In the intricate worlds of stocks and cryptocurrencies, the term “FUD” has evolved into a powerful and pervasive force that influences investor and consumer sentiments. Standing for Fear, Uncertainty, and Doubt, FUD represents a tactic where emotions are strategically manipulated through rumors, adverse facts, or false news stories.

While its origins date back decades, the concept has gained prominence, particularly within the cryptocurrency community in recent years. This exploration delves into the nuanced nature of FUD, its manifestation in both stocks and crypto, and strategies for investors to navigate these complex landscapes.

Understanding FUD: Unveiling a Manipulative Tactic

FUD, as a concept, transcends the boundaries of traditional finance and permeates the dynamic world of cryptocurrencies. In essence, it represents a set of psychological tactics aimed at instilling Fear, Uncertainty, and Doubt in the minds of investors and consumers.

This manipulation often takes the form of spreading rumors, disseminating adverse facts, or crafting false narratives that can negatively impact market perceptions. Investors and traders may find themselves making decisions based on heightened emotions rather than sound analysis, contributing to market volatility.

The roots of FUD can be traced back to the stock market, where the term was first employed to capture the potential for investors to succumb to anxiety or pessimism that influences their decision-making processes. Over time, however, the concept has found a new home in the cryptocurrency space, gaining significant traction due to the unique characteristics and challenges of digital assets.

FUD in Crypto: Navigating the Uncharted Waters

The cryptocurrency landscape, characterized by its novelty and technological intricacies, provides fertile ground for the propagation of FUD. The fear of the unknown, coupled with the potential for misunderstanding the underlying blockchain technology, creates an environment where FUD can flourish. Issues such as security concerns, regulatory developments, and the prevalence of rumors contribute to significant market swings.

One notable source of FUD in the crypto space is the collapse of exchanges, a phenomenon that has occurred in the past, leading to widespread panic and distrust among investors.

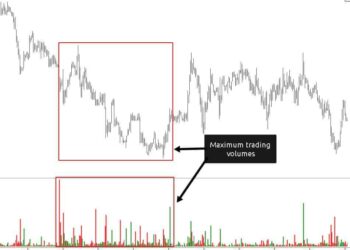

Additionally, fraudulent schemes, such as rug pulls, where the creators artificially inflate the value of a token and then sell off in high quantities, contribute to the prevalence of FUD. As investors react to negative headlines and uncertainties, the market experiences pronounced fluctuations, reflecting the impact of FUD in the crypto sphere.

While FUD in the crypto market shares similarities with its manifestation in traditional stocks, the decentralized and relatively unregulated nature of cryptocurrencies adds a layer of complexity.

The lack of a central authority or regulatory framework leaves investors more susceptible to the influence of FUD, making it crucial for market participants to develop a discerning approach to information consumption and decision-making.

FUD in Stocks: A Historical Insight

In the traditional realm of stocks, FUD was initially associated with the potential for investors to succumb to anxiety or pessimism, impacting their decisions.

This psychological tactic often manifests during periods of economic uncertainty, market downturns, or unforeseen events that cast a shadow of doubt over the future. Social and mass media play pivotal roles in disseminating FUD, influencing the sentiments of investors and triggering panic selling.

While FUD in stocks has a historical foundation, its prevalence has surged in recent times, fueled by the rapid dissemination of information through digital channels.

Investors are exposed to a constant flow of news, opinions, and analyses, making it challenging to discern reliable information from speculative or sensational narratives. The advent of online forums and social media platforms has amplified the speed at which FUD can spread, influencing market dynamics in real-time.

Especially during turbulent times in financial markets, FUD can prompt a wave of “sell first, ask questions later” behavior among investors. The fear of potential losses and the uncertainty surrounding market conditions contribute to reactionary decision-making, creating opportunities for market manipulation.

However, disciplined, long-term investors often view such turbulent periods as attractive buying opportunities, leveraging the emotional reactions of others to build strategic positions.

FUD vs. FOMO: Balancing Acts in Market Psychology

In the lexicon of market psychology, FUD stands in contrast to another potent force – the Fear of Missing Out (FOMO). While FUD capitalizes on inducing fear and doubt, FOMO stems from the anxiety of not benefiting from a trend enjoyed by others. In the context of stocks and crypto, understanding the interplay between these psychological forces is essential for investors seeking to navigate volatile markets.

FOMO becomes particularly pronounced in the crypto market, characterized by its higher volatility and the potential for rapid price movements. Investors, driven by the fear of missing out on lucrative opportunities, may make impulsive decisions to enter the market during periods of intense bullish activity.

The danger lies in the possibility of investing in assets that are overvalued or subject to speculative bubbles, leading to heightened risks of financial loss.

Recognizing the contrasting dynamics of FUD and FOMO enables investors to approach decision-making with a more balanced perspective. Strategic investors focus on fundamental analysis, risk management, and a long-term perspective, steering clear of emotional reactions driven by either fear or the desire to chase short-term gains.

Developing a disciplined and informed approach to market psychology equips investors to weather fluctuations and make sound decisions based on a comprehensive understanding of market dynamics.

Dealing with FUD: Crafting a Strategic Shield

Effectively dealing with FUD requires a multifaceted and strategic approach. Investors can adopt several measures to protect themselves from the negative influence of manipulative tactics and make informed decisions:

1. Verify Information Sources:

In the age of digital information, discerning the credibility of sources is crucial. Investors should verify the authenticity of information before reacting to it. Cross-referencing news from multiple reliable sources can provide a more accurate understanding of market conditions.

2. Professional Guidance:

Relying on professional guidance from financial experts, analysts, and reputable institutions can provide a more informed perspective. Investors should seek insights from sources with a proven track record of accurate predictions and analysis, steering clear of unofficial or unverified news outlets.

3. Thorough Research:

Conducting thorough research on investment opportunities is paramount. Investors should delve into the fundamentals of the assets they are considering, understanding the technology, market trends, and the team behind the project. “Do Your Own Research” (DYOR) is a mantra often emphasized in the crypto community, encouraging investors to independently assess the potential of a project.

4. Maintain Investment Discipline:

Discipline is a key element in navigating the emotional rollercoaster of markets influenced by FUD. Establishing clear investment goals, risk tolerance levels, and a long-term strategy can help investors stay focused on their objectives amid market fluctuations.

5. Evaluate Industry and Company Potential:

Beyond short-term market sentiment, investors should evaluate the long-term potential of the industry and specific companies. Focusing on the underlying value proposition, technological innovations, and market positioning can provide a more robust foundation for investment decisions.

While FUD can trigger emotional reactions and market volatility, investors armed with knowledge, discipline, and a strategic mindset can navigate these challenges effectively. By staying informed, conducting thorough research, and adhering to a disciplined investment approach, market participants can shield themselves from the negative impact of manipulative tactics and contribute to a more resilient and rational market environment.

Other Crypto Slang: A Diverse Lexicon

The cryptocurrency world boasts a diverse lexicon, reflecting the unique culture and language that has evolved within this dynamic ecosystem. Understanding this terminology is essential for individuals

navigating the crypto space. Here are some commonly used crypto slangs:

| Term | Definition |

|---|---|

| HODL | Encourages investors to “hold on for dear life.” |

| Sats | The smallest unit of Bitcoin, named after its creator, Satoshi Nakamoto. |

| DYOR | Advises investors to “do your own research” rather than relying on hype. |

| Ape | Refers to purchasing an NFT or token without proper research. |

| Bagholder | Someone holding onto a losing investment. |

| Scam Coin | A fake cryptocurrency created to deceive investors. |

| Rug Pull | A fraudulent scheme where the value of an asset is artificially inflated and then sold off. |

In conclusion, understanding and navigating FUD in both stocks and the crypto sphere is a critical skill for investors. The psychological tactics employed to induce fear, uncertainty, and doubt can significantly impact market dynamics, leading to both challenges and opportunities. Investors who cultivate a disciplined and informed approach, backed by thorough research and a long-term perspective, are better equipped to weather the storms of market volatility.

By recognizing the contrasting forces of FUD and FOMO, investors can strike a balance between caution and opportunism. The evolving landscape of digital assets requires continuous adaptation, and investors who stay abreast of market developments while adhering to sound investment principles contribute to the maturation of the cryptocurrency ecosystem.

As the crypto world continues to innovate and redefine traditional financial paradigms, informed decision-making becomes paramount. Embracing the diversity of crypto slang, understanding market psychology, and fortifying one’s approach with strategic measures pave the way for investors to thrive in these dynamic and transformative markets.