Cryptocurrencies have taken the world by a storm, and more and more people are looking to invest in them. But let’s be honest, figuring out how they actually work can be quite intimidating. There are so many terms to learn and concepts to understand that it can make your head spin. However, one essential idea that you must comprehend is tokenomics, which refers to how the supply and demand of cryptocurrencies impact their value.

So, what exactly is tokenomics, and how does it affect digital assets?

In simple terms, tokenomics is the study of the economics behind cryptocurrencies. It’s all about analyzing the way tokens (or coins) are created, distributed, and traded, and how these factors impact the overall value of a digital asset.

Tokenomics can be a complex topic, but it’s crucial to understand if you want to invest in cryptocurrencies. In this blog post, we’ll break down the basics of tokenomics and show you how it affects the value of digital assets. So, let’s dive in!

What is Tokenomics?

Tokenomics refers to the economic principles and theories that govern the creation, distribution, and management of cryptocurrencies or tokens. It is the study of the incentives, mechanisms, and rules that influence the behavior of the actors in the cryptocurrency ecosystem, including users, investors, developers, and other stakeholders. Tokenomics aims to create a sustainable and effective token economy that incentive’s the adoption and usage of the token while ensuring the long-term viability and growth of the project.

Fig 1. Showing Demand and Supply Curve (Money and Finance, 2022)

The Key Components Of Tokenomics (Supply, Demand, And Distribution)

- Supply: This refers to the total number of tokens that are available for use or circulation within a cryptocurrency ecosystem. The supply of tokens can vary depending on the rules set by the project developers, which may include factors such as inflation, deflation, or fixed supply. The supply of tokens can also be influenced by the actions of the community, such as mining or staking.

- Demand: This refers to the desire or willingness of individuals to acquire and hold a particular cryptocurrency. Demand for a cryptocurrency can be influenced by several factors, such as its utility, functionality, scarcity, and market sentiment. High demand for a token can lead to an increase in its value, while low demand for tokens can result in a decrease in its value.

- Distribution: This refers to how the tokens are initially distributed and subsequently circulated within the cryptocurrency ecosystem. The distribution of tokens can impact the value of a cryptocurrency as it can affect its perceived scarcity and adoption rate. For instance, if tokens are distributed in a way that encourages widespread adoption and usage, it can increase demand and, therefore, the value of the token.

How Tokenomics Differs From Traditional Economics

Tokenomics is quite different from traditional economics in a few ways. For one, traditional economics is all about physical goods and services, whereas Tokenomics deals with digital assets such as cryptocurrencies and tokens. The value of physical goods is based on their intrinsic value, while the value of cryptocurrencies depends entirely on how much they’re being used within the ecosystem.

Another big difference is that traditional economics is heavily influenced by government policies, regulations, and central banks, while Tokenomics operates independently of any central authority. In other words, the community has more say in how tokens are distributed, the level of demand, and the overall supply of tokens in the market.

Additionally, traditional economics focuses on macroeconomic indicators such as GDP, inflation, and employment rates, while Tokenomics focuses on micro economic indicators such as token velocity, token burn, and staking rewards. Traditional economics is all about maximizing profits, while Tokenomics is focused on creating a sustainable and efficient token economy that encourages people to adopt and use the token. In Tokenomics, the aim is to create a network effect where the value of the token grows as more people use it.

How does tokenomics work?

Tokenomics works by creating a system that encourages participation and rewards users for contributing to the network. The process involves designing and managing the token system, which includes various aspects such as token issuance, distribution, supply, demand, utility, economics, and governance. The goal is to create a self-sustaining ecosystem that incentive’s users to get involved and helps the network grow. Tokens can be used for various purposes within the network, such as for transaction fees, staking, or voting rights. Their value is determined by the supply and demand chain, which can be influenced by market sentiment, adoption rate, and competition. Overall, tokenomics is an essential aspect of blockchain networks, as it helps to create a self-sustaining ecosystem that rewards contributors and incentive’s participation.

Supply in Tokenomics

Supply in tokenomics refers to the total number of tokens that will be created and made available for trading. The supply can be either fixed or variable, depending on the design of the token. For example, Bitcoin is an example of a token with a fixed supply of 21 million coins that will ever exist (This means that no more coins will be created beyond the 21 million). The last Bitcoin is expected to be mined around the year 2140. This fixed supply creates scarcity and is believed to increase the value of Bitcoin over time. Approximately 18.8 million Bitcoins have already been mined, and around 2.2 million coins are left to be mined over the next century. On the other hand, Ethereum has a variable supply that can adjust based on demand. This is because the supply of Ethereum increases every time a new block is mined, which incentive’s miners to participate in the network. The variable supply of Ethereum means that its inflation rate changes over time, which can impact its value. The supply of tokens can impact the token’s value, with a fixed supply potentially increasing in value as demand grows, and a variable supply potentially decreasing in value as more tokens are created.

Token allocations and vesting periods

Token allocations and vesting periods are important components of tokenomics. Token allocations determine how digital assets are distributed among stakeholders, and vesting periods are used to incentivize stakeholders to remain committed to the project or company over the long term. Fair and balanced token distributions are crucial for healthy growth, and vesting periods prevent early dumping of tokens on the market, which can negatively impact their value. These aspects of tokenomics are critical to the success and adoption of digital assets.

Mining And Staking

Mining and staking are two ways to secure and validate transactions on a blockchain network. Think of mining as a process where powerful computers solve complex problems to add new blocks to the blockchain and create new cryptocurrency tokens. This method is commonly used by cryptocurrencies like Bitcoin and Ethereum that rely on proof-of-work (PoW) consensus.

Staking, on the other hand, requires holding cryptocurrency tokens as collateral to verify transactions and create new blocks on the blockchain. This method is commonly used by cryptocurrencies like Cardano and Polkadot that rely on proof-of-stake (PoS) consensus.

Both mining and staking are crucial for the security and decentralization of blockchain networks, but they’re used by different types of blockchains depending on their consensus mechanism. So, if you’re interested in getting involved with a blockchain project, it’s important to understand which consensus mechanism it uses and whether it involves mining or staking.

Yields

Yields in the crypto world refer to the returns that investors earn on their investments, and can come from staking rewards, mining rewards, and lending/borrowing activities. For example, when you stake your cryptocurrency tokens, you can earn rewards in the form of additional tokens. Similarly, mining yields refer to the rewards earned by miners who validate transactions on the blockchain. By lending your cryptocurrency to others, you can earn interest on your investment, while borrowers can pay interest to access capital. Yields can be an attractive feature for investors looking to earn passive income from their crypto holdings, but it’s important to understand the risks associated with different types of yields and investments in the crypto market.

Token burns

Token Burns refer to the practice of removing cryptocurrency tokens from circulation, reducing the total supply and increasing the value of the remaining tokens. This can be done for various reasons such as reducing the supply through a buyback program or incentivizing users to hold onto their tokens. Token burns can be a useful tool for blockchain projects to manage their token supply and increase the value of their tokens. There are many real-life examples of token burns. One notable example is Binance Coin (BNB), the native token of the Binance cryptocurrency exchange. Binance conducts quarterly burns of its BNB tokens, where a portion of the tokens are bought back from the market and then burned. This reduces the supply of BNB in circulation, and can lead to an increase in the value of the remaining tokens.

TOKENOMICS ANALYSIS

Tokenomics analysis can be useful for both investors and project teams. Investors can use tokenomics analysis to evaluate the potential value of a cryptocurrency or blockchain project, as well as to identify potential risks or red flags. Project teams can use tokenomics analysis to refine their token design and economic strategy, as well as to identify areas for improvement. Tokenomics analysis is a process used to evaluate the economic factors and strategies behind a cryptocurrency or blockchain project. It involves looking at factors such as the token distribution, token utility, mining or staking rewards, token burns, and more. The goal of a tokenomics analysis is to understand how the project’s token is designed to function and how it can be used, as well as to access the potential value of the token over time.

The Supply-Side

When we talk about the supply side in tokenomics analysis, we are referring to the amount of tokens that are available for people to buy, sell, and trade on a particular blockchain network or platform.

In simple terms, imagine that you have a jar of marbles. The number of marbles in the jar represents the supply of tokens. If you add more marbles to the jar, the supply of tokens increases. If you take marbles out of the jar, the supply decreases. Now, let’s say that people want to buy these marbles from you. If there are only a few marbles in the jar, people will have to compete with each other to buy them, which could drive up the price. If there are lots of marbles in the jar, the price might be lower because there is more supply available.

In tokenomics, the supply of tokens can have a big impact on their value and how they are used in the ecosystem. If there are a lot of tokens available, they might be used for things like rewards, voting rights, or payment for goods and services. If the supply is limited, the tokens might be more valuable and rare, making them more desirable to investors and collectors.

The supply side is an important part of tokenomics analysis because it helps us understand how much of a particular token is available, how it is being used, and what factors might influence its value.

The Demand Side

When we talk about the demand side in tokenomics, we are referring to the factors that influence people to buy and hold a particular cryptocurrency or token.

The demand side can be broken down into two main factors: utility and speculation. Utility refers to the usefulness of the token in the real world, such as its ability to be used for transactions or access certain services. Speculation refers to people buying the token in the hope that its value will increase in the future.

When the demand for a particular token increases, its price tends to go up as well. This is because there are more people trying to buy the token than there are people trying to sell it, which creates a shortage and drives up the price. Conversely, when the demand for a token decreases, its price tends to go down.

Therefore, when analyzing the demand side of a token’s tokenomics, it is important to consider factors such as its utility, adoption rate, market sentiment, and overall market trends. These factors can help determine whether the token is likely to increase in value or not.

ROI

ROI (Return on Investment) is a financial metric that measures the profitability of an investment relative to its cost. It is expressed as a percentage and calculated by dividing the net profit by the cost of the investment.

Let’s consider the example of investing in Bitcoin. Suppose you bought 1 Bitcoin for $10,000 in January 2022 and sold it for $60,000 in January 2023. The net profit from the investment would be $50,000 ($60,000 – $10,000).

To calculate the ROI, you would divide the net profit by the cost of the investment and multiply by 100 to express the result as a percentage:

ROI = (Net Profit / Cost of Investment) x 100 = ($50,000 / $10,000) x 100 = 500%

This means that the ROI on your investment in Bitcoin was 500%, which is a very high ROI

Energy Levels In Tokenomics

Energy levels in tokenomics refer to how active people are in a particular cryptocurrency or blockchain project. There are three levels: passive, active, and super energy.

Passive energy means someone is just holding the cryptocurrency without doing anything with it. Active energy means someone is using the cryptocurrency, for example, by staking it or voting.

Super energy means someone is actively contributing to the project, such as by building apps or helping with governance.

By understanding how many people are at each energy level, we can get a better idea of how healthy and active a project’s community is. This can help identify areas where improvements can be made, such as incentivizing passive holders to become more active, or rewarding super energy contributors for their efforts. Ultimately, analyzing energy levels can help improve a cryptocurrency or blockchain project’s chances of success.

In 2022, around 72% of ADA holders in the Cardano network were classified as passive, meaning they held ADA without actively participating in the network. Meanwhile, approximately 27% of ADA holders were classified as active users, utilizing their ADA to participate in staking or other activities on the network. Only about 1% were categorized as super energy contributors, who were highly engaged and actively contributing to the development of the Cardano ecosystem. Using this information, developers and stakeholders could have strategized to encourage more people to become active or super energy contributors, which could have helped to drive the growth and success of the Cardano network.

Game Theory

Game theory is a branch of mathematics that analyzes the behavior of individuals in strategic decision-making situations. It has several applications in the field of economics, including the analysis of behavior in cryptocurrency ecosystems. In the context of crypto, game theory can be used to analyze the behavior of miners, investors, and users, and how their decisions impact the overall functioning of the cryptocurrency ecosystem.

In a Proof of Work (PoW) system, game theory can help analyze the strategic behavior of miners. Miners may choose to collaborate to increase their chances of solving the mathematical puzzle, or they may work alone to earn a larger share of the rewards. However, too many miners can lead to increased competition and reduced profitability for all participants. In a cryptocurrency market, game theory can be used to analyze the behavior of investors and traders. Traders may hoard tokens to drive up the price, while others may sell tokens to drive down the price, leading to irrational decision-making based on fear or greed.

Finally, game theory can also be used to analyze the behavior of users in a cryptocurrency ecosystem, such as those participating in DeFi platforms. Users may stake tokens to vote on decisions or participate in DeFi platforms to earn rewards. However, users also face the risk of losing their tokens if the platform is hacked or if the project fails. In summary, game theory provides valuable insights into the behavior of market participants in the crypto ecosystem, helping stakeholders understand the incentives and risks associated with different strategies.

Tokenomics Example; Bitcoin

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. Its tokenomics refers to the economics of Bitcoin, including its supply, demand, and distribution. Here are some key aspects of Bitcoin’s tokenomics:

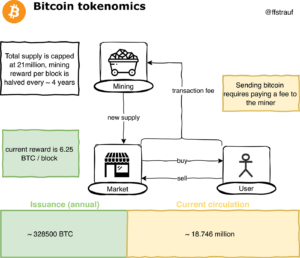

Fig 2. Showing bitcoin chart for supply and distribution. Tokenomics 101: Bitcoin & Ethereum

Supply: Bitcoin’s supply is capped at 21 million coins. This means that there will only ever be 21 million bitcoins in circulation, and no more can be created after that. The current supply is around 19 million bitcoins, and the remaining 2 million will be gradually mined over time until the year 2140.

Mining: Bitcoin is mined by solving complex mathematical equations, and miners are rewarded with newly minted bitcoins. The mining rewards are halved every 210,000 blocks, which occurs approximately every four years. The current block reward is 6.25 bitcoins.

Demand: Bitcoin’s demand is driven by a number of factors, including its potential as a store of value, its ability to serve as a medium of exchange, and its decentralized nature. Bitcoin’s demand can also be influenced by macroeconomic events and investor sentiment.

Distribution: Bitcoins are distributed through a combination of mining rewards and transactions. Some bitcoins are held by early adopters and investors, while others are used in commerce or held in wallets for future use.

Value: Bitcoin’s value is determined by supply and demand in the market. The price of Bitcoin can be highly volatile, and it can fluctuate based on a variety of factors, including news events, regulatory developments, and technological advancements.

Overall, Bitcoin’s tokenomics are designed to create a deflationary currency that is decentralized, secure, and scarce. Its limited supply and decentralized nature, make it an attractive alternative to traditional currencies, while its potential as a store of value has made it a popular investment asset for many people.

Conclusion:

Tokenomics is a fundamental concept that every cryptocurrency investor should understand. By understanding the basics of supply, demand, and distribution, investors can make informed decisions and navigate the often volatile cryptocurrency market. As the adoption of cryptocurrencies continues to grow, an understanding of tokenomics will become increasingly important for anyone looking to invest in digital assets.