An explanation of the Merge as well as the shift to PoS

Ethereum (ETH), the second most popular blockchain platform in the world after Bitcoin (BTC), aspires to be everything its forerunner is not but falls short in accomplishing.

Ethereum is being held back by some of Bitcoin’s limitations, such as Bitcoin’s insistence on a proof-of-work (PoW) consensus algorithm and Bitcoin’s overall lack of scalability. These limitations are preventing Ethereum from becoming more popular.

The goal of Ethereum’s multi-phased upgrade, which includes the Beacon Chain, the Merge Chain, and the Shard Chain, is to improve the scalability and security of the Ethereum network by making several modifications to the underlying infrastructure.

The most notable change is the transition from a consensus method known as proof-of-work (PoW) to a proof-of-stake (PoS) model, which both offer varying degrees of divergence from one another in the protocol.

In 2013, Vitalik Buterin, the creator of Ethereum, proposed a blockchain platform that supported applications in addition to other benefits that were not necessarily centred around financial transactions.

Buterin envisioned a future in which developers would be able to harness the power of decentralization to build governance systems, lending platforms, databases, and more. They would also be able to represent physical assets in a digital space.

Buterin believes that Ethereum is a global supercomputer, despite the fact that the network has trouble validating more than a few hundred transactions in a reasonable amount of time.

Users who transact small amounts on Ethereum are required to pay fees and additional costs that can sometimes exceed 100% of the transaction amount.

Ethereum is undoubtedly built on some dubious technology, which is surprising given that it is a platform with the goal of revolutionizing the way in which people interact with one another over a network.

Thankfully, Buterin, a number of network developers, and the Ethereum Foundation are all aware of the constraints that the project faces.

Additionally, the Ethereum development team is aware that the limitations of Ethereum’s blockchain make it difficult for institutional investors and other parties who might be interested to adopt Ethereum.

Buterin and the ETH crew have outlined a network upgrade that they call Ethereum 2.0, also known as Eth2, in order to address the scalability issues that Ethereum is experiencing.

Changes to Ethereum’s core functionality are included in the upcoming Ethereum 2.0 release; however, implementing these changes will take years.

Since the year 2020, developers of Ethereum have been toiling away at bringing the network’s upgrade closer to fruition in the hopes of making Ethereum considerably quicker, more secure, and more accessible than it has ever been.

What is Ethereum 2.0?

The Ethereum 2.0 consensus algorithm represents a significant departure from the previous version. The Eth2 upgrade, which is now referred to as the consensus layer upgrade, will result in Ethereum switching to a proof-of-stake algorithm. Previously, Ethereum ran an algorithm that required a significant amount of energy to validate transactions.

When compared to a PoW algorithm, a PoS one offers a number of advantages, including the ability to adjust various aspects of a network, such as its scalability, security, and accessibility.

A comparison of proof-of-stake and proof-of-work systems

Proof-of-work was the first method to be implemented for reaching a consensus on a blockchain and was used by Bitcoin, which was the first cryptocurrency ever created.

Miners are users who lend their computer power, such as graphics processing units (GPUs) and central processing units (CPUs) in order to participate in Proof-of-Work. Miners are responsible for solving complex algorithms and validating blocks.

Within a blockchain network, transactions are stored in groups called blocks. Each block can hold a certain number of transactions. When a block contains the required number of transactions, it is sent to the network to be validated and recorded there.

In order to avoid double spending or other kinds of duplicate transactions, each batch of financial dealings needs to be verified as being completely unique.

Miners are tasked with discovering the 64-digit hexadecimal code that is unique to each block. This code demonstrates the block’s one-of-a-kind status.

The hexadecimal puzzle is solved with the help of computing power provided by miner computers; this process is known as proof-of-work. A computer is putting in real work and finding a solution to a problem by utilizing real power.

The mining of blocks, unfortunately, has a negative impact on the surrounding environment. It consumes a significant amount of power and substantially raises the miner’s monthly electricity bill. Additionally, mining for cryptocurrency is conducted in the form of a competition.

Miners who only have one graphics card face stiff competition from businesses that have hundreds or even thousands of cards at their disposal.

Users who do not have a lot of money to invest in a suitable mining rig are excluded from the competition because the reward is only given to the first miner who discovers the code.

There are options besides mining on your own, such as joining a mining pool, in which case the reward for mining is distributed among a large number of participants.

Proof-of-stake, on the other hand, eliminates many of the issues that are inherent to the PoW consensus algorithm. Mining is analogous to proof-of-stake in that it requires users to validate transactions in order to proceed.

On the other hand, participants in a Proof of Stake network are referred to as validators. Users who stake, also known as lock-in, a certain amount of cryptocurrency into the network are known as validators.

These users send a signal to the network indicating that they want to be validators to secure their funds. The more funds staked by a validator, the more these users earn as rewards for their participation in the network.

Users who are also validators are tasked with verifying the legitimacy of transactions carried out on the network in which they are participating.

After a validator has validated a transaction, it will be added to the blockchain, at which point the validator will receive a reward.

A Proof of Stake (PoS) system is more accessible than a Proof of Work (PoW) system because anyone can participate in it if they have the funds rather than needing to invest in expensive hardware.

When more users are connected to the network and validating transactions, scalability increases. This is because more users are able to validate transactions.

The validation of a network by an increased number of users also leads to improved decentralization and security.

On a PoS network, rather than having a single, centralized point that malicious actors could target, there are increasingly more points of stability.

Mining on a PoS network uses less power than mining on a PoW network, so there is less of an impact on the environment caused by PoS networks.

More decentralization on a network also helps prevent something known as a 51% attack.

This is an attack that is common on Proof-of-Work (PoW) networks and involves a malicious actor taking control of 51% of the network’s nodes and validating transactions with malicious intent.

Proof-of-stake is designed in such a way that it prevents 51% attacks by making it necessary to hold 51% of all tokens on the network in order to launch such an attack.

Because doing so would require stealing from potentially hundreds of Ethereum wallets at once, holding 51% of all tokens on a PoS network sounds like it would be nearly impossible to achieve.

When the upgrade is finished, Ethereum will be able to reap all of the rewards that come with using proof-of-stake.

PoS will improve Ethereum’s scalability, accessibility, and security, in addition to making it more eco-friendly.

However, upgrading Ethereum’s network to version 2.0 is not a simple process; it calls for a significant amount of participation from users before the modifications take effect.

Explaining the Difference Between Ethereum and Ethereum 2.0

Proof-of-stake is significantly more energy-efficient than proof-of-work because it decouples the consensus mechanism from power-hungry computer computation. This is the primary distinction between Ethereum PoW and Ethereum PoS. It also suggests that a smaller amount of CPU power is necessary to ensure the blockchain’s integrity.

Additionally, Ethereum 2.0 is a great deal more effective than the initial version of Ethereum, which could only handle 15 transactions per second. It is now able to process up to 100,000 transactions every single second.

It is also essential to remember that after The Merge, a proof-of-work version of Ethereum known as ETHPoW went live. This version of Ethereum still employs the PoW consensus mechanism in order to validate blocks.

Transitioning to Ethereum 2.0

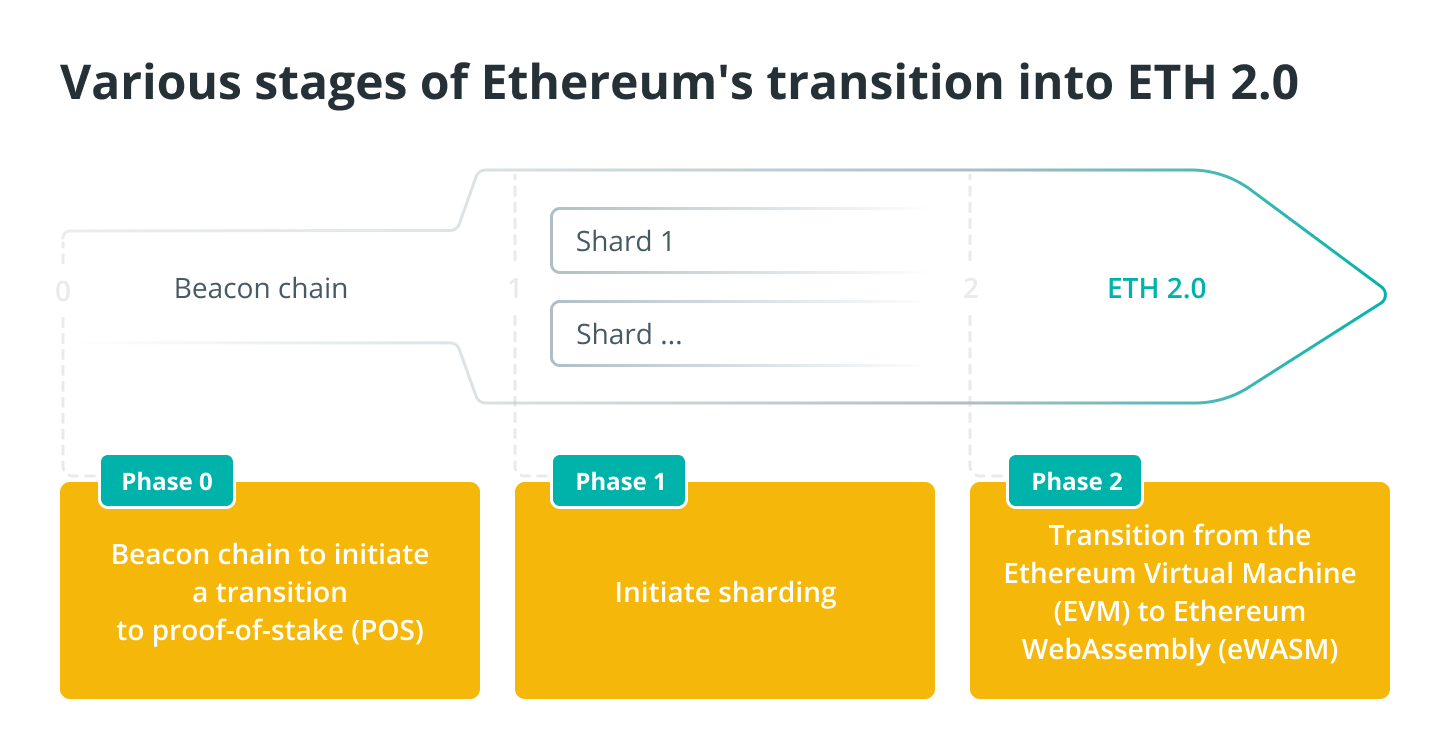

Ethereum’s transition into 2.0 is broken down into various stages.

Phase 0

The Beacon Chain is a new feature that was introduced as part of Phase 0 of the Ethereum 2.0 upgrade. Users will be able to stake (lock away) their Ethereum and become validators after the Beacon Chain, which is scheduled to be launched on December 1, 2020, marks the transition to PoS.

Having said that, the main Ethereum blockchain is unaffected by Phase 0 because the Beacon Chain already exists in parallel with the mainnet of Ethereum.

Despite this, the Beacon chain and the mainnet will eventually be connected to one another. The “merging” of Mainnet into the proof-of-stake system that is controlled and coordinated by Beacon Chain is the goal of this project.

In addition, prospective validators who stake 32 ether in order to show their interest in the Beacon Chain can still register their interest in the network. It is a significant request to make of users to stake 32 ETH, considering that 32 ETH is equal to tens of thousands of dollars worth of Ethereum.

Additionally, staked funds will be held for at least two years until Ethereum 2.0 is completely ready for release, at which point they will be released. Because early validators are anticipated to have a high level of commitment to the continuation of the project, the entry requirements are quite stringent.

Phase 1

The developers of Ethereum 2.0 cited unfinished work and code auditing as major reasons for the significant delay in the launch of Phase 1, which was initially scheduled to occur in the middle of 2021 but was pushed back to early 2022.

In the subsequent stage, the Beacon Chain will be merged with the mainnet, marking the beginning of the transition to a PoS consensus algorithm.

Beginning with Phase 1, Eth2 will store Ethereum’s transaction history and support smart contracts on the Proof-of-Stake network.

Due to the fact that Ethereum 2.0 will remove mining from the network, the task of validating transactions and staker deployment will become official. It is to be anticipated that a significant number of miners will make use of their holdings by staking them in order to become validators.

Sharding was originally intended to be introduced in Phase 1 of the Ethereum 2.0 upgrade, but that plan was scrapped.

The process of sharding involves dividing a database, or in this case, the blockchain, into a number of distinct smaller chains that are referred to collectively as shards.

Eth2 will have 64 shards, which means it will distribute the load of the network across 64 new chains. The requirements for the necessary hardware to run a node are reduced when shards are used.

After the completion of the merger between the mainnet and the Beacon Chain, this upgrade will take place.

With Ethereum 2.0, validators and other users can run their own shards, which will enable them to validate transactions and prevent the mainchain from experiencing excessive congestion.

In order for shard networks to enter the Ethereum ecosystem in a secure manner, a consensus method known as proof-of-stake is required. On the Beacon Chain, staking is going to be implemented, which will set the stage for the update to the Shard Chain that will come later.

Phase 2

At long last, Ethereum WebAssembly, also known as eWASM, will be released during Phase 2 of the project.

The World Wide Web Consortium developed WebAssembly with the intention of making Ethereum a great deal more efficient than it is right now. This goal was one of the motivations behind the creation of this technology.

A deterministic subset of WebAssembly known as Ethereum WebAssembly has been proposed for use as the execution layer for smart contracts on Ethereum.

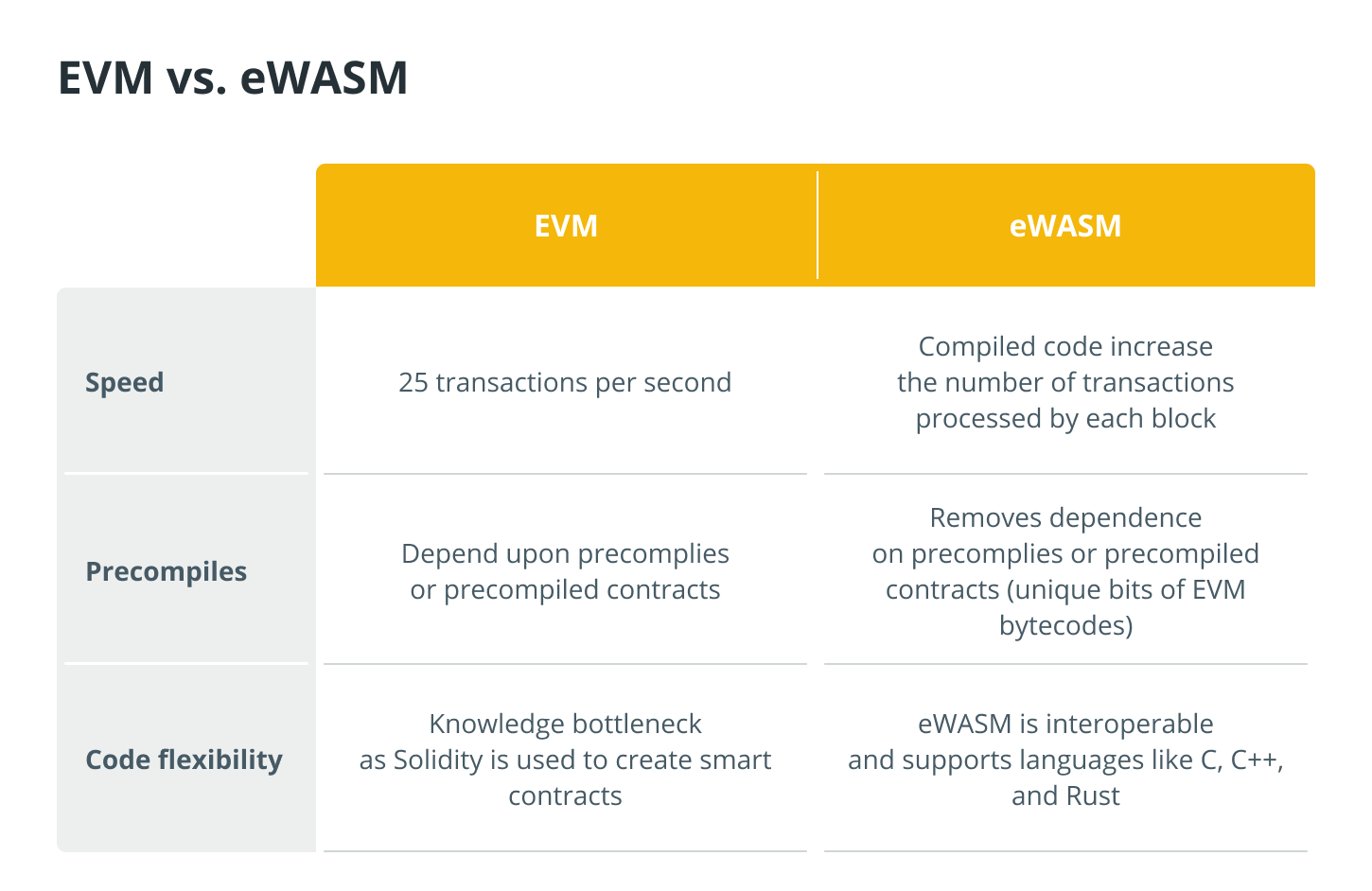

At this time, Ethereum makes use of something that is known as an Ethereum Virtual Machine, or an EVM. An EVM enables Ethereum to run as a global supercomputer.

Users from all over the world can log into this computer and use it to execute smart contracts and interact with decentralized applications (DApps).

The Ethereum Virtual Machine (EVM) is responsible for storing all of the code required to carry out commands on Ethereum.

Additionally, it is responsible for facilitating wallet addresses for transactions and calculating transaction fees, also known as gas fees, for each transaction.

The EVM is capable of supporting multiple actions at the same time. For example, it can determine whether or not a smart contract needs to be terminated because it consumes too much gas, whether or not a DApp is deterministic, which means that it will always execute the same inputs and outputs, and whether or not a smart contract is isolated, which means that if something goes wrong with that contract, the error won’t affect the Ethereum network as a whole.

On the other hand, the Ethereum network is currently experiencing some congestion issues. The EVM is significantly slower than it was designed to be as a result of the concurrent processing of a large number of transactions.

The Ethereum Virtual Machine (EVM) is notoriously difficult to upgrade due to the fact that it was written in a specialized, opaque coding language known as Solidity.

The eWASM was developed with the express purpose of taking the place of the EVM, which was scheduled to be put into use during Phase 2.

The eWASM is able to compile code much more quickly than the EVM, which helps to speed up the processes that occur within the network.

The eWASM makes Gas operate more effectively, and the eWASM is compatible with a wide variety of conventional programming languages, such as C and C++. The eWASM project’s overarching goal is to make the development of Ethereum significantly more approachable.

Unfortunately, the launch of stage two has been significantly delayed due to difficulties in implementing the previous stages. This delay was caused by the difficulties in implementing the previous stages. The exact release date of eWASM is unknown to the developers working on the project.

What should we expect next?

Ethereum 2.0 is an update that is essential for the platform’s continued development. Users are forced to pay absurdly high gas fees, endure lengthy wait times for transaction validation, and expend a significant amount of energy in the process as it currently stands.

The inability of the Ethereum network to scale has an impact on more than just the most fundamental transactions on the platform.

The issues with Ethereum have an effect on nonfungible tokens (NFTs) as well as aspects of decentralized finance (DeFi), such as lending and borrowing money.

Because of the congestion on the network, the cost of constructing and trading NFTs on Ethereum, for instance, can easily run into hundreds of dollars in gas fees.

After the launch of Ethereum 2.0, the network will almost immediately begin to experience benefits in every conceivable area.

As a result of Ethereum’s sharding and the proof-of-stake consensus algorithm, the cost of trading and minting NFTs on Ethereum will decrease.

The implementation of eWASM will make it simpler for developers working on Ethereum to create decentralized applications (DApps) and compile smart contracts.

Due to the fact that eWASM was developed in accordance with the standards of the World Wide Web, it will be much simpler to obtain in-browser support for Ethereum lite clients.

The adoption of proof-of-stake by Ethereum will, once and for all, make the network more accessible than it has ever been, all while having a negligible effect on the natural environment.

It is difficult to speculate on the effects that Eth2 will have over the long term. It is important to note that Ether, the native currency of the Ethereum network, is not necessarily intended to be a high-value asset like Bitcoin. This is something that should be kept in mind.

Ether, on the other hand, is utilized more for the purpose of moving value from one location to another. For instance, a user might purchase Ether with the intention of converting it to DAI, which they could then lend out and use to earn interest on their investment.

Although many people in the cryptocurrency industry are optimistic that Ethereum 2.0 will push Ether’s price into the five-digit range, the upgrade could end up having the opposite effect.

After all, increasing the size of the Ethereum ecosystem merely makes room for a greater number of ERC-20 assets.

The Ethereum standard for all assets that are based on Ethereum is called ERC-20. Every ERC-20 token must adhere to the same ruleset, making it possible for all ERC-20 assets to be used interchangeably.

Before interacting with any of the different decentralized applications (DApps), users will purchase Ether and then convert it to one of the other tokens that are compatible with the ERC-20 standard.

Value invested in Bitcoin is expected to remain there for extended periods, which will lead to a gradual increase in the asset price.

When it comes to Ethereum, the value that is constantly being traded increases proportionally to the level of development of the network.

Naturally, a sizeable increase in the price of Ether is to be anticipated prior to the asset reaching its new equilibrium. The question that needs to be answered is how high the price of Ethereum will go as the network grows and diversifies. Outside of the Ethereum ecosystem itself, the increased usability introduced by Ethereum 2.0 may have a positive impact on the cryptocurrency industry.

For example, if developers of decentralized applications (DApps) start taking advantage of Ethereum 2.0’s proof-of-stake functionality, then other blockchain networks are going to take notice.

To maintain development or even a user base, Ethereum’s competitors will need to provide features comparable to Ethereum’s scalability capabilities.

In addition, there is a possibility that Bitcoin will face pressure to abandon its limiting PoW consensus method.

Individuals and businesses that are not currently involved in cryptocurrency will begin to understand its financial benefits as Ethereum 2.0 features, such as staking, start to make an impact.

If interested parties find out that Eth2’s staking interest rates are higher than those offered by traditional banks, they may decide to join Eth2.

More users than ever before will become validators, taking part in the Ethereum network and educating themselves on blockchain in its entirety. This is expected to happen sooner rather than later.

The information that is gained on Eth2 has the potential to be transferred to other networks, which would result in increased participation throughout the cryptocurrency industry.

It’s possible that investors will abandon banks in favour of decentralized lending platforms because of the higher interest rates they offer. It is possible for residents to transfer all of their money out of banks and into the widespread Ethereum network.

Moving money to Ethereum gives the user complete control over their funds without the need for a bank, which can eliminate a number of control issues, including the need to pay fees and limits on the amount of money that can be moved.

There is no question that Ethereum 2.0 will have an effect on how the rest of the world perceives the value of ether. If Ethereum 2.0 is successful in achieving its goals, ether could transition from being a commodity that is often valued to a vital asset.

Ether can be utilized in day-to-day operations by corporations and individuals all over the world, allowing for the creation of databases and applications within the network.

A paradigm shift in how people around the world perceive Ethereum would be an extremely beneficial development.