs).

Through the use of NFTs, ownership of content can be directly incorporated into the content itself. When content creators sell their work, the money from those sales goes directly to them.

In the event that a new owner decides to sell the NFT, royalties may also be paid to the owner if the previous owner was able to establish appropriate smart contracts.

Transferability

Additionally, NFTs are very simple to transfer. Trading non-fungible tokens (NFTs) is made simple in certain markets by the presence of a variety of trading options.

Because of this, moving NFTs around between buyers and sellers is a breeze, and neither party needs to worry about their possessions being misplaced or stolen.

For example, game developers might distribute non-fungible tokens (NFTs) as in-game items, which players could then keep in their digital wallets.

After that, players are free to take the in-game items with them, use them in real life, or even sell them for a profit.

As a result of the fact that NFTs are based on smart contracts, ownership transfers are simplified as a result.

When certain conditions are satisfied, ownership can be transferred from the buyer to the seller. These conditions are outlined in smart contracts.

What are the dangers associated with NFTs?

The following sections will provide an explanation of the risks that are associated with NFTs.

Smart contract risks

By exploiting vulnerable areas in smart contracts, hackers are able to launch attacks on DeFi networks and make off with significant amounts of cryptocurrency in certain circumstances.

One recent example is the hack performed on Poly Network, in which NFTs worth $600 million was taken.

The insufficient security of the smart contract was the primary cause of the hack because it provided an access point for those who attempted the theft.

Proof that smart contracts can put networks at risk for attacks if there are flaws in the code is provided by the recent large-scale attack on a prominent decentralized financial infrastructure network known as Poly Network.

The difficulties of evaluation

Evaluation is one of the most difficult challenges presented by the NFT market. Due to the lack of established standards, there is still a great deal of unpredictability regarding the process of determining NFT prices.

The prices of non-fungible tokens are notorious for being highly unpredictable despite being largely set by factors such as their uniqueness, creativity, and scarcity.

People have a hard time isolating the factors that might be driving NFT prices, so price swings are something that people have come to expect and accept. As a result, evaluating NFTs continues to be a very difficult task.

Legal challenges

There are currently no statutory definitions of NFT in effect in any country. This is due to the fact that there is not yet an international organization that is responsible for overseeing the global implementation of regulations regarding NFTs.

The necessity of a regulatory body is becoming more and more apparent by the day as a direct result of the increased interest in NFTs.

The applications of NFTs have also undergone significant development in recent years. In a situation like this, there is a pressing requirement for the establishment of a regulatory framework complete with clear-cut rules and guidelines.

Cybersecurity risks

The number of instances of cyber attacks on the market for NFTs has also increased in tandem with the rise in popularity of these markets.

In some cases, fake replicas of complete NFT stores are set up on the internet in an attempt to deceive consumers into purchasing their wares.

Imitating the genuine NFT stores’ content, logos, and branding allows fake NFT stores to pass themselves off as a genuine article.

The only distinction is that they are peddling non-fungible tokens (NFTs), which are conceptually nonexistent both in the physical world and on the internet.

Actors with malicious intentions may also assume the identity of well-known NFT artists in order to sell their own artworks while passing them off as the artist in question’s creations.

There is still a risk of online fraud within the NFT market due to issues such as counterfeit NFT giveaways, theft of copyright, fake stores, and impersonation of NFT artists.

Intellectual property rights

When buyers are confident that they are getting their goods from a legitimate source, it is advantageous for them to own NFTs.

However, buyers run the risk of purchasing replicas that have been passed off as originals if they purchase NFTs from markets and buyers with a lower reputation for reliability.

Therefore, purchasers have a responsibility to exercise caution and conduct the research necessary to ascertain whether or not the seller actually possesses the NFT they are selling.

The buyer of a replica of a non-fungible token (NFT) receives only the right to use the NFT but none of the intellectual property rights associated with the NFT.

This continues to be a weakness in the trading of NFTs because there are currently no intellectual property rights (such as copyright, trademark, moral rights, and so on) associated with decentralized blockchain technology.

The challenge of considering NFTs as securities

According to the Securities and Exchange Commission, the majority of non-traditional financial instruments (NFTs) currently traded on the market are traded as securities.

As a consequence of this, there are a significant number of buyers who are considering investing in NFTs as securities.

Due to the fact that not all NFTs can be classified as securities, there is a potential for buyers to take on additional risk.

Technically speaking, for NFTs to be qualified as securities, they must first satisfy the criteria outlined in the Howey test for securities.

Whether or not an NFT can be considered a security depends on the particular set of circumstances. It is not considered a security if an NFT represents ownership of an artwork, game collectible, or other items of a similar nature.

On the other hand, a non-financial instrument may be regarded as an investment contract if it is marketed as a speculative investment and as something that will increase in value over the course of time. In accordance with the directive issued by the Supreme Court of the United States, investment contracts are broadly classified assets that perform the same functions as securities.

Are NFTs a good investment?

This question has not yet been conclusively answered because the value of NFTs is highly dependent on the particular use case being considered.

When non-fungible tokens (NFTs) are used to represent ownership of a piece of artwork or a game collectible, for instance, this can be a lucrative investment case.

Aside from that, it is difficult to provide a definitive answer to whether NFTs make for profitable investments.

The regulatory ambiguity that surrounds NFTs presents a significant barrier to the widespread adoption of these instruments.

Because there is a lack of regulation, buyers and sellers do not have rules to follow when conducting transactions. As a result, it is difficult to evaluate risks and find ways to mitigate them when buying or selling non-fiat currencies (NFTs).