What is the difference between a bull and a bear market for cryptocurrencies, and how should one approach either one? The terms “bull” and “bear” are frequently utilized to describe the performance of stock markets, specifically how much their values have increased or decreased respectively.

In this context, a market that is rising is referred to as a bull market, while a market that is declining is referred to as a bear market.

These terms are used to refer to longer periods of predominantly upward or downward movement in the cryptocurrency market. This is due to the fact that the cryptocurrency market is generally volatile and experiences daily fluctuations.

Similar to the way that changes in the economy are signalled by significant swings, changes in the markets are indicated by substantial swings of at least 20% in either direction.

The application of these trends to cryptocurrency will be the primary focus of this article. In particular, we will talk about the following:

A market that is either bullish or bearish. Which characteristics distinguish bull markets from bear markets? How can we tell whether the market for cryptocurrencies is bullish or bearish?

The primary distinctions between a bull market and a bear market, as well as advice on how to invest in either type of market.

What is a bull market?

A bull market is a term used to describe economic conditions that are, on the whole, favourable. When this occurs, it indicates that a market is increasing, and it is also typically accompanied by optimistic investor sentiments regarding the market’s current uptrend.

In a bull market, asset prices continue to rise over an extended period of time. This rise in asset prices occurs alongside a robust economy and high levels of employment.

This is true for traditional markets as well as cryptocurrency markets. On the other hand, it is more common to see bull runs in cryptocurrency that are stronger and more consistent over longer periods of time.

What does it look like when the cryptocurrency market is on a bull run? It is not uncommon for there to be a price increase of up to forty percent within one to two days. This is due to the fact that crypto markets are relatively smaller in comparison to traditional markets, and traditional markets are, as a result, more stable.

It is believed that the term “bull market” originated from the fighting style of a bull, in which it attacks its opponents with its horns in an upward motion.

In modern parlance, a “bullish” market or investor is typically one that expresses optimism regarding the continuation of an asset’s rise in value.

On the cryptocurrency market, a charging bull is symbolic of an upcoming bullish phase for cryptocurrencies.

In this region, you’ll see that the value of cryptocurrencies is increasing as a result of generally favourable economic conditions and optimistic investors who are looking to capitalize on their rising crypto portfolios.

To put it another way, bull markets are initiated by investors by purchasing various types of securities. This is also possible with fiat currency, as rising prices of securities are typically indicative of bullish market conditions.

The bull market will continue as long as the amount of demand exceeds the amount of supply. After a certain amount of time, the bull runs out of steam, so to speak, and the market shifts and becomes a bear market.

What causes a bull market?

As was stated earlier, the beginning of a bull market can be attributed to investors. When they have the expectation that prices will begin to rise and remain elevated for an extended period of time, they begin purchasing stocks (while the price is still low) and are optimistic about the return on investment that they will receive (ROI). The rising level of optimism among investors is another factor that contributes to the continued rise in stock prices.

There are a number of other aspects that contribute to the development of a bull market. A robust gross domestic product (GDP) and low unemployment rates are two examples of these advantages.

In most cases, improved market conditions are the root cause of an increase in investors’ level of confidence. Bull markets in cryptocurrencies, like bull markets in traditional markets, are influenced by a variety of similar factors.

Cryptocurrency markets, on the other hand, are still in their infancy when compared to traditional securities markets, which have existed for many decades, if not centuries. Because there are fewer investors overall, the cryptocurrency market may also be driven by factors that are specific to its niche.

For instance, bull runs in cryptocurrencies could be caused by factors such as:

- Support from mainstream media and popular culture: Consider the bull runs of 2017 that were influenced by celebrities such as Paris Hilton and DJ Khaled, as well as television shows such as The Big Bang Theory.

- The incorporation of institutional capital; the 650 million dollar investment that MicroStrategy made in Bitcoin (BTC) is a good example of this (over 70,000 BTC).

- Traditional finance is showing signs of growing optimism, with JPMorgan strategists predicting that Bitcoin could rally to as high as $146,000.

- Unprecedented occurrences that pose a risk to conventional finance: The COVID-19 pandemic, for instance, caused a lot of people to turn to cryptocurrencies in the midst of the strain that the pandemic placed on conventional financial markets.

Characteristics of a crypto bull market

The following are some of the attitudes and behaviours that are typical of a bull market:

- An accumulation of price hikes over an extended period of time.

- A robust demand in spite of a limited supply.

- A rise in the level of confidence that investors have in the market.

- An excessive markup on the cost of certain projects.

- The introduction of discussions pertaining to cryptocurrencies into both traditional media and social media platforms.

- A general interest in cryptocurrency among celebrities, influencers, and other sectors that may not have been interested in cryptocurrency previously.

- A sharp increase in the cost of goods in the event that favourable news is reported.

- A marginal decrease in market prices in the event that adverse news occurs.

What is a ‘bull run’ in the cryptocurrency market?

A bull run is a term used to describe an extended period in which a significant number of investors are purchasing cryptocurrencies.

It is characterized by the characteristics that were mentioned above, such as rising prices, demand outweighing supply, and high market confidence.

Typically, increased investor confidence triggers a positive feedback loop, which further extends the current bull run (more investments, continued rise in prices).

The level of confidence that investors have in a particular asset is one of the primary factors that determine the price of that asset. This is especially true for cryptocurrencies.

What is a bear market?

A bear market, on the other hand, is one in which the value of cryptocurrencies has dropped by at least 20% and is continuing to fall. Bear markets tend to last for several months.

One notable example of this is the crash that occurred in the cryptocurrency market in December of 2017 when Bitcoin’s price plummeted from $20,000 to $3,200 over the course of just a few days.

A decline of at least 20% from the most recent highs indicates the presence of a bear market that is on the decline. Because of this, prices are currently very low and continuing their downward trend.

The downward trend has a similar impact on the expectations of investors, which in turn helps to perpetuate the downward pattern. It is believed that the word “bear” originated from the fighting style of a bear, which involves starting high, then attacking with claws downward, and finally pushing down with all of its weight.

A bear market is characterized by sluggish economic growth and elevated levels of unemployment. Poor economic policies, geopolitical crises, bursting market bubbles, and even natural disasters can all lead to these conditions.

During bull runs, the vast majority of investors are filled with general optimism and confidence; however, bear markets lack this quality.

In general, the goal of crypto traders is to acquire assets during a bear market, particularly at the very bottom of the market.

Nevertheless, it can be difficult to know exactly when a bear market has ended. As a result, it can be difficult for investors to take the risk of purchasing low-value cryptocurrencies that may or may not recover their value.

When the market receives news about unfavourable conditions pertaining to a particular cryptocurrency or stock, prices typically drop immediately.

As a result of the downward spiral, an increasing number of people delay making investments due to the conviction that they will soon be subjected to additional depressing news and that they must prepare themselves for the worst.

Some people even get so scared that they liquidate their holdings, which further contributes to the downward trend. Investors typically regain their confidence over time, which can eventually lead to the beginning of a new bull cycle. Bear markets typically end up settling down.

What causes a crypto bear market?

A bear market is typically triggered when there is a consistent downward trend in pricing. As price declines continue, investors simultaneously lose faith that prices will eventually rise again, which leads to further downward trends in price.

In general, events such as wars, political upheavals, pandemics, and sluggish economies have the potential to kick off the beginning of a bear market. A bear market could also start as a result of intervention from the government.

However, when it comes to cryptocurrencies, it is much more difficult to forecast when a bear market will begin based on previous trends. In contrast to the stock market, which already has decades’ worth of data for investors and analysts to refer to, the cryptocurrency market is still in its infancy.

There are many different factors that can contribute to a bear market; however, there are a few common warning signs that indicate a bear market is about to begin. The following are some of the signs that a bear market for cryptocurrencies may soon emerge:

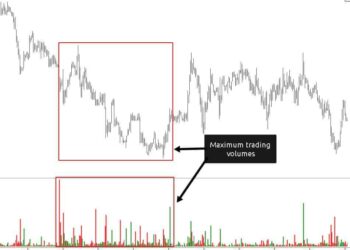

- A decrease in the volume of trading: This typically indicates that people have begun hoarding their coins as a result of the uncertainty in the market.

- Pessimism from traditional sources of finance, such as when Jamie Dimon, CEO of JPMorgan, called Bitcoin a fraud in 2017, just a few months before the price reached $20,000 per unit and then promptly crashed.

- The death cross is a type of technical indicator that refers to the point at which an asset crosses from a moving average of 50 days to one of 200 days.

- Backwardation refers to a situation in which the price of an asset on the futures market is lower than its price on the current market.

- Variations in the federal funds rate, which refer to the interest rate at which financial institutions lend and borrow each other their excess reserves overnight.

- Intervention from regulatory bodies: The Chinese government’s restrictions on cryptocurrency software and mining are a good example of this type of intervention. These types of interventions result in the suspension of a significant number of mining operations, which in turn causes widespread unpredictability.

Characteristics of crypto bear markets

The following are examples of attitudes and behaviours that are common during a bear market:

- Prices that have been going down for an extended period of time.

- There is a disparity between supply and demand.

- A lack of confidence on the part of investors in the market.

- There is no discussion of cryptocurrencies, either positively or negatively, in any mainstream or social media outlets.

- A widespread lack of faith in cryptocurrencies among financial experts, analysts, and traditional institutions.

- A pullback from recent highs in the event of favourable news.

- Keep your lows lower in the event that bad news comes out.

Key distinctions between a bull market and a bear market

The question that a lot of people want to be answered, then, is how you can tell if the market for cryptocurrencies is bullish or bearish. Despite the fact that both are largely determined by the trend of cryptocurrency prices, there are significant distinctions between the two that investors should be aware of.

The impact that rising and falling market trends have on cryptocurrency is, for the most part, equivalent to what they do on stock prices.

The volatility of cryptocurrency, on the other hand, results in distinct patterns of behaviour among cryptocurrency markets. As a consequence of this, cryptocurrency markets have a tendency to move more quickly whenever bull or bear market trends begin to take hold.

Both bull and bear markets are much simpler to identify in the stock market. It’s possible that this won’t be the case with cryptocurrencies, given that crypto investors provide feedback that has a different impact on cryptocurrencies than it does on stocks.

Take for instance the cryptocurrency markets, which are currently attempting to recover from a bear market. As a result, an investor will typically switch into bull investor mode when the market has reached its lowest point during a bear market. As a direct result of this, cryptocurrency prices will rise much more quickly.

When compared to stock bull markets, crypto bull markets tend to move much more quickly. They also have a tendency to have a shorter lifespan, typically lasting anywhere from a few days to a month at most.

Then, as the bull market continues to gain strength, investors’ holdings will gradually decrease because they are likely selling the currency and cashing out their positions.

Because of this, bull and bear markets have a different effect on cryptocurrencies than they do on stocks because cryptocurrencies are more volatile and exchanges happen much more quickly.

There are a number of key distinctions between bull and bear markets, including the following:

The supply and demand

When the market is in a bull run, there is a high demand for cryptocurrencies despite a limited supply. There is a high demand from investors to acquire cryptocurrency, but only a minority are willing to sell their holdings. The increased competition among investors to buy what is offered subsequently drives prices even higher.

Bear markets, on the other hand, are characterized by a greater number of people selling than buying (as opposed to the investment principle). As a result, if demand is lower than supply, prices will continue to fall.

Market Scenario

A rise in GDP heralds the beginning of a bull market, whereas a fall in GDP indicates the beginning of a bear market. This is due to the fact that an increase in GDP typically coincides with an increase in revenue for companies and an increase in salaries for employees. Together, they make it possible for more money to be spent by consumers.

On the other hand, gross domestic product (GDP) declines when business revenues are low and wage growth is either slow or nonexistent. As a result, bear markets typically coincide with economic recessions, which are characterized by a decrease in GDP for two quarters in a row.

Effects on the economy

A weak economy is often accompanied by a bear market. Profits fall, which has a negative impact on the economy. This happens when companies are unable to meet their revenue goals and when consumers do not spend enough money.

People are hesitant to trade or invest in cryptocurrencies and stocks for the same reason, possibly because of the current market conditions.

On the other hand, a bull market is associated with a robust economy, which is characterized by increased spending by consumers and significant increases in business profits. During bull runs, there is also an increase in trading activity involving cryptocurrencies.

Viewpoints of potential investors

The mindset of investors and the performance of the cryptocurrency market are closely connected. When a bull market is present, an increase in the prices of cryptocurrencies further boosts investors’ confidence in the market.

As a direct consequence of this, an increased number of investors are inspired to put their money into the market in the expectation of achieving satisfactory returns on their investments.

During a bear market, the sentiment of investors toward cryptocurrencies is typically bearish. As a result of this, some investors panic and sell their holdings, which further drives prices down and causes more investors to act in the same manner.

Stock price

One of the quickest ways to determine whether or not one is in a bullish or bearish market is to look at the prices of the cryptocurrencies that are currently being traded. In addition, increasing asset prices are a leading indicator of growing market confidence and an impending bull run. On the other hand, falling asset prices are consistent with waning investor confidence and the approach of a bear market.

Liquidity

A bullish market is characterized by increased liquidity, which enables stocks to trade at lower transaction costs. This is possible because investors have a high level of confidence that they will receive rapid and consistent returns. On the other hand, a bearish market is characterized by reduced liquidity because investors do not have faith in the overall market conditions.

International investments

Price growth that is steady and uninterrupted is indicative of a bull market. As a consequence of this, a growing number of investors are confident in the uninterrupted rise in price and are more willing to take risks. On the other hand, falling prices in a bear market come hand in hand with decreased confidence among investors.

Job market

Alterations in consumer preferences are also closely linked to fluctuations in unemployment rates. A bull market is characterized by falling unemployment rates, which are accompanied by an improving economy and increased consumer purchasing power.

However, companies have a tendency to reduce their employee headcounts during bear markets, which causes an increase in the unemployment rate. Because of this, a bear market is likely to continue for a longer period of time because people are earning less, which means that businesses are also earning less revenue.

Is it better to buy in a bull or bear market?

Bearish market conditions typically present an opportunity for cryptocurrency traders to make purchases at more favourable prices. As a consequence of this, when bullish markets appear, they have a greater chance of making a substantial profit.

Buying, on the other hand, can be advantageous during a bull market for a number of reasons. When markets are bullish, buying during those times can help contribute to an upward trend, which can in turn drive your profits as the market continues to strengthen.

Both of these strategies, along with any other trading tactic, carry some level of risk. So, the key is to really be able to understand historical trends and stay updated with cryptocurrency news. During the time that you spend investing in cryptocurrencies, you will most likely come across both bulls and bears, so it is in your best interest to consider buying both bullion and bearing.

How to invest in a bull market?

When investing in a bullish market, it’s always best to recognize the trend early on so you can likewise buy early. After some time has passed, you will have the opportunity to sell at higher prices just as the market is reaching its peak. Bear markets tend to be short-lived, so any losses that do occur are typically insignificant and only temporary.

But what if things take an unexpected turn (like a crisis or regulatory intervention), and you sense a bear market emerging? What would you do then? In this situation, the best course of action is to reduce your positions, particularly those that are in cryptocurrencies with less track record.

It is possible that you will want to temporarily place your holdings in cash, precious metals, or other assets of a similar nature. This is due to the fact that they are more likely to withstand the impact of a collision.

Cryptocurrencies also tend to be available at lower prices at the end of bullish markets, so keep an eye out and take advantage of the possibility of increasing your investments.

How to invest in a bear market?

During a bear market, there is a natural increase in risk associated with investing in cryptocurrencies because prices are lower and investors have little to no confidence in cryptocurrencies.

On the other hand, taking on this risk opens the door to the prospect of greater returns in the years to come. As a result, it is possible to buy cryptocurrencies when their prices are low and then sell them when they are at their highest point during the subsequent bull market.

An additional tactic that investors employ is selling their existing holdings as soon as they recognize the beginning of a downward trend in the market. They then repurchase these holdings at a much lower price in the future as the market continues to fall.

It is impossible to predict how long a bear market will continue, which is especially true if it is caused by a recession or other similar conditions. The problem is that it is impossible to predict how long the price drop will actually last or how much further prices are capable of falling. As a consequence of this, you run the risk of making an ill-timed purchase or of passing up a lucrative investment opportunity.

Conclusions

Many different factors are driving bull and bear markets in the cryptocurrency space. When compared to the stock market, the cryptocurrency market has a smaller number of investors and is more volatile. As a result, there are a few key distinctions to be made when comparing trading opportunities during bullish and bearish market conditions.

Investors in cryptocurrencies typically make purchases when prices are low during bear markets and keep their holdings so they can realize significant profits when the subsequent bull market begins.

During bullish trends, professional traders should keep an eye out for what is known as the “rectangle pattern.” There are still a ton of other trading strategies available.

One useful strategy is to continue monitoring historical patterns of bull and bear market trends in the market. Using this information, you may be able to anticipate upcoming ones, or at the very least, it can provide you with strategies for navigating changes in the market.

Another beneficial practice is making it a habit to stay current on the latest news regarding cryptocurrencies, as well as to learn from industry professionals by reading up on their best practices.

It is essential to keep in mind that there are always risks associated with each investment strategy, regardless of whether you are making investments during a bull market or a bear market.

As a result, we strongly suggest that you conduct your own investigation so that you can be certain that the choice you make is the most appropriate one given the circumstances.

You can always consult Blockrum’s Crypto guides and basics that contain great resources, such as this excellent beginner article on how to get involved with crypto if you want to read up on the fundamentals of crypto in the event that you want to learn more about the subject.

We also have a vast repository of materials that provide a more in-depth look into the particulars of various cryptocurrencies, such as Bitcoin, Ethereum, and Dogecoin, amongst others. By reading useful resources, you will become more familiar with industry terms and the most effective strategies for dealing with various types of cryptocurrencies.