Decentralized finance, also known as DeFi, is an application of blockchain technology that has proven successful and offers a potentially advantageous alternative to conventional finance.

Decentralized finance, or DeFi for short, refers to a wide range of financial products and services that are powered by distributed ledger technology (also known as blockchain).

Decentralized finance applications, also known as DApps, are developed with the intention of doing away with the role of the middleman in financial transactions, which has traditionally been played by conventional financial institutions like banks.

This is achieved by the technology through the implementation of a trust mechanism that is based on blockchain technology and enables secure peer-to-peer (P2P) transactions without the need to pay a commission to the bank.

The proliferation of use cases surrounding decentralized finance has created new opportunities for investors in decentralized finance to earn passive income.

Investors are required to commit their DeFi assets as resources to confirm transactions and execute processes over the proof-of-stake (PoS) consensus mechanism in order to generate passive income. Let’s look at the many opportunities we have for earning passive income based on DeFi.

DeFi yield farming (liquidity mining)

In the context of DeFi, “yield farming” or “liquidity mining” refers to earning additional cryptocurrencies by utilizing existing crypto assets. In order to participate in the yield farming investment strategy, investors are required to stake or delegate crypto assets in a liquidity pool that is based on smart contracts.

The pool recycles the cryptocurrencies that have been invested in order to supply liquidity for DeFi protocols, and it rewards users with a portion of the fees that it has obtained by doing so.

DeFi yield farms allow users to use ERC-20 tokens like Ether (ETH) when it comes to investments and rewards. In the world of passive income based on DeFi, yield farming is typically regarded as one of the more high-risk investments due to the fact that it is programmed to earn the maximum possible yield or return.

The trading of cryptocurrencies on decentralized exchanges (DEXs) is made easier with the help of liquidity pools, which in turn offer a “yield” in the form of payment for completing tasks such as confirming transactions.

The strategies executed on the smart contracts will determine the level of success each pool achieves with its yield. The monetary value of the user’s tokens that were invested in the liquidity pool will also be taken into consideration when determining the payout amount.

When a user contributes cryptocurrency to a liquidity pool or lends cryptocurrency to a liquidity pool, the operator or the farmer intends to redistribute the assets with the ultimate goal of achieving the highest annual percentage yield (APY).

The annual percentage yield (APY) is a unit that can measure the annual returns earned on investments, including the interest compounded each year. Traditional banks typically provide an average savings rate of 0.06% APY, but decentralised finance institutions’ potential return on investment is significantly higher.

DeFi staking

Staking in DeFi is very similar to yield farming in many respects, and as a result, it serves as an incentive for users to keep their cryptocurrency holdings for longer periods of time. Users must either deputize or lock up their cryptocurrency holdings to become validators on the blockchain. This process is analogous to yield farming.

When participating in staking, users have the opportunity to earn rewards by staking their tokens for a predetermined period of time; the specifics of these plans are determined by the operator. Before a user can be added as a validator to any blockchain, that blockchain must first meet the requirements for a minimum amount of tokens, which in the case of the Ethereum blockchain is 32 ETH.

In addition, the estimated earning potential that can be obtained through DeFi staking will be determined by two factors: the rewards plan of the network and the length of time that the staking will be conducted. Staking not only has monetary benefits but also directly contributes to improving the performance of blockchain projects and making them more secure.

DeFi lending

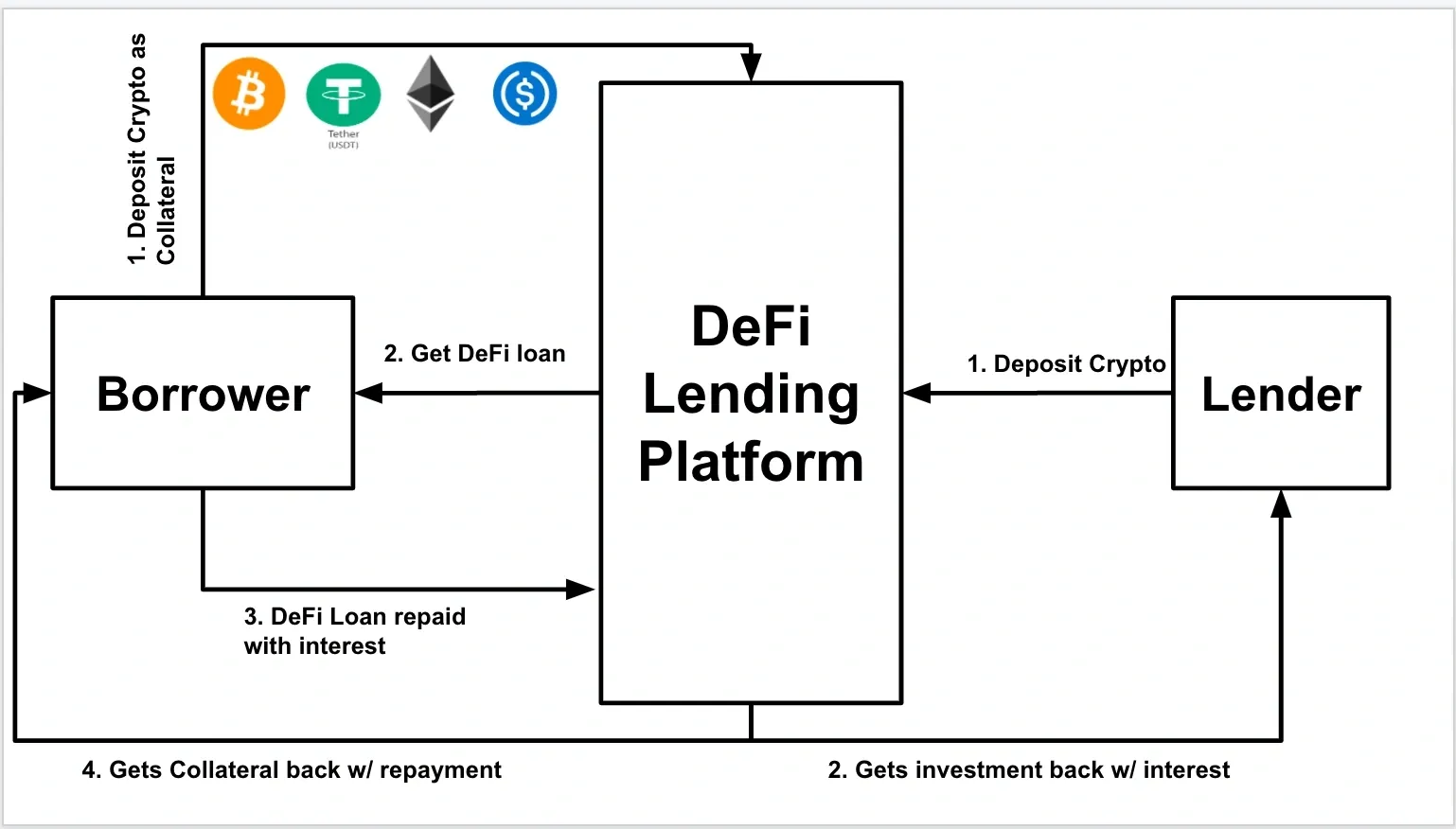

The term “lending” is a catch-all phrase that refers to a wide range of investment strategies that involve earning passive income through the use of cryptocurrencies. Through the use of pre-programmed smart contracts, investors can communicate directly with borrowers in a decentralized form of lending known as DeFi.

To put it another way, DeFi lending platforms make it possible for investors to list their cryptocurrency tokens so that they can be borrowed by borrowers and repaid with interest after a predetermined amount of time.

Not only do smart contracts assist in removing the risks that are normally associated with lending in conventional finance, but they also do away with the necessity of providing collateral. However, most applications for loans do not require background checks, which are essential in mitigating the risks of credit fraud and fraud in general.

The peer-to-peer (P2P) service that DeFi lending provides enables borrowers to borrow cryptocurrency directly from other investors in exchange for timely interest payments. Smart contracts, in contrast to traditional forms of lending, make it possible for users located anywhere on the planet to pool and share crypto assets without the involvement of a third party.

In addition, the blockchain technology that underpins the system ensures that all transactions are both transparent and unchangeable for all parties involved.

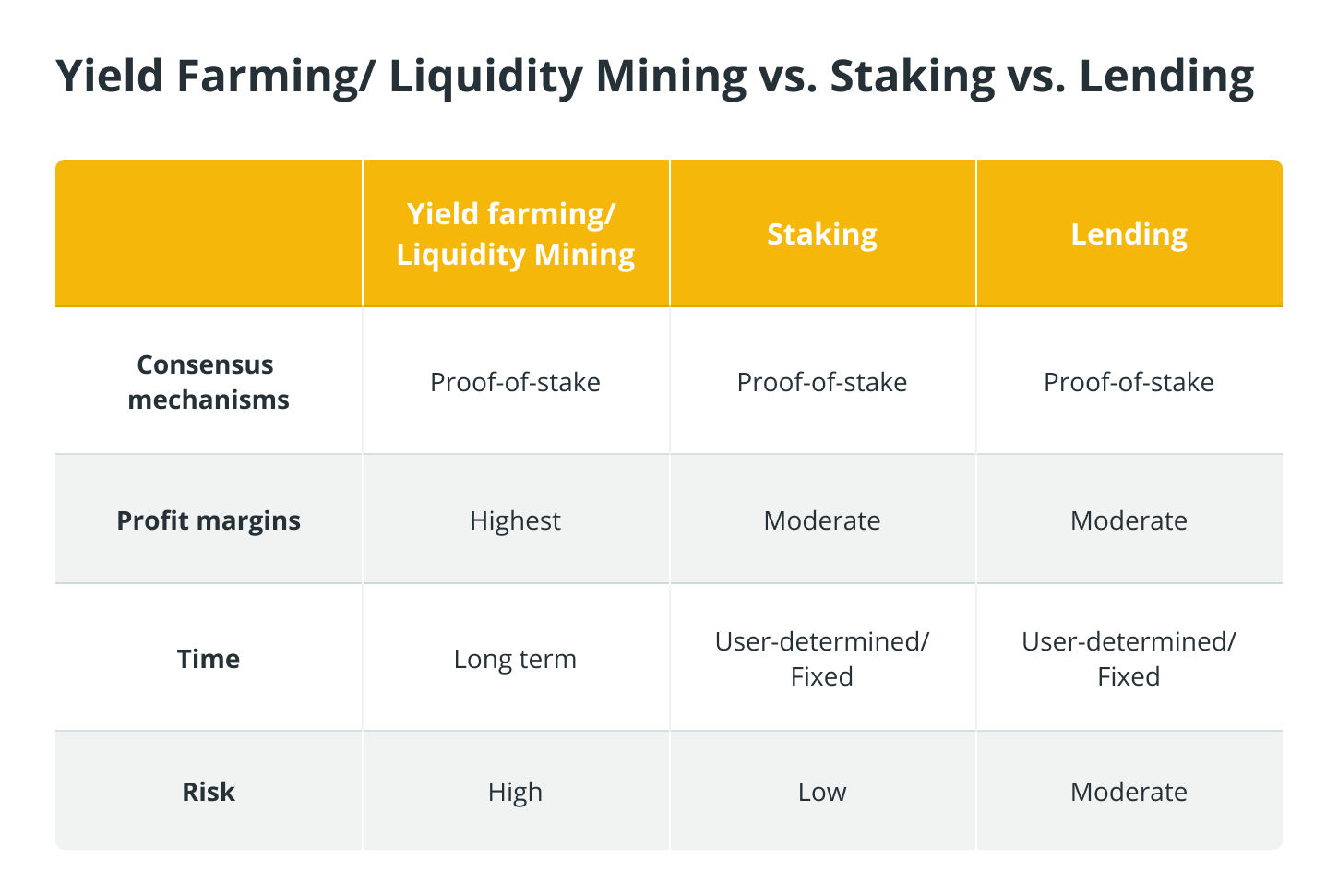

Differences between DeFi alternatives for passive income

Risks of DeFi-based passive incomes

Every type of investment comes with a certain amount of risk, which is typically accompanied by a potentially lucrative opportunity for profits that is proportionately higher. Scams, hacking attacks, and smart contracts that are either incomplete or overly optimistic are the primary dangers posed by revenue streams based on the DeFi platform.

The price volatility of cryptocurrencies could result in a loss in terms of profit during a bear market due to the fact that earnings from DeFi-based platforms relate to the number of tokens earned. When this occurs, investors have a tendency to keep holding onto the tokens until the price of the market increases and provides unrealized gains.

Additionally, the intent of the pool’s owners is a potential factor in the level of risk associated with the DeFi investment strategy. As a result, it is essential to determine whether or not the service providers can be trusted by looking at their previous payouts.

Monitoring the status of your investments

Because there are so many distinct opportunities to generate passive income with DeFi, it can be a hassle to keep track of your numerous wallets spread across various platforms.

As a consequence of this, a significant number of DeFi traders now make use of portfolio trackers or aggregators. These applications connect to several different protocols and wallets and allow you to evaluate and manage your entire portfolio from a single dashboard.

The term “yield aggregator” refers to a service that increases productivity by streamlining the processes involved in making a profit. It could be made up of hundreds of farms and vaults, all of which are set up to make money off a diverse range of decentralized services using various business models.

You can even access chart views that perform real-time analysis on data from multiple aggregators, which are provided by some aggregators. Other aggregators even provide cross-chain integrations and multiple wallet connections.

Cross-chain is a technology that enables blockchain networks to share information and value with one another, thereby improving the networks’ ability to interact with one another.

The walled nature of blockchains is destroyed as a consequence of this, leading to the development of a decentralized but connected ecosystem.

In addition, cross-chain integrations make it easier for you to determine the potential annual percentage yield (APY) returns across pools and track portfolios across wallets. In addition, any user can use any of these methods to generate passive income by leveraging their digital assets.

They supply the cryptocurrency markets with much-needed capital and liquidity in exchange for rewards, eliminating the need for any middlemen to be involved in the transaction. This is a crucial service that they provide.

Be wary of projects merely interested in stealing your locked tokens and redeeming them at liquidity pools to deplete your funds. These projects are sometimes referred to as scammers or “rug pullers.” Be sure that the farms and platforms you use have a good reputation and that they have published smart contracts that have been audited by an outside party.

Before getting involved in liquidity pools, staking, or lending, investors should conduct extensive research on the various parties that are involved in the transaction.

Decentralized Finance, also known as DeFi, provides users with a number of different opportunities to earn income, including lending and borrowing, yield farming, staking, trading, and participation in ICOs and IEOs.

Having said that, it is a high-risk environment, and there is a possibility that you could lose money. Before investing, it is essential to conduct extensive research and get a solid understanding of the DeFi ecosystem and the specific protocols.