Exploring Cryptocurrency Trading Strategies and Methods

In recent years, it has become increasingly common for financial institutions to include cryptocurrencies in their portfolios. Cryptocurrencies are the first entirely digital commodities that asset managers have added to a portfolio for investments. They have their unique nature despite having many of the same traits as conventional assets.

Cryptocurrency Trading is the practice of buying and selling cryptocurrencies to make a profit. The operating method, the object, and the trading plan are the three components that make up the concept of cryptocurrency trading.

The transactions done, affects how trading in cryptocurrencies is conducted on the cryptocurrency market. For instance, the contract for differences (CFD) in cryptocurrency trading, which is a deal between a customer and a seller, offers that the buyer will reimburse the seller the difference between them when the position closes. Trading in cryptocurrencies is defined as a trade of cryptocurrencies.

An algorithm that specifies a collection of accepted guidelines for purchasing and selling digital assets on cryptocurrency exchanges is referred to as an investor-formulated trading strategy in cryptocurrency trading.

This article will go in-depth on different cryptocurrency trading strategies like day trading, futures trading, high-frequency trading (HFT), dollar-cost averaging, and scalping, as well as the advantages and disadvantages of trading cryptocurrencies.

Cryptocurrency Trading Strategy

An effective trading plan can reduce financial risk. It prevents you from making hasty and foolish decisions that could end up costing you a lot of money. If you are a novice, you might even think about trading on the Binance Futures testnet to get used to the highs and lows of the market.

Here are a few of the typical tactics used by cryptocurrency traders:

Day Trading

The goal of day trading in cryptocurrencies is to join and exit an opportunity in the market on the same day during trading hours. Because transactions are frequently initiated and completed within a single day, it is also referred to as intra day trading. So, is Bitcoin (BTC) tradable day to day? Absolutely, day trading BTC is like toying with the day-long fluctuations of bitcoin.

The sole purpose of day trading cryptocurrencies is to gain from minute changes in the market. Due to the volatility of cryptocurrencies, day trading in the market could be quite profitable. Day traders develop trading strategies using technical analysis, but it is a time-consuming and risky approach that is primarily appropriate for advanced traders.

HODL (Buy-And-Hold)

The investment strategy known as “HODLing,” which is an incorrect spelling of “hold,” involves individuals purchasing cryptocurrencies and holding them for an extended period. This makes it possible for investors to gain from a rise in the asset’s worth. So, how can the HODL approach be used to profit from cryptocurrency?

When investing for a long time, HODLing enables investors to benefit from long-term value growth. Investors stand to gain since they can prevent the risk of selling low while buying high and are not prone to short-term volatility, as such, they can benefit from the HODL strategy.

Cryptocurrencies are more susceptible to fraudulent activities like money laundering because they have not been in existence for long, unlike fiat currencies like the US dollar and the euro or assets like gold and silver. Because of this, some nations might not approve of cryptocurrencies, which would lower the value of digital assets.

Crypto Futures Trading

An agreement to purchase and sell a specific quantity of an underlying cryptocurrency, such as BTC, at a preset future price on an agreed-upon day and time is the basis of a crypto futures trading strategy.

Without having to own any of them, futures trading methods give you access to a variety of cryptocurrencies. People who own cryptocurrencies, for instance, can use futures to hedge against market volatility. So how do futures contracts work with crypto trading?

Arbitrage Trading

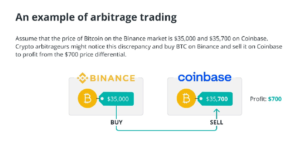

To profit from their cryptocurrency or Bitcoin trading strategies, traders depend on arbitrage opportunities. In the trading strategy known as arbitrage, a trader buys cryptocurrency on one exchange and sells it on another. Between the purchase and sell prices, there is a spread.

Due to the disparity in liquidity and selling volume, traders might be able to book a profit. To take advantage of this chance, they open accounts on exchanges where there is a sizable price differential for the cryptocurrency they are selling.

Nevertheless, the traders have to make a deposit, withdrawal, and trading fee on two occasions minimizing the take-home earnings.

Additionally, if you skip the price difference on two exchanges (as mentioned above), you won’t profit from that arbitrage opportunity.

High-Frequency Trading

HFT strategy involves the building of algorithms and trading bots that assists in the swift entry and exit of a crypto asset. The design of such bots requires a thorough understanding of complex market rules and a solid foundation in mathematics and computer science. As a result, it is more suitable for experienced traders than beginners.

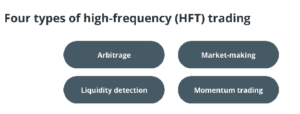

There are 4 kinds of HFT strategies: Arbitrage, market-making, liquidity detection, and momentum trading. As earlier stated, arbitrageurs search for differences in price between two similar assets and benefit from the price errors on various exchanges. HFTs might employ latency arbitrage to take advantage of these errors, which are frequently caused by low latency.

HFT, an algorithmic trading strategy, is used by quant traders to take advantage of the bid-ask price difference and sell or purchase assets in milliseconds using latency. To take action on expected responses to the volatile cryptocurrency market, traders who follow momentum strategies can identify short-term price differences.

Systems for detecting liquidity depends on being able to identify the market activities of other traders, usually institutional investors. Additionally, their main objective is trading on the market activity of other dealers.

Please take notice, that algorithms can respond instantly to changes in the market. As a consequence, algorithms may considerably expand their bid-ask spreads during volatile markets or temporarily halt trading, which will in turn minimize liquidity and maximize fluctuations.

Dollar-Cost Averaging (DCA)

The DCA strategy enables traders to make a profit from market gains without placing their holdings at risk by investing a predetermined sum of money at regular intervals but in small increments.

To utilize the dollar-cost averaging strategy, simply decide on a fixed sum of money to invest in your chosen cryptocurrency over a predetermined period. When you reach your objective, you continue investing regardless of market trends.

When you employ the dollar-cost averaging approach, you invest at both market highs and lows. Additionally, DCA smooths out your investments so that you can buy your chosen cryptocurrency gradually without being as affected by extreme highs or lows as you would be if you were to buy it all at once.

You must pay higher trading commissions because it is a long-term plan. Therefore, before implementing any trading strategies, do your study.

Scalping

Scalp traders benefit by taking advantage of inefficiencies in the market. But to turn a profit, the scalping trading strategy calls for a growing trading volume. Before choosing an entry or exit spot within a day, scalpers consider historical trends and volume levels.

Despite the risk, an experienced dealer is mindful of the margin requirement and other important guidelines to prevent a negative trading experience. Because it is relatively clear when to enter or exit the market, scalp traders favor extremely liquid markets. This technique is typically used by whales or large traders to trade big positions.

Range Trading

In range trading, an active investing strategy, the trader chooses a price range within which to buy or sell cryptocurrency over a brief peri. For instance, if you assume BTC will increase to $50000 in the coming weeks and it is presently trading at $45000, you might anticipate it to trade in a range between $45000 and $50000.

By purchasing BTC at $45000 and then selling it at $50000, you could attempt range trading. Repeat this process until you think Bitcoin won’t trade in this band any longer.

Index Investing

A financial vehicle known as a cryptocurrency index fund is created from a pool of money that investors have set aside and comprises a portfolio of cryptocurrencies. To reduce the risk associated with investing in individual coins, index investing is done which includes buying exchange-traded funds (ETFs) like Bitcoin Futures or spot ETFs, as well as investing in indexes like the decentralized finance (DeFi) Pulse Index.

Without leaving the primary protocols, holders of the index can decide on governance suggestions. This is a component of the team’s idea for smart indexes that maintain the value offered by direct token possession.

An index fund doesn’t need a big team of research specialists to help fund managers choose the best crypto assets because it replicates its underlying benchmarks.

Swing Trading

Swing traders mess around with market instability for about one week or a month. By employing basic and specialized trading indicators, their plans are established. Swing trading allows sufficient timing for traders to keep a record of the price of a crypto asset and generate investment decisions.

Additionally, Swing trading regularly requires swift decisions and implementation, and this isn’t suitablefor a beginner.Also, traders need to stay engaged every day and evaluate the market even if trades are not done daily, making it a complicated and lengthy strategy.

However, examples of automated technologies that can help you perform swing trades quicker are crypto bots and signals. For instance, trading robots will examine the market and buy and sell assets without human assistance once particular criterias are fulfilled.

Trend Trading

Holding positions for a few months is a key component of trend or position trading to capitalize on directional signals. Typically, trend traders take short contracts when they expect traders to move in the opposite direction (downward). However, if they anticipate an upward market trend, they invest in the long run.

To improve the effectiveness of their investment strategy, they must take trend reversals into account employing indicators like moving average convergence divergence and the stochastic oscillator.

Trend trading is appropriate for new traders because they are worried about the financial dangers associated with cryptocurrency investments. But before investing money, every dealer, no matter how experienced, must do their research.

The following list entails the advantages of cryptocurrency trading:

Significant price fluctuations

Cryptocurrencies are susceptible to drawing speculative interest and investors due to their high volatility. For instance, intra day price changes can result in excellent profits for traders, but they also come with a greater risk, such as the potential for losses due to a sudden downward price trend.

Virtual Privacy

Using cryptocurrencies to make online purchases of products and services does not involve disclosing any personal information. Additionally, given the rising privacy and identity theft worries, cryptocurrencies could be able to offer users some privacy advantages.

Each exchange has its own set of Know Your Customer (KYC) methods for recognizing users or customers. Exchanges’ KYC procedure enables financial institutions to reduce risks to their finances while maintaining the confidentiality of wallet owners.

Programmable Smart Capabilities

Some cryptocurrencies also offer limited ownership and voting rights as benefits to holders. A cryptocurrency portfolio may also contain a partial stake in tangible assets like real estate or works of art.

24-Hour Market

The crypto market closes, right? It doesn’t because the market is decentralized. The cryptocurrency market is physically conducted from multiple locations and is available twenty-four hours a day, seven days a week. Instead, people can use cryptocurrencies to make payments in many places around the world.

Peer-To-Peer Transactions

The fact that cryptocurrencies do not need a financial institution to serve as an intermediary to reduce transaction costs, makes this one of their most important advantages. Additionally, those who are suspicious of established institutions might find this characteristic appealing.

The Drawbacks Of Cryptocurrency Investing

Despite the aforementioned advantages, the crypto industry is not without dangers or drawbacks. Here are some of these explained:

Issues With Cyber Security

Like digital technology, cryptocurrencies are susceptible to cybersecurity vulnerabilities and can be taken by hackers, resulting in crypto heists. In addition to the use of sophisticated cybersecurity precautions that go beyond those used in conventional banking, this issue must be mitigated through ongoing maintenance of the security infrastructure.

Concerns About Scalability

Prior to the enormous expansion of the technical infrastructure, the volume of transactions and transaction speed were unable to compete with conventional currency trading. Scalability issues, for instance, contributed to a several-day trading slowdown in March 2020. Traders who wished to move cryptocurrency from their personal wallets to exchanges were hampered by the congestion.

Regulatory Obstacles

Investors in cryptocurrencies are largely unprotected in the market as there is presently no legal framework in place to provide asset protection. Certain exchanges in the US, though, abide by rules set by federal and local authorities.

How Should I Buy Cryptocurrency?

If you are asking “what is the best way to trade cryptocurrencies”? You should know that there is no best or worst method to trade cryptocurrencies. You must first concentrate on your financial or investment goals if you’re searching for the best cryptocurrency exchange for day trading or the most effective application to trade cryptocurrencies.

You should also be conscious of the asset classes you are prepared to include in your investment portfolio as well as the level of risk you are comfortable taking. Additionally, become acquainted with the fundamentals of cryptocurrency trading, such as order types as well as choosing the trading tools you want to use.