Learning where to buy digital assets like Bitcoin (BTC), Ether (ETH), or a smaller-cap altcoin is one of the first steps in getting involved in the cryptocurrency investment market.

Binance and Coinbase are two of the most widely used and well-known cryptocurrency exchanges in the world, despite the fact that there is a plethora of other software available that serves the same purpose.

If you are interested in investing in the market, one of your primary concerns should be selecting a cryptocurrency exchange that is suitable for your needs.

If the experience is not smooth enough and there are barriers to accessibility that prevent a purchase from being made, it may be discouraging for beginners, in particular.

Both of these markets have been operating for a good number of years. Coinbase was one of the first cryptocurrency exchanges to launch in 2012, and Binance followed in 2017.

Is it safe to say that Coinbase is a better option than Binance? The consensus among cryptocurrency users is that Coinbase is the easiest platform to get started with. How do they compare to one another, and is it reasonable to believe that Binance is suitable for novices?

We will do our best to answer these and other questions, focusing on the primary distinctions that exist between the two exchanges and providing readers with helpful pointers on how to determine which cryptocurrency exchange platform is most suitable for the trading strategy that they employ.

Binance vs. Coinbase — Which should you choose?

There is no “better” platform; rather, the question that needs to be asked is which is more appropriate for the new user or for any user, depending on the investment goals that they have.

Both Coinbase and Binance have their good points and bad points, but if we had to summarize the differences between the two exchanges in a single sentence, we would say that Coinbase is less complicated to use and more suited to novice traders, while Binance is more cost effective and more suited to experienced investors.

However, before deciding on the platform to begin a journey into crypto trading and investment, there are a lot of other things to think about, and we encourage you to read on so that you can find out more about them.

A little history of the two exchanges

Binance

Changpeng Zhao, also known as CZ, is a Chinese-Canadian business executive who founded Binance in 2017. Prior to that, he was a software developer who contributed to the creation of Blockchain.info and also worked as the chief technology officer for OkCoin, which is also a cryptocurrency exchange.

In terms of the average trading volume of cryptocurrencies, Binance is currently the largest exchange that can be found anywhere in the world. In terms of trading volumes as well as market capitalization, it is, in fact, Coinbase’s direct competitor.

Binance is available in more than 180 countries around the world; however, due to the United States more onerous local jurisdictional regulations, they were forced to establish Binance.US as a separate company that caters solely to users in that country. Binance is accessible worldwide.

The exchange has been the subject of multiple regulatory actions in a variety of countries all over the world, primarily as a result of allegations pertaining to problems with money laundering.

Before the company could finally become established and move its headquarters to the Cayman Islands, it was forced to relocate there on multiple occasions.

Binance has gained a reputation as an exchange that is known for engaging in certain business activities on occasion before first obtaining permission to do so, which has resulted in the creation of additional regulatory issues.

Taking action without being constrained by an excessive number of regulations unquestionably promotes more rapid innovation, as demonstrated by the exchange over time and across other platforms.

On the other hand, it has also resulted in authorities conducting a more thorough investigation.

Binance Coin (BNB) was one of the top five coins by market capitalization shortly after its release shortly after the exchange’s launch. Binance Coin was one of the first cryptocurrencies ever created.

The cryptocurrency exchange Binance introduced Binance Smart Chain (BSC) in the year 2020. BSC is a blockchain network that was designed to run decentralized applications (DApps) that are based on smart contracts and to give users the ability to manage their digital assets cross-chain.

The Binance Smart Chain is backed by Coinbase Cloud, which provides a safe read/write and participation infrastructure for BSC. This infrastructure gives those who want to build on the chain or help secure the network the ability to do so.

Binance’s success over the years has been cemented by the company’s implementation of features such as Bitcoin mining, decentralized finance (DeFi), and other financial crypto services.

Coinbase

The “input” of a generation transaction that does not have any parent transaction outputs is where Coinbase got its name, “Coinbase.” This type of transaction does not have any parent transaction outputs. In simple words, it’s the first transaction of a new block.

The platform, which is based in the United States and was the first mainstream Bitcoin exchange, was established by a former engineer for Airbnb named Brian Armstrong and a former trader for Goldman Sachs named Fred Ehrsam.

It launched in the United States in June 2012, three years after the Bitcoin white paper became known worldwide.

In the beginning, Bitcoin was the only existing cryptocurrency that was traded on the platform. Additionally, for the very first time, users were able to purchase Bitcoin using bank transfers.

During its first few years of operation, the trading platform was supported monetarily by well-known venture capital firms such as Union Square Ventures and Andreessen Horowitz. It formed partnerships with companies such as Overstock, Expedia, and Dell to facilitate the acceptance of Bitcoin payments by those companies.

Coinbase essentially operates on two separate platforms, referred to simply as Coinbase and Coinbase Pro. Coinbase Pro is a more advanced trading platform that was derived from the platform formerly known as GDAX (Global Digital Asset Exchange). Its target audience is traders with more experience.

The user-friendly Coinbase platform was developed with new cryptocurrency investors in mind who merely require the ability to buy or convert the cryptocurrency. Additionally, it can be put to use for instructional purposes.

Directly listing their shares on the Nasdaq stock exchange in April 2021, Coinbase Global made history by becoming the first cryptocurrency company to go public (investments offered directly to the public with no brokers involved).

Coinbase is trusted by approximately 73 million verified users, 10,000 institutions, and 185,000 ecosystem partners in over 100 countries. These users are able to invest in cryptocurrencies in a quick and secure manner as well as use the platform as a medium of exchange.

On the regulatory front, Coinbase has, for the most part, been successful in maintaining a compliant stance. The crypto community, on the other hand, has levelled widespread criticism at it for its close collaboration with the Internal Revenue Service (IRS) and the equivalent office in other countries to reveal personal data for taxation purposes.

How do they compare?

Cryptocurrencies available

Coinbase and Binance both give users the option to buy cryptocurrencies with fiat currencies such as the U.S. dollar, the euro, or the pound sterling. Coinbase is the largest cryptocurrency exchange in the world.

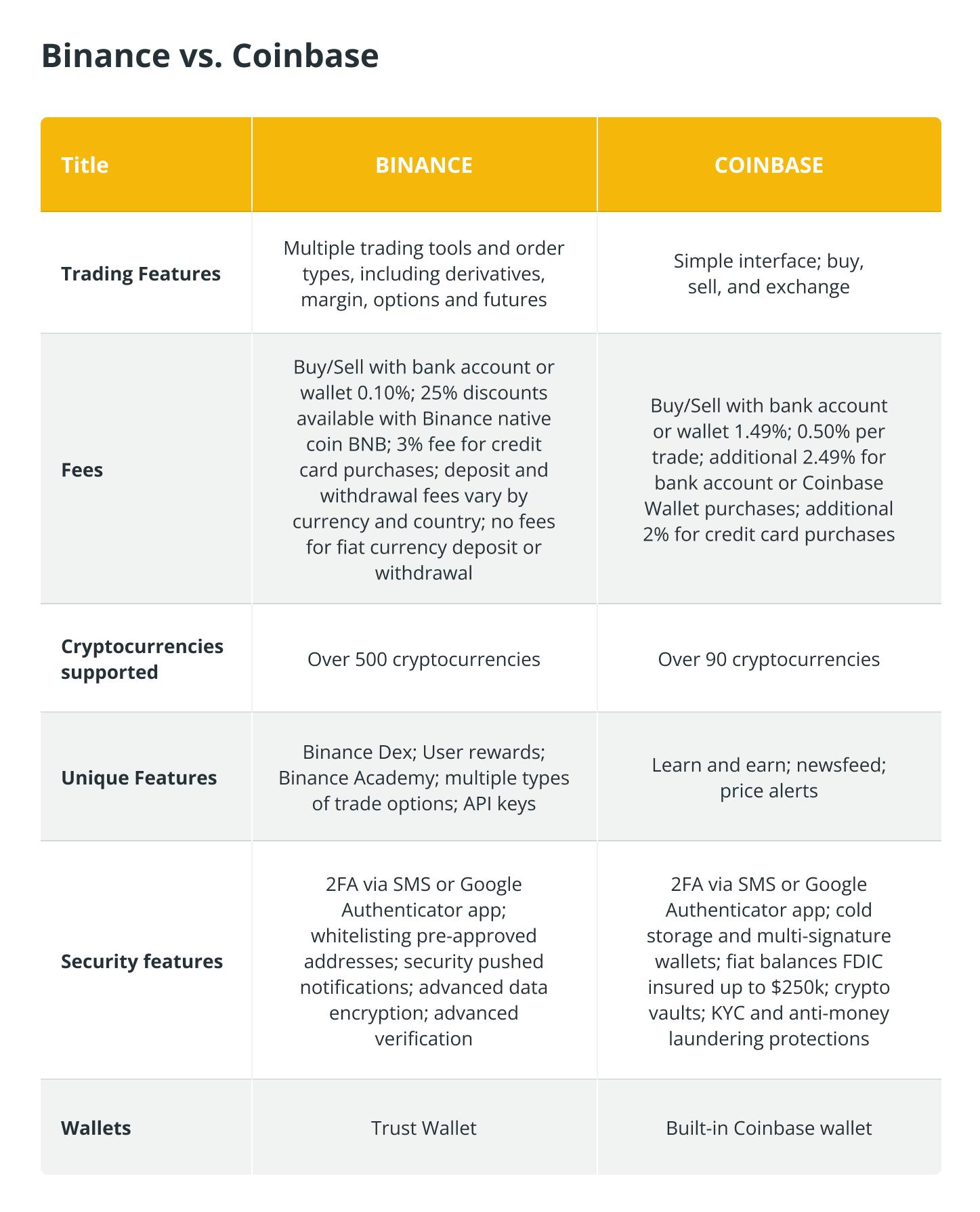

Their service offerings, however, are quite distinct from one another, beginning with the number of cryptocurrencies that are supported by each platform.

Binance gives users access to more than 500 different cryptocurrencies, and Binance US gives users access to more than 60 different types of digital assets. Coinbase and Coinbase Pro together provide access to more than 90 different digital currencies.

Users who want to buy, hold, or trade the leading cryptocurrencies could simply use Coinbase. Coinbase is a marketplace where coins such as Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL) as well as all major cryptocurrencies are widely available.

A more comprehensive trading platform, such as Binance, which provides several trading options for lesser-known coins and tokens may appeal to crypto traders of all experience levels and be the platform of choice. On Coinbase, the minimum purchase amount is $10, while on Binance it’s only $1.

Comparing the fees of Binance and Coinbase Pro

One significant difference between the two platforms is the distinct payment structures that each one offers. The fees charged by a cryptocurrency exchange can be a deciding factor for a trader or investor, particularly when taking into account the costs associated with making deposits and withdrawals of funds.

Since Binance operates on its own cryptocurrency, known as BNB, it is able to charge significantly lower fees than its competitor Coinbase.

Binance

There is no fee associated with making bank transfers using available fiat currencies. On the other hand, Binance.US charges a 4.5% transaction fee for using a credit card to buy cryptocurrencies, while the primary exchange only charges 1.8%.

The fees associated with withdrawals vary depending on the blockchain network and can change for a variety of reasons, including network congestion. Deposits, on the other hand, do not cost anything for any cryptocurrency.

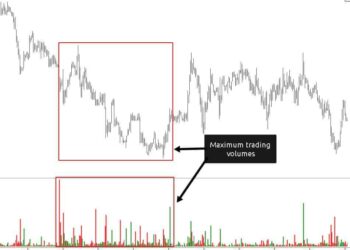

Users will receive a discount equal to 25% of their total purchase price for BNB trades. The maker and taker trading fee is typically set at 0.1%, but it can drop as low as 0.02% when there is a significant increase in the volume of trades.

Coinbase Pro

Additionally, Coinbase Pro does not charge any fees for bank transfers. However, the maker-taker fee is reduced to 0.5% for those customers whose monthly trading volume is less than $10,000.

When trade volumes are extremely high or at “whale levels,” which means in the range of millions of dollars, the fee drops all the way down to 0.1% from its normal rate of 1%.

In addition to the fees that are standard for the network, there is a fee of 1% applied when converting cryptocurrency to cash or withdrawing it. In order for the transaction to be processed by the blockchain network, a network fee must first be paid.

There is a fee of 3.99% for purchases made with a credit card, a fee of 1.49% for purchases made with a Coinbase wallet or bank account, and a fee of $10 for deposits and $25 for withdrawals for wire transfers.

In a nutshell, Binance provides significantly lower fees for each transaction. Additionally, it offers a fee structure that is designed to attract high-volume traders to use its services.

Binance V.s Coinbase’s unique features

Coinbase is a platform that, in general, enables users to buy and sell cryptocurrencies in a straightforward manner, without the use of any advanced features. Binance, on the other hand, gives traders access to a substantial number of trading tools, making for a more rounded overall experience.

Binance unique features

Recommendations: Binance Access to the best DApp recommendations on DeFi, including lending, earning, insurance, and derivative services, NFTs, cross-chain bridge solutions, the BSC building tool, trading, and the opportunity to purchase any cryptocurrency using the MoonPay payment system are all available through Dex.

User rewards:

Binance frequently hosts giveaways and challenges on their platform in order to encourage user participation. Users can claim prizes from the Binance rewards center after completing the required tasks. In addition, Binance will frequently give away coins or tokens that will soon be listed on their platform in the form of airdrops.

Binance Academy:

It offers a free all-encompassing education on cryptocurrencies, making it suitable for both novice and experienced traders. This education includes tutorials on trading, mining, NFT, metaverse, and everything else related to cryptocurrencies.

Multiple possibilities for commercial exchange:

Binance provides its users with a variety of trading tools, one of which is advanced charting that incorporates embedded TradingView charts and features hundreds of overlay management and indicators.

API keys:

By providing the general public with access to their API keys, Binance makes it possible for third-party applications to integrate with Binance.

Coinbase unique features

Users can earn rewards equivalent to a small amount of the cryptocurrency they are investigating by watching educational videos on cryptocurrency projects. These rewards can then be redeemed for cryptocurrency.

Newsfeed:

Coinbase users can take advantage of the built-in newsfeed service to stay current on the latest cryptocurrency news, as well as trends and developments in the cryptocurrency market.

Price alerts:

Users of Coinbase have the option to receive mobile pushed notifications that keep them apprised of any updates to their cryptocurrency’s price or other relevant information via the watchlist.

Binance vs. Coinbase: Wallets

It is not recommended for beginners or advanced users to leave their crypto assets on exchanges because single-server platforms are more susceptible to hacking attacks than distributed systems. Distributed systems are more secure.

There are numerous varieties of cryptocurrency wallets; the majority of them, known as “hot wallets” in contrast to “cold wallets” or “storage,” is only operational when the user is connected to the internet.

Internet-based wallets are more susceptible to hacking attacks; users of these wallets should, as a result, give careful consideration to how they can best safeguard their assets.

Moreover, cryptocurrency exchange wallets are custodial, which means that the exchanges own custody of the assets belonging to their customers. This poses a potential risk in the event that the exchange declares bankruptcy or abruptly ceases business operations for a variety of reasons, as was the case in the past with the Canadian Exchange Quadriga, for example.

Users of custodial wallets never have complete control of their crypto assets because the exchange acts as a bank; as a result, owners do not possess the private keys to claim full ownership of their assets. Custodial wallets are not recommended.

On the other hand, moving assets out of the custodial wallet means that the owners need to take full responsibility for their investments, and if they lose the private keys to their wallet, they may also lose access to their funds. This means that moving assets out of the custodial wallet is not recommended.

Both Coinbase and Binance offer cryptocurrency wallet apps that can be used independently or in the browser. In 2018, Binance completed its acquisition of Trust Wallet, which means that it is now the official wallet for the Binance platform.

It is compatible with over 53 different blockchains and over one million different types of digital assets, such as DApps and NFTs.

The digital assets of Trust Wallet’s over five million users are protected by a personal identification number (PIN), biometric access, an encrypted key, and a 12-word recovery phrase.

It permits earning interest on the stored cryptocurrencies as well as staking coins, thereby providing currency holders with some decision-making power on the network in the form of voting and generating an income for themselves.

The Coinbase Wallet gives users the ability to store over 4000 different types of crypto assets in a single location, such as cryptocurrencies, DApps, and NFTs.

It is designed to protect digital assets with security that is at the forefront of the industry, and it can be used either on a mobile device or in a browser.

Password and biometric access controls are utilized to ensure the safety of the assets. In addition to this, it offers an additional layer of security in the form of a secret recovery phrase that is made up of 12 words and is encrypted.

The Coinbase wallet is straightforward and simple to use, much like the standard trading platform counterpart it corresponds to. In contrast, the Binance Trust Wallet is more complicated to use but has lower transaction fees.

Security Compared Between Binance and Coinbase

The cryptocurrency industry has finally addressed the security concerns that, in the past, caused users to be understandably alarmed. However, due to the numerous security breaches that have taken place over the years, exchanges have been encouraged to deliver improved security features that grant more reliability in the present day.

In spite of this, it is still not strongly recommended for users to leave their assets on exchanges, and users should be aware of the potential risks that may be incurred as a result of taking such an action. Because it has never been the target of any significant attacks since it was first launched, Coinbase gives off the impression of having superior security.

On the other hand, in 2019, the cryptocurrency exchange known as Binance was the victim of a significant hack in which up to 7000 Bitcoin were taken. After the traumatic event, Binance has since implemented stringent new security measures to raise all existing standards to a higher level.

Both Binance and Coinbase provide users with a variety of robust security features to safeguard their digital assets. Coinbase, on the other hand, seems to be more forthcoming about the measures it takes to safeguard its users’ money.

The following is a list of some of the available security options for each platform:

Security measures taken by Binance

The customers of Binance have access to a wide variety of protection tools and settings for their security features. On occasion, however, it does not provide complete transparency regarding their particulars.

For example, the platform does make it clear that the vast majority of users’ funds and assets are kept in offline cold storage facilities rather than being exposed to the elements.

On the other hand, it does not divulge the specific amount of the funds that are secured.

Binance is a cryptocurrency exchange that employs stringent sign-in procedures, such as two-factor authentication, which can be carried out using the Google Authenticator app, SMS, hardware, or email.

It offers advanced access control along with opt-in security features such as whitelisting for IP addresses and wallet addresses, control over API access, and management of devices.

The practice of whitelisting cryptocurrency addresses is becoming increasingly widespread among exchanges. It provides the capability of restricting access to addresses that have the ability to withdraw a user’s cryptocurrency.

Customers record them in their address books, which prevents their funds from being accessed by any other addresses.

In the event that suspicious activity is identified, Binance will send urgent emails, notifications, and security alerts to its users.

Every time a withdrawal attempt, password reset, two-factor authentication, or email address change is made, the exchange risk management system performs an analysis of the data.

Any behaviour that is considered to be out of the ordinary will result in the suspension of withdrawals for a period of at least 24 to 48 hours.

It is possible to protect user data and personal information with Advanced-Data Encryption, which includes protecting data in transit with end-to-end encryption, ensuring that only users have access to their data and Know-Your-Customer (KYC) information.

In order to unlock additional features, such as access to higher deposit and withdrawal limits, the advanced verification feature requires the customer to provide a picture of themselves along with a photo identification that has been issued by the government.

Security measures implemented by Coinbase

Coinbase is the only cryptocurrency exchange that offers FDIC (Federal Deposit Insurance Corporation) insurance on currency deposits with limits of up to $250,000, and the company offers a guarantee that it will keep 98% of its assets offline in cold storage.

Coinbase customers can take advantage of two-factor authentication by downloading the Google Authenticator app or receiving SMS messages.

Coinbase also provides cryptocurrency vaults as an additional layer of protection for its users’ stored digital assets.

These vaults add optional security steps such as multiple user approvals to prevent fraudulent withdrawals, which prevents stored cryptocurrencies from being immediately withdrawn from the vault.

They are also time-locked, which means that any unapproved withdrawals from the vault are reversed within twenty-four hours.

The primary distinctions between Binance and Coinbase

Taxes on Binance versus Coinbase

When calculating a customer’s Cost Basis tax report, Coinbase employs a First in, First out methodology. The report provides a summary of all purchases and sales of cryptocurrencies, as well as the cost basis and capital gains incurred by a customer over the course of a specific fiscal year.

Binance also offers users the possibility to generate their account statements to perform tax calculations.

Through the use of the Tax Tool Functionality, each and every transaction is automatically tracked and accounted for. The Tax Tool Functionality API is able to automatically file taxes through the use of tax tool vendors from third-party services for more than one fiscal year.

Coinbase vs. Binance — staking rewards compared

By contributing to the proof-of-stake (PoS) network of a specific asset, investors are able to participate in staking and earn income with their cryptocurrency holdings.

When users stake their cryptocurrency, they contribute to making the underlying blockchain of that asset more secure and more efficient. In exchange for this contribution, the network will reward the users with additional assets.

Users are able to participate in staking projects and earn cryptocurrencies in a hassle-free and secure manner simply by submitting a simple request. This eliminates the need for users to manage private keys, engage in trading, or carry out any other complex tasks.

Coinbase and Binance are two of the cryptocurrency exchanges that support staking for a wide variety of cryptocurrencies and digital assets.

Coinbase staking

Coinbase provides a staking service for a select number of cryptocurrencies, including Ethereum (ETH), Tezos (XTZ), and Algorand, in addition to a program in which users can earn cryptocurrencies by watching educational videos (ALGO).

Binance staking

Staking options on Binance include locked staking and DeFi staking. DeFi stacking makes it easier for users of proxies to take part in related decentralized projects in a way that is both friendly to newcomers and uncomplicated.

The practice of locking digital assets on a proof-of-stake (PoS) blockchain for a predetermined amount of time is referred to as “locked staking.” The user receives staking rewards in addition to making a contribution to the network when they do this.

Summary:

Both Binance and Coinbase provide users with a variety of robust security features to safeguard their digital assets. Coinbase also provides cryptocurrency vaults as an additional layer of protection for its users’ stored digital assets.

Coinbase and Binance are two of the cryptocurrency exchanges that support staking for a wide variety of cryptocurrencies and digital assets. The user receives staking rewards in addition to making a contribution to the network when they do this.