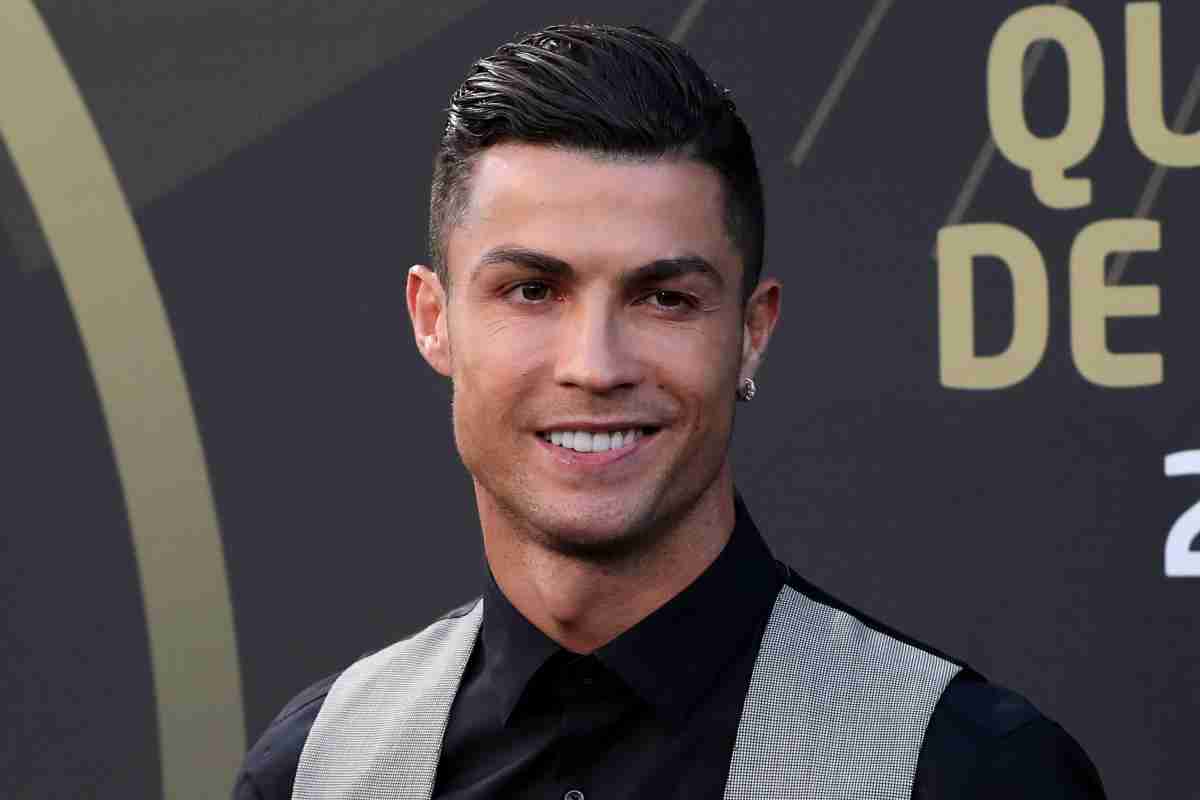

Ronaldo’s Alleged Role in Binance Lawsuit

Cristiano Ronaldo Binance lawsuit is coming in as the renowned soccer star is embroiled in a $1 billion class-action lawsuit related to his association with cryptocurrency exchange Binance. The lawsuit, filed in the District Court for the Southern District of Florida, accuses Ronaldo of actively participating in the offer and sale of unregistered securities in collaboration with Binance.

The legal action, initiated by lead plaintiff Michael Sizemore, alleges that Ronaldo’s promotions encouraged investments in unregistered securities, making him complicit in the misrepresented offerings of Binance.

The lawsuit claims to represent consumers who purchased unregistered securities from Binance, asserting that Ronaldo’s involvement played a crucial role in promoting these investments. Michael Sizemore, a California resident and the lead plaintiff, allegedly bought unregistered securities from Binance based on Ronaldo’s endorsements and exposure to misrepresentations regarding the Binance platforms. The legal filing contends that Ronaldo’s promotions actively solicited investments in unregistered securities, leveraging his vast following to encourage fans and supporters to invest with the Binance platform.

Ronaldo’s partnership with Binance in 2022, particularly in the creation of a non-fungible token (NFT) collection showcasing animated figures representing moments from his illustrious career, is highlighted in the lawsuit.

The legal action asserts that Ronaldo’s promotions were disseminated on public websites, television, and social media platforms accessible nationwide, including in Florida. The suit suggests that Ronaldo likely received substantial compensation, possibly in the form of digital assets transmitted through Binance platforms, in exchange for his promotional services.

The lawsuit against Ronaldo is part of a series of legal challenges faced by Binance. In June, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance and its founder Changpeng “CZ” Zhao, alleging violations of federal securities laws.

Recently, Binance agreed to a $4.3 billion settlement in a separate case with U.S. prosecutors related to alleged breaches of sanctions and money-transmitting laws. Ronaldo’s involvement in the Binance saga adds a new dimension to the legal complexities surrounding the cryptocurrency exchange.

The lawsuit against Ronaldo underscores the regulatory scrutiny on celebrities endorsing cryptocurrency platforms. It references prior warnings from the SEC about virtual tokens potentially being classified as securities, emphasizing the obligation for celebrities to disclose when they receive compensation for promoting securities.

As the legal proceedings unfold, the case raises broader questions about the responsibility of influencers in the cryptocurrency space and the potential impact on the relationship between celebrities and the rapidly evolving world of digital assets.

The class-action lawsuit against Cristiano Ronaldo represents a notable development in the ongoing intersection between the world of sports celebrities and the cryptocurrency industry. Ronaldo, with his immense global influence and social media reach, holds a unique position in the digital era, making his endorsements and partnerships subject to heightened scrutiny.

The accusations in the lawsuit highlight the potential consequences for celebrities who engage in promotions within the crypto space without proper disclosure and adherence to regulatory guidelines.

The collaboration between Ronaldo and Binance, particularly in the creation of an NFT collection, exemplifies the increasing trend of celebrities entering the crypto space. NFTs, often associated with high-profile individuals and their unique digital assets, have become a focal point of attention and investment.

This lawsuit serves as a cautionary tale, emphasizing the need for clarity in celebrity endorsements, especially in industries with evolving regulatory landscapes like cryptocurrencies.

As the legal proceedings unfold, the case against Ronaldo may prompt a reevaluation of endorsement practices within the crypto industry. The lawsuit’s timing, amid Binance’s recent settlements and regulatory challenges, adds an intriguing layer to the unfolding narrative.

Questions arise about whether other celebrities involved in crypto promotions will face similar legal scrutiny, and if these cases will contribute to the establishment of clearer guidelines for celebrity endorsements within the cryptocurrency space.

The broader implications of this lawsuit extend beyond the individuals involved, impacting the reputation and regulatory landscape of the entire cryptocurrency industry. With regulatory bodies increasingly vigilant about potential securities violations and misleading promotions, the case may catalyze discussions around the responsibilities of both influencers and the platforms they endorse. It underscores the need for greater transparency and adherence to existing regulations to foster trust and credibility in the burgeoning crypto ecosystem.

The $1 billion class-action lawsuit against Cristiano Ronaldo in connection with Binance reflects the evolving challenges faced by celebrities engaging in cryptocurrency promotions.

The outcome of this legal battle could set precedents for future cases involving celebrity endorsements within the crypto space, influencing how influencers navigate their partnerships and responsibilities in this dynamic and rapidly evolving industry.

As the crypto landscape continues to mature, regulatory clarity and ethical considerations will play pivotal roles in shaping the relationship between celebrities and the ever-expanding world of digital assets.