Decentralized finance Vs Centralized Finance

Customers are frequently unaware of the underlying rules or agreements that govern financial assets and goods, which can lead to the traditional centralized finance (CeFi) ecosystem giving the impression of being mysterious to those who are not experts in the field.

Decentralized Finance (DeFi), on the other hand, is making a name for itself as an ecosystem that claims to provide transparency and control. This is due, in part, to the underlying integrity-protected blockchain, as well as higher financial asset yields than CeFi platforms. DeFi is making its mark as an ecosystem that claims to provide transparency and control.

However, it’s possible that the line between CeFi and DeFi isn’t always as clear as it seems.

This article compares and contrasts DeFi and CeFi from a variety of perspectives, including the law, economics, security, privacy, and the ability to manipulate markets.

What exactly is CeFi and how does it function?

Ancient Mesopotamia is credited with being the birthplace of centralized finance several thousand years ago. Since that time, people have used many different commodities and assets as a form of currency. These include livestock, land, cowrie shells, precious metals (such as gold, which is recognized as a store of value by nearly all cultures), and, more recently, fiat currencies.

As a consequence of this, it has been demonstrated that a medium of exchange can either have an intrinsic worth (like land, for instance), or it can have a value that is imputed to it (fiat currency).

The concept of a centralized institution, such as a government, supporting the financial worth of a currency and commanding a military force has served as the basis for all known attempts to build an everlasting, stable currency and financial system. These attempts have all been based on the idea that a currency and a financial system must be intertwined. But in the world of crypto, what does CeFi stand for?

The central tenet of centralized exchanges, also known as CEXs, in the cryptocurrency industry is that all crypto trading orders must pass through a central exchange in order to be executed. Centralized finance operates on this principle.

Companies such as Binance, Coinbase, and Kraken are examples of CeFi businesses. Users sign up for accounts on these exchanges and primarily use the same platform to send and receive tokens in exchange for cryptocurrencies.

However, this is not the end of it. In addition to dealing in cryptocurrency transactions, the services of lending, borrowing, and margin trading are also made available by these exchanges.

Even though users’ funds are stored on the exchange, users do not have control over those funds, and the funds are vulnerable to threats in the event that the exchange’s security procedures are compromised.

As a direct consequence of this, various forms of cybercrime have been directed toward centralized exchanges. Customers using centralized exchanges feel confident disclosing their personal information and entrusting these organizations with their funds because they believe centralized exchanges are reliable.

In addition, large exchanges typically have entire departments devoted to providing customer support, which makes it easier for customers to get assistance. Customers are provided with a sense of safety and are subsequently reassured that their financial matters are in capable hands when the quality of customer service is of an exceptionally high standard.

What is DeFi, and how does it work?

New imputed currencies have emerged as a result of the development of blockchain technology and its inherent characteristics of being decentralized and permissionless. One of the most powerful features of blockchain technology is its ability to enable the transfer and trade of financial assets without the need for trusted intermediaries.

In addition, decentralized finance is a new subfield of blockchain that concentrates on the development of financial technology and services that are built on top of ledgers that contain smart contracts.

By utilizing cryptocurrencies and smart contracts, DeFi is able to provide its services without relying on any third parties. In the modern world of finance, financial institutions perform the function of acting as transaction guarantors.

The fact that these institutions handle your money gives them a significant amount of power. On the other hand, in the case of DeFi, the role of the financial institution in the transaction is played by a smart contract.

The majority of CeFi’s products, such as asset exchanges, loans, leveraged trading, decentralized governance voting, and stablecoins, are compatible with DeFi.

Despite this, the number of products that can be purchased is consistently growing, and even some of the most complex commodities, such as options and derivatives, are undergoing rapid development.

In addition, DeFi is distinguished by the presence of three distinguishing characteristics: accessibility, control, and transparency. A user is able to investigate the specific rules that govern the functioning of various financial assets and goods when using DeFi.

As an illustration, DeFi makes an effort to eradicate private agreements, back-deals, and centralization, all of which are significant obstacles to the transparency of CeFi.

DeFi gives its users control by allowing them to remain the custodians of their assets. This means that no one should be allowed to censor, move, or destroy their assets without their permission.

Designing and deploying DeFi products is possible for anyone who possesses a functional computer, access to the internet, and a modicum of technical know-how. While this is going on, the actual operation of the DeFi software is being handled by the blockchain and the distributed network of miners that it consists of.

DeFi vs. CeFi: Various properties compared

In the section below, we’ll talk about the most common differences between DeFi and CeFi.

Public verifiability

Even though the DeFi application code might not always be open source, in order for it to be considered a non-custodial form of DeFi, both its execution and its bytecode need to be publicly verifiable on a blockchain.

Because of this, in contrast to CeFi, any user of DeFi can observe and verify the orderly execution of state changes in DeFi at any time. Because of this level of transparency, the new DeFi technology possesses an unrivalled capacity to convey trust.

Atomicity

A transaction on a blockchain makes it possible to carry out a series of actions sequentially, which may include a number of different financial transactions.

This combination has the potential to be made atomic, which indicates that the transaction will either succeed with all of its activities or fail as a whole.

Atomicity could be enforced in CeFi through the use of time-consuming and expensive legal agreements, despite the fact that the programmable atomicity attribute is not present in CeFi.

Anonymous development and deployment

Transactions in centralized finance offer users a lower level of anonymity than those in decentralized finance. The identities of the people behind the creation and management of many DeFi projects are unknown, as is the case with Bitcoin’s original developer as well.

Once the DeFi smart contracts have been installed, it is the responsibility of the miners to ensure that they are carried out. Applications that use anonymous DeFi can function even without a front-end, which requires users to interact directly with the smart contract.

Custody

DeFi, in contrast to CeFi, gives customers the ability to directly control their assets whenever they want (there is no need to wait for the bank to open). Having such enormous power, however, comes with a significant amount of responsibility. Users are responsible for the majority of technological risks unless an insurance policy covering them is purchased.

As a direct consequence of this, centralized exchanges, which are essentially the same as conventional custodians, have emerged as one of the most popular options for storing cryptocurrency assets.

Trading of crypto assets

The foundations on which the CEXs are built are identical to those of their traditional analogues. CEXs are responsible for maintaining limit order books, which are off-chain records of outstanding orders posted by traders. On the other hand, decentralized exchanges, also known as DEXs, operate in a very different fashion.

These exchanges match the parties involved in a transaction by utilizing automated market-maker (AMM) protocols. AMMs use mathematical algorithms to set prices, and transaction volumes are taken into consideration in this process.

Flexibility in the order execution

Users of permissionless blockchains frequently publish in public the transactions they plan to carry out through the use of peer-to-peer networks.

Because there is no persistent centralized entity ordering transaction execution, for instance, peers can engage in transaction fee bidding contests in order to steer the order in which transactions are executed.

As a direct result of the ease with which orders can be manipulated, numerous strategies for manipulating markets have been demonstrated, many of which are now routinely used on blockchains.

On the other hand, regulatory organizations in CeFi impose stringent requirements on the various financial institutions and services available there, such as the manner in which transaction orders must be carried out.

The fact that CeFi’s financial intermediaries are centralized, on the other hand, makes this possibility more plausible.

The costs of transactions

Fees attached to transactions in DeFi, and blockchains in general, are an essential component in the fight against spam. However, because financial institutions in CeFi have the ability to rely on Anti-Money Laundering (AML) verifications of their customers, these institutions have the option of providing transaction services at no cost to their customers (or are compelled by governments to offer some services for free).

hours of continuous market activity

It is common knowledge that CeFi markets are prone to experiencing outages. For example, the New York Stock Exchange and the Nasdaq Stock Exchange, which are the two most important trading venues in the United States, both operate from 9:30 am to 4:00 pm Eastern Time, Monday through Friday.

As a result of the persistent nature of blockchains, the majority of DeFi markets, if not all of them, are available for trade around the clock, seven days a week. As a direct consequence of this, DeFi does not engage in pre-market or post-market trading, in contrast to CeFi, which does, despite the fact that liquidity on a wide range of goods is typically low during these times.

Privacy

Only blockchains that do not protect users’ privacy when executing smart contracts host the cryptocurrency DeFi. Because of this design flaw, the blockchains in question only offer a veneer of anonymity rather than the real thing.

As a result of the fact that centralized exchanges that implement AML policies are frequently the only viable option for converting fiat currency into cryptocurrency assets, these exchanges have the ability to divulge address ownership information to authorities upon request.

Arbitrage risks

To reduce or eliminate the possibility of experiencing price fluctuations, an arbitrage deal should ideally be structured to function atomically. Arbitrage on centralized and hybrid exchanges is inherently vulnerable to price fluctuations in the market. This is the case even when the arbitrageurs are working together with the exchanges to guarantee atomicity of execution.

When transaction fees are not taken into consideration, risk-free arbitrage between two decentralized exchanges operating on the same blockchain can be achieved.

This is because of the atomicity property of the blockchain, which enables traders to compose a smart contract that executes the arbitrage and reverts to its original state if the arbitrage does not result in a profit.

The arbitrage risk of two DEXs on separate blockchains is comparable to that of a CEX and hybrid exchange when they are arbitraged together.

Inflation

Inflation refers to a decline in the value of a currency supply due to the creation of additional units of currency in circulation. The relationship between supply and inflation does not always clearly reveal itself; there are times when the money supply increases without causing inflation. Although inflation is defined as the loss of a currency’s purchasing power, the relationship between supply and inflation does not always reveal itself clearly.

In a Central Bank Directed Economy (CeFi), central banks retain the power to produce fiat money. Inflation is frequently measured in relation to the value of a representative consumer goods market basket, also referred to as a consumer price index.

In the world of DeFi, the asset supply of a number of different cryptocurrencies may be subject to change. Bitcoin (BTC) will likely, at some point in the not-too-distant future, face the conundrum of a supply having a hard cap. In contrast, the economic activity it has to sustain does not have a cap, which will result in a scarcity of currency.

Because there is no inflation and therefore no block reward, blockchains in general and Bitcoin, in particular, may be susceptible to security flaws because there is no inflation.

It is not yet clear whether Bitcoin and other cryptocurrencies, when compared to fiat currencies, experience a significant income gap as a result of inflation in the fiat system. There is no compelling evidence to suggest that cryptocurrencies offer a solution to this issue.

Fiat conversion flexibility

CeFi services are frequently used for the trading of Bitcoin and other major coins that were generated using independent blockchains. As a general rule, DeFi services do not support these tokens because the process of completing atomic cross-chain exchanges can be difficult and time consuming.

CeFi services are able to provide a solution to this issue because they store funds from multiple chains (whereas decentralized services require that tokens follow Ethereum token standards to achieve interoperability).

CeFi has a significant advantage in this regard due to the fact that many of the coins with the highest market cap and the most frequent trading activity exist on separate blockchains and do not adhere to the rules governing interoperability.

Conversion options available for Fiat.

When it comes to exchanging traditional currency for Bitcoin or vice versa, centralized services typically offer greater versatility than their decentralized counterparts.

The majority of DeFi providers do not offer fiat on-ramps because the conversion of fiat currency to cryptocurrency requires the involvement of a centralized institution. Additionally, customers can be onboarded significantly more quickly in CeFi, which contributes to an improved overall experience for the customer.

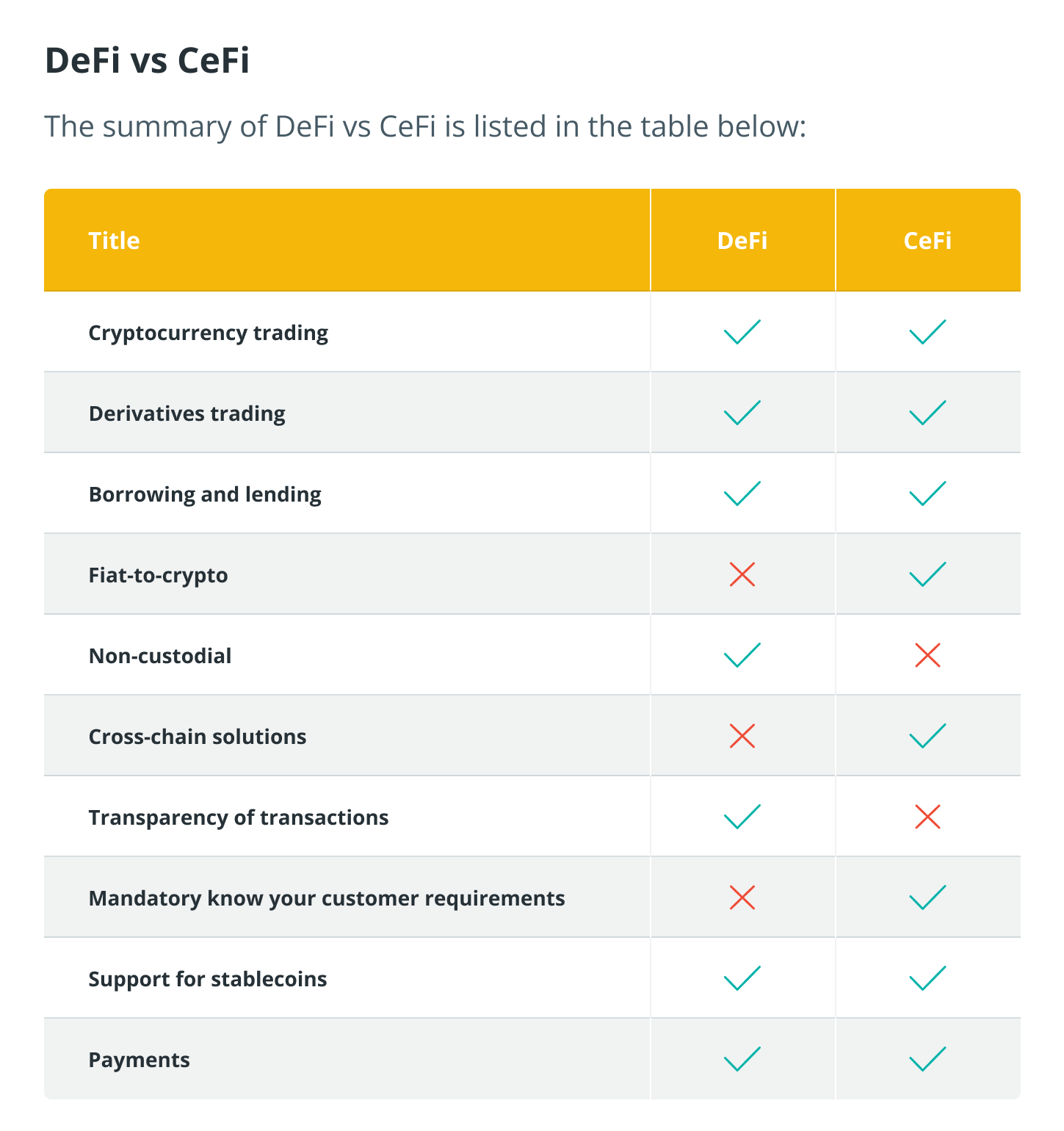

The comparison between DeFi and CeFi is summarized in the table that follows:

Synergies between CeFi and DeFi

The development of DeFi is just getting started right now. The blockchain settlement layer gives DeFi and CeFi their distinctive characteristics, such as decentralization, non-custody, and transparency. CeFi also has these characteristics.

On the other hand, the blockchain imposes restrictions on the throughput of DeFi transactions, the confirmation latency, and users’ ability to maintain their privacy.

The traditional financial system is still very important to DeFi, as it has been for a long time. It is important to note that the value of crypto-assets on DeFi is still principally determined and recognized in terms of fiat currency.

Because their value is pegged to that of a traditional currency, stablecoins have become one of the most popular types of digital assets. Only central banks are authorized to issue what is known as central bank money, as was mentioned at the beginning of this piece.

As a direct consequence of this, the use of fiat currency renders central banks irrelevant, at least for the time being.

Lending platforms backed by CeFi serve as a connecting point between the conventional monetary system and the market for cryptocurrencies. These services give users the ability to borrow fiat money directly (instead of fiat-pegged stablecoins) and use their cryptocurrency holdings as collateral in order to do so.

These platforms are managed by well-established businesses that act as counterparties to customers who are borrowing money and making deposits. As a direct consequence of this fact, the businesses in question are frequently referred to as crypto banks.

In addition, both DeFi and CeFi strive to accomplish the same thing, which is to offer consumers superior financial products and services while simultaneously driving economic growth.

To summarize, both DeFi and CeFi come with their own individual set of advantages as well as drawbacks, and there is no easy way to combine the advantages that come with both types of systems.

As a consequence of this, we are of the opinion that these two distinct yet intertwined monetary systems will coexist and be to each other’s benefit. A few potential synergy partnerships are highlighted in the following section.

Bridges

Financial institutions are connecting their DeFi and CeFi systems in order to improve their overall efficiency. Oracles such as Chainlink transport CeFi data to DeFi; Synthetix enables users to trade CeFi financial instruments as DeFi derivatives; and the Grayscale Bitcoin Trust makes it possible for users to trade Bitcoin on the CeFi over-the-counter market.

DeFi as an innovative addition to CeFi

Not only do DeFi protocols mimic standard CeFi services, but they also optimize these services to take advantage of the characteristics that are unique to blockchains. For instance, the well-known order-book architecture that was used in CeFi has been replaced in DeFi by a brand-new exchange mechanism referred to as AMM.

The Automated Market Maker (AMM) is a form of smart contract that purchases assets from liquidity providers. As a consequence of this, traders conduct their business against the AMM smart contract rather than dealing directly with liquidity providers.

The AMM design cuts down on the number of interactions with market makers, which results in lower transaction costs compared to a CeFi order book.

In response, CeFi is implementing these new developments. Following in the footsteps of the AMM concept, centralized exchanges such as Binance started offering market-making services.

While existing DeFi markets are not prepared to enter the DeFi market-making industry, certain CeFi markets, such as foreign exchanges, which have used a combination of the AMM model and human interaction, are in a good position to do so.

AMM providers may choose to implement certain CeFi strategies in order to lessen the risk that their customers face from arbitrageurs.

Lesson for CeFi: DeFi collapse

On March 12, 2020, the cryptocurrency market experienced a catastrophic crash, with the price of ETH falling by more than 30 percent in a little under a day’s time. On the 19th of May in 2021, the price of ETH dropped by more than forty percent.

“Black Thursday” refers to the day that the Dow Jones Industrial Average dropped by 9.99%, earning it the moniker in CeFi markets (but with less dramatic daily moves).

CeFi and DeFi were both under a great deal of pressure while the crashes were occurring. The destabilization of centralized exchange systems can be attributed to an unusually high volume of trading activity (for example, Coinbase paused trading for almost an hour, and exchanges were momentarily shut down after exceeding pre-determined daily movement limitations).

Similarly, the cost of gas on Ethereum (ETH) skyrocketed to the point where a regular ETH transfer costs more than one hundred dollars.

The subsequent burden on the network led to the failure of the MakerDAO liquidation bots in February 2020, which resulted in a delay in the confirmation of users’ transactions.

In contrast to CeFi, services provided by DeFi are theoretically accessible at all times due to the decentralized and distributed nature of blockchains.

In contrast, when faced with the aforementioned extreme circumstances, most users will find that the cost of DeFi systems has become unreasonably high. Since then, there has been a greater focus placed on how resilient the protocols underlying DeFi are.

The settlement processes and user behaviours of CeFi and DeFi are distinct from one another; however, CeFi could potentially gain a lot of knowledge from DeFi’s stress tests. While CeFi is dependent on circuit-breakers to reduce excessive asset volatility (trading is halted when volatility exceeds specified levels), DeFi appears to have been successful in avoiding such disruptions up until this point. This could be of assistance to CeFi in better understanding its limits.