As a crypto holder, you are probably familiar with the terms “proof-of-work” and “proof-of-stake”. These terms are the mostly used consensus mechanisms in the blockchain for decentralized projects. Well, a consensus mechanism is a set of regulations, algorithms, and other systems of agreement that determines if a transaction on the blockchain is valid.

The purpose of a consensus mechanism is for decentralized cryptocurrencies to ensure that no user spends the same money twice (double spending) without a third party like PayPal regulating it. Therefore, for a cryptocurrency to be valid on the blockchain, it has to either follow the proof-of-work (PoW) or proof-of-stake (PoS) model.

Satoshi Nakamoto (the man to create the first cryptocurrency, bitcoin) thought of validating a transaction without needing a central authority or regulatory body. He came up with a consensus mechanism called proof-of-work to allow networks to agree to the validation of a transaction.

While proof-of-work is an old model, the proof-of-stake model is modern and 100% way better than the former model. For instance, the PoW was/is known to consume a lot of electricity and handle limited transactions at once. There are many cons associated with the proof-of-work model, which is why new consensus mechanisms that consume less energy have emerged, like the proof-of-stake.

Most cryptocurrencies commence projects with PoS, while some have just changed from PoW to PoS. Bitcoin is the most accepted cryptocurrency that uses the proof-of-work model and Ethereum is the leading asset with the proof-of-stake model. The key difference between these two models is that while PoS relies on staking, PoW relies on mining. Keep reading to know more about these most important consensus mechanisms.

What is proof of work and proof of stake?

Proof of work involves mining cryptocurrency, which means completing complicated computational puzzles before new transactions can be added to the blockchain. By spending lots of time, energy and power, it is intended that the cost of fraud increases way more than the rewards for any dishonest activity on the network. People who use and love the PoW over the years have argued that the process is straightforward and helps them manage their time.

Anyone with a proof-of-work cryptocurrency can mine and add more blocks to the blockchain to earn block rewards. Solving complicated puzzles involves lots of crunching with equipment used by miners.

PoW is similar to a game of lottery, which implies that miners have to create a series of candidate blocks of new transactions that must survive really tough conditions. Most of the time, these candidate blocks do not survive and the miner has to try again.

The goal of mining cryptocurrency is to be the first miner with the target hash. Such miner can receive crypto rewards and update the blockchain. PoW supporters love this mechanism even though the process of finding the hash is difficult. A hash is a string of pseudorandom numbers. Although the process of finding the hash is cumbersome, verification is easy.

How Does Proof of work (PoW) work?

How Does Proof of work (PoW) work?

Transactions using the PoW consensus mechanism occur on the blockchain. Several blocks consisting of a transaction order is arranged in chronological form on the blockchain.

Some miners use expensive and high-class computers to compete by uploading legitimate blocks that meet the criteria of the network. The proof-of-work algorithm chooses which miner can upload new entries into the ledger. The ledger contains all recorded transactions on the blockchain and arranges them into successive blocks to avoid a user double-spending. Double spending destroys the blockchain network and ruins its important features, such as immutability, decentralization, and trust.

Thereafter, the ledger becomes distributed throughout the blockchain to prevent cases of tampering. Users can identify ledgers that has been tampered with by using a hash (a string of numbers). Through the hash function, users can ascertain if the data that created the hash is same as the original data or, whether it has been tampered with.

Then, transactions that occurs after are verified by a node. PoW algorithm, with the aid of computational power plus cryptography, will help users solve mathematical problems during the hash process. In turn, this will create new blocks and secure legal transactions.

The hash process involves guessing a hash. The miner who wins the target hash distributes it to the network. If users find it to be accurate, a new block will be added to the blockchain and the miner will receive his crypto rewards.

Using dogecoin as an example to show how PoW works to secure the blockchain: when a dogecoin holder places a transaction, it passes through a process called verification. These transactions are categorized into different blocks for mining.

The algorithm for dogecoins’ proof-of-work (which is script) will create a hash for the block. Miners will begin to compete to generate a target hash below the hash rate for the block. A miner that wins earns a dogecoin reward in the form of 10,000 dogecoins, which can be sold or held in their crypto wallet.

Pros and Cons of Proof-of-work.

| Pros | Cons |

| Provides an advanced level of security. | It consumes lots of energy. |

| Gives room for miners to make money by earning rewards. | Requires expensive equipment like a single-purpose computer. |

| Network is open and decentralized. |

Proof-of-work Blockchain Examples

The proof-of-work list in blockchain or the proof-of-work example in the blockchain is all the cryptocurrencies that support the PoW consensus mechanism.

- Bitcoin: Bitcoin is the first cryptocurrency to launch (in 2008) and establish the proof-of-work in cryptocurrency. It is popularly known as the first generation of crypto. Bitcoin, long before now, has provided a decentralized currency aiding peer-to-peer transactions.

- Litecoin: Litecoin is an alternative to bitcoin, known as the altcoin. It was launched in 2011 by Charlie Lee. It was developed as a bitcoin fork because of bitcoins’ slow transactions. It became an open-source and network that allows near-zero cost payments globally. The reward for being the miner to add a block to the litecoins’ blockchain is 12.5 LTC per block.

- Dogecoin: Although it was named after a meme, the coin has had better days. It was developed by Billy Marcus and Jackson Palmer. Miners are rewarded with extra dogecoin for supporting the blockchain (mining).

- Bitcoin Cash: Bitcoin cash was also created to boost the speed of transactions and charge cheaper fees. It uses the PoW to mine and add new blocks to the blockchain.

- Ethereum Classic: The platform is great for handling smart contracts. It is a hard fork of bitcoin and totally different from ethereum. Ethereum classic is rewarded to miners capable of solving complicated puzzles and verifying transactions.

- Monero: This is another proof-of-work cryptocurrency that is often neglected but it is the largest crypto that focuses on privacy. Transactions that occurs on the platform are untraceable and completely hidden.

Why is Proof-of-work Required For Bitcoin.

Bitcoin is a decentralized currency that allows peer-to-peer transactions without a central authority. And as such, the blockchain needs to be secured to prevent dishonest transfer of value within the network. Bitcoin relies on solving complicated computational puzzles as the basis for trust.

The proof-of-work is done to prove that the nodes on the bitcoin blockchain agree and do not lie. Through this consensus mechanism, alteration of the blockchain is impossible and for it to be possible, subsequent blocks has to be re-mined. This provides security for the users/blockchain which prevents fraud and builds trust.

What is Proof-of-stake in Cryptocurrency.

The proof-of-stake consensus mechanism was initiated in 2011 to make up for the shortcomings of the previous consensus mechanism, proof-of-work. Instead of solving computational problems, the PoS is based on a verifiable stake in the network.

A validator validates transactions on the blockchain to earn rewards and to do this, users need to put a particular amount of cryptocurrency on the line. The PoS is a great way of making your money work for you (passive income).

How Does PoS Work.

Crypto users who want to earn rewards must lock their crypto for a while. It is usually advisable to use cryptocurrencies that support crypto staking. Users are chosen based on the amount of crypto staked.

For instance, Mr. A stakes 45 Ethereum coins, Mr. B stakes 15 Ethereum coins, Mr. C stakes 20 Ethereum coins, Mr. D stakes 75 Ethereum coins, and Mr. E stakes 55 Ethereum coins. At the end of the day, Mr. D will be chosen to validate new transactions and add them to the block.

If the network notices any dishonest activity, the user may lose his stakes in a process called slashing. Users who are selected to validate transactions earn rewards in the form of transaction fees. Rewards from staking can be earned either by staking and becoming a validator or by delegating your coins through a wallet.

Pros and Cons of Proof-of-stake.

Even the PoS has its advantages and disadvantages. They are:

| Pros | Cons |

| No high amount of wastage of energy resources. | Security is not as strong as the proof-of-work. Most of the security of exchanges that support staking has been breached at a point. |

| Faster and inexpensive transactions | Can tend towards centralization |

| It is an easy way for a cryptocurrency holder to make passive income. | Only users with high stake can be chosen to validate transaction. |

| Does not require expensive equipment | |

Proof-of-stake Blockchain Example.

These are coins that supports the staking consensus mechanism. These coins include:

- Ethereum (ETH)

- Binance (BNB)

- Cardano (ADA)

- Polkadot (DOT)

- Avalanche (AVAX)

- Algorand (ALGO)

- Cosmos (ATOM)

- Toncoin (TON)

- Near Protocol (NEAR)

- Elrond (EGLD)

- Polygon (MATIC)

- Solana (SOL)

- Tron (TRX)

- Texos (XTZ)

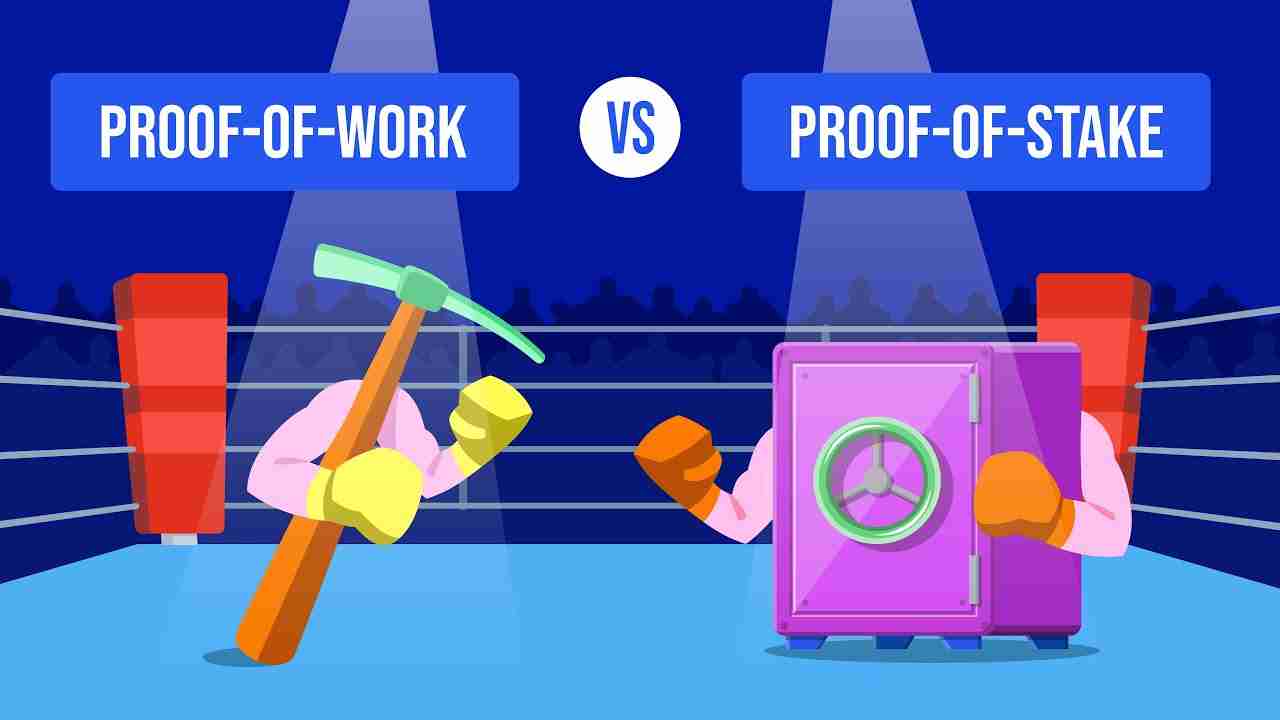

Proof of Work Vs Proof of Stake

Proof of work and proof of stake are two different consensus mechanisms that have the same aim but work differently to achieve it. Their aim is to secure the integrity of the blockchain and earn rewards. While proof of stake involves staking coins, proof of work involves mining blocks. Let’s take a look at the differences they have.

| Key characteristic | Proof-of-work | Proof-of-stake |

| How it works | The amount of computational work solved influences that chance of mining a block. | The amount of coins staked influences the chances of validating a new block. |

| How are rewards earned? | The first person to mine a block successfully earns a reward. | The validator receives a network fee for every block validated. |

| Centralization | Centralized in nature. | Decentralized in nature. |

| Security | Security is based on the enormity of the hash. The higher the hash, the higher the security. | As staking and locking assets is done, the blockchain becomes secure. |

| Equipment | The PoW system uses specialized equipments like application-specific integrated units (ASICs) and graphics processing units (GPUs). | No specialized equipment is required. A standard grade device will suffice for staking. |

| Efficiency | Proof-of-work systems are more energy-efficient and expensive. | This system consumes less energy and is inexpensive. |

| Reliability | It is more reliable | It is less reliable. |