Typically, short-selling is linked to the financial market. However, given the volatility of most crypto assets, investors can also short Bitcoin (BTC) and other cryptocurrencies. Investors can profit greatly from short sales when there is market volatility.

Shorting, also known as short-selling, is the term for a financial strategy in which securities are borrowed and sold in anticipation of further price declines. When someone shorts a cryptocurrency, they wager that its value will fall further and that it will eventually be even cheaper to buy.

It may seem counter intuitive, to the idea of making money when an asset’s value rises to bet on its decline. However, shorting offers the chance to make money even when values decline. Before engaging in shorting, it’s crucial to be aware of the dangers as there is a sizable potential for loss.

There are several methods that one can use regarding shorting cryptocurrency, and it’s advantageous for investors to acquire knowledge about shorting or short-selling Bitcoin and other digital assets, particularly when they believe that certain crypto assets will crash. Additionally, shorting could help protect one’s cryptocurrency assets from possible losses.

When an investor wants to short a stock in the conventional market, they lend shares from their broker at a specific price. The investor then offers these loaned shares for sale, anticipating a decline in price. When that occurs, the investor may then acquire back and return the shares to the broker at the discounted price keeping the price difference as profit.

In shorting cryptocurrency, the process is a bit unique but maintains the same idea. Investors frequently use options such as futures contracts or contracts for difference (CFDs) to short cryptocurrency instead of obtaining real units from a broker.

These derivatives, which can be used similarly to shorting stocks, enable investors to make bets on the price fluctuations of a specific cryptocurrency without actually owning it. But shorting is a more sophisticated investing approach that needs some practice. Before engaging in short-selling, an investor must have a firm grasp of market patterns, price fluctuations, and risk management.

Is It Secure To Short Cryptocurrencies?

There is a significant risk involved in shorting cryptocurrencies. It includes trading with leverage as well as futures and options trading, both of which are quite advanced and difficult in terms of trading strategies. Shorting entails taking on debt, as opposed to long trades, which involve making wagers that an asset’s price will increase. Without exercising caution, an investor may find it challenging to pay back loans secured by their assets.

Additionally, if the market tendency shifts negatively, the exchange operating their investment may sell off their position to recover their investment, leaving the person with less money than they had initially.

Additionally, it is challenging to correctly forecast price movements due to the cryptocurrency market’s high volatility and rapid change. This indicates that there is a high risk of loss when shorting cryptocurrencies, and buyers should exercise more caution to avoid entering a situation where they could end up losing a sizable sum of money.

Due to this, some cryptocurrency exchanges, like Binance, require an exam from users before they can trade derivatives. To make sure they comprehend the sophisticated financial products they’re using, this is done. Granted, they can find the answers to these exams online, so if they really want to, anyone can start short trading. However, these additional precautions might discourage novice investors from engaging in short trading without fully comprehending the risks involved.

When shorting cryptocurrencies, it’s crucial to select a reliable exchange or dealer because the market is plagued with fraud and illicit transactions.

Before using any platform for shorting or other trading purposes, it is best to conduct an in-depth study on it. In general, investors should proceed cautiously when shorting cryptocurrencies and ensure that they are aware of the risks and strategies involved before making an effort.

How To Sell Cryptocurrencies Like Bitcoin And Others

There are several ways to sell cryptocurrency, including purchasing options or futures contracts, using a CFD, or engaging in margin trading. Delving deeper into each approach.

Futures Or Options Trading

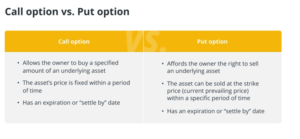

Investors can purchase futures or options contracts to acquire or sell a specific asset by a particular date at a specific price. Options trading offer the investors the opportunity to proceed with the transaction or not proceed, while futures trading call for pre-agreed transactions to occur on a specific date.

Using futures or options requires, as was already stated, a solid understanding of crypto derivatives, market trends, and risk management techniques. There is a futures market for cryptocurrencies, just like there is for other commodities.

For instance, Bitcoin futures enable a trader to sell or purchase BTC at a later period. As a result, by selling a futures contract, one can fix a price in the hopes of later purchasing the asset at a reduced cost and profiting from the asset’s decline in value. It’s important to note that this shorting approach might not be profitable if Bitcoin’s value increases, but an investor could profit greatly if the market turns.

Recent exchanges, have made it much simpler to benefit from a bearish market by permitting investors to speculate against digital currency assets through short-selling.

Conversely, options trading also permit speculators to short cryptocurrency. The ability to purchase or sell a specific asset in the binary options market (also known as call and put options) in the future at a predetermined cost. In particular, a put option offers the benefit of allowing the holder to sell their currency at the present market rate, even if the value declines in the future.

By hanging onto their put options, a trader who uses binary options instead of futures can reduce their losses. By doing this, they can only lose as much as they spent on the options.

Utilizing CFDs

A contract for difference, or CFD, is one that compensates the parties for any differences in an asset’s worth between the times the contract is opened and the time it is closed. Short-term trading frequently employs CFDs, which let investors make bets on whether the value of a commodity will rise or fall without actually owning it.

Shorting cryptocurrency with CFDs enables investors to possibly profit from a decline in value, much like futures and options trading. But it’s crucial to remember that CFDs frequently come with high costs and the possibility of significant losses should the market move against the investor.

The investor benefits if the value of an object decreases, if not they incur a financial loss. Investors who use CFDs do not need to store or retain any cryptocurrency because the transaction is settled in fiat. Additionally, CFDs have a more flexible settlement tenure compared to futures, which have fixed settlement dates.

Leverage is another feature of CFDs that enables investors to take control of a larger position with a smaller investment. For instance, an investor with a 2:1 leverage ratio can short $100 worth of Bitcoin with just $50 of initial capital.

CFDs are presently uncontrolled and thus are unlawful in the United States for use in markets that are regulated. However, since crypto Crypto traders remain able to utilize them, though, as the market for cryptocurrencies is mainly unregulated.

Trading On Margin

Margin trading, which is frequently carried out via a margin trading network like a cryptocurrency broker or exchange, is another method to short cryptocurrency. Investors essentially borrow money from brokers to use in trades, enabling them to hold a bigger position under their control.

For instance, if an investor has $200 in their account but wants to buy $1200 worth of bitcoin, the other $1000 will either be leased from an exchange or broker or put on margin. The investor borrows a commodity from the broker to short it to trade larger sums and earn greater profits.

Margin dealers typically borrow money to buy cryptocurrency, then sell it once its worth increases, keep the difference, and repay the loan plus interest.

Prediction Market

Another method of shorting Bitcoin and other cryptocurrencies is through prediction markets, which involve betting on the results of future occurrences. For instance, a trader might forecast that Ether (ETH) will fall by a specific percentage. Should anyone accept their wager, they stand to gain if their forecast is accurate.

Those who don’t want to invest money in buying cryptocurrencies can still partake in the market by shorting cryptocurrencies on prediction markets like Gnosis, Argur, and Polymarket without owning any cryptocurrency themselves.

However, because it entails projecting the future, shorting cryptocurrency through prediction markets is regarded as a high-risk strategy and there is an unending possibility for loss. It also calls for some knowledge of market trends and research on them, as well as a thorough grasp of how prediction markets operate.

What Are The Benefits And Dangers Of Cryptocurrency Shorting?

Since those using margin are essentially trading with borrowed money, this could lead to greater earnings for them. Again, as long as those who use prediction markets make the right predictions, their profit potential is limitless.

Additionally, shorting cryptocurrency can add a degree of equilibrium to a strategy for investing and help a portfolio build a barrier against possible losses. However, the benefits that can be obtained from shorting coins shouldn’t be disregarded. If a trader can correctly forecast the course of a cryptocurrency’s price movement, they can achieve significant gains and possibly obtain higher returns than if they had invested directly in the commodity.

The Dangers Of Shorting Cryptocurrency

However, the dangers of shorting cryptocurrency are much more obvious. An investor may lose everything if they bet that a cryptocurrency’s worth will fall but rises instead. The tools or techniques used to initiate a short position and the amount of money invested both have a significant impact on how much one stands to lose.

For instance, if an investor uses a margin to acquire $5,000 worth of Bitcoin and its value falls by 50% in just two days, their investment is now only worth $2,500. They also owe the broker or exchange platform the amount they borrowed plus interest which may cause substantial damages.

The possibility of losing out on profits if a cryptocurrency’s value begins to increase after selling should not be overlooked. Although using prediction markets properly requires in-depth knowledge or research, which can offer some protection against potential losses later.