Ethereum definition

If Bitcoin (BTC) is supposed to be the money of the future, then what exactly is Ethereum? That is a reasonable question for someone who is not familiar with the cryptocurrency industry to ask, given that they most likely see Ethereum and its native Ether (ETH) cryptocurrency listed alongside Bitcoin virtually everywhere on exchanges and in the news. To compare Ethereum to Bitcoin as if it were in direct competition with that cryptocurrency is not entirely accurate. It has different objectives, characteristics, and even technological components.

Ethereum is a decentralized blockchain network that is powered by the Ether token. It enables users to make transactions, earn interest on their holdings through staking, use and store nonfungible tokens (NFTs), trade cryptocurrencies, play games, use social media, and a great deal more. Ether is the token that powers the Ethereum network.

Many people believe that Ethereum is the next step for the internet. A decentralized network that is powered by its users, such as Ethereum, is an example of Web 3.0. Centralized platforms, such as Apple’s App Store, represent Web 2.0. Decentralized applications (DApps), decentralized finance (DeFi), and decentralized exchanges (DEXs), for example, are all supported by this “next-generation web.”

This guide will provide you with information on the history of Ethereum, mining Ethereum, how Ethereum works, how to buy Ethereum, ETH versus BTC, the benefits of Ethereum, and a glimpse of Ethereum 2.0.

The Evolution of Ethereum

At a time, Bitcoin’s blockchain project was the second-largest in the world, but Ethereum recently overtook it. Vitalik Buterin co-created the project to address Bitcoin’s shortcomings. Buterin released the white paper for Ethereum in 2013, which detailed smart contracts, which are essentially automated and immutable “if-then” statements. These statements make it possible to develop decentralized applications. Although there was already activity in the blockchain space pertaining to DApp development, platforms were not interoperable. Buterin had the goal that Ethereum would bring them all together. According to him, the only way to ensure continued adoption was to standardize the operation of and interaction between DApps.

As a result, Ethereum 1.0 came into existence. Imagine it as Apple’s App Store: a single location housing tens of thousands of distinct applications that all adhere to the same set of guidelines. Only that ruleset is hardcoded into the network, and it is automatically enforced, with developers having the ability to enforce their own rules within decentralized applications (DApps). There is not a central party that can make changes to and enforce regulations like there is with Apple. Instead, the power lies within the hands of the individuals who come together to form a community.

Putting together a network of this kind would, of course, not come cheap. Because of this, Buterin and the other co-founders of Ethereum, including Gavin Wood, Jeffrey Wilcke, Charles Hoskinson, Mihai Alisie, Anthony Di Iorio, and Amir Chetrit, organized a token presale to raise $18,439,086 in Ether, which will be used to fund Ethereum’s ongoing and upcoming development.

Additionally, the group established the Ethereum Foundation in Switzerland with the goal of fostering continued growth and maintenance of the network. Soon after that, Buterin made the announcement that the foundation would operate as a nonprofit, which led to the departure of a few of the co-founders.

Over the course of time, developers brought their very own decentralized concepts to Ethereum. In 2016, these users established The DAO, a democratic group that voted on proposed changes to the network and voted on changes to the network itself. Because the organization was supported by a smart contract, there was no requirement for a CEO to act as a figurehead for Ethereum’s governance. Instead, the changes could only be made after receiving support from the majority of voters.

However, everything went wrong when an unidentified hacker used a security flaw to steal $40 million in funds from The DAO’s holdings. To undo the damage caused by the theft, members of The DAO voted to “hard fork” Ethereum, which means they will separate from the previous network and upgrade to a new protocol. This is equivalent to performing a substantial software upgrade. This newly created blockchain will be known as Ethereum, whereas the original network will be referred to as Ethereum Classic.

How does Ethereum work?

In contrast to Bitcoin, the Ethereum network is not hosted on a single server but distributed across thousands of computers worldwide through the participation of users acting as “nodes.” Because of this, the network is decentralized and has a high level of immunity to attacks; as a result, it is essentially unable to be taken offline. It doesn’t matter if just one computer goes down because there are thousands of others keeping the network operational.

In its most basic form, Ethereum is just a single decentralized network that operates on a computer known as the Ethereum Virtual Machine (EVM). Since every node contains its own copy of the computer, it is imperative that all interactions be validated before anyone’s copy can be updated.

Interactions within a network are generally referred to as “transactions,” They are recorded in the blocks that make up the Ethereum blockchain. Before committing them to the network, miners check the validity of these blocks, which then serve as a record of past transactions or a digital ledger. A consensus method that uses mining to verify transactions is known as proof-of-work, or PoW for short. A one-of-a-kind 64-digit code is used to identify each individual block. Miners devote the computing power of their computers to finding that code to demonstrate that it is exclusive. Miners are compensated in ETH for their efforts and the “proof” of their work is the processing power of their computers.

Additionally, just like Bitcoin, all transactions on Ethereum are completely open to the public. Miners confirm the change and add the blocks to everyone’s copy of the ledger by broadcasting completed blocks to the rest of the network after they have mined them. Blocks that have been confirmed cannot be altered in any way, making them the definitive record of all network transactions.

However, if miners are compensated for their efforts, where does all of that Ether (ETH) come from? The user who initiates a transaction is responsible for paying a fee that is referred to as “gas.” This fee is associated with each transaction. This fee is paid to the miner who validated the transaction, which both encourages more mining in the future and maintains the integrity of the network. Gas functions essentially as a limit, putting a cap on the number of operations that can be performed in a single transaction for each user. In addition to that, it helps prevent spam from being sent over the network.

Because Ethereum is more of a utility token than a token of value, there will never be a shortage of ETH. Ether is constantly being added to circulation through the distribution of miner rewards, and once the network transitions to proof-of-stake, it will also do so through the distribution of staking rewards (PoS). In theory, there will always be a demand for ether, which means that inflation should never devalue the asset to the point where it can no longer be used.

The unfortunate reality for many people is that Ethereum gas fees can run quite high depending on the activity of the network. This is due to the fact that a block can only store a certain amount of gas, which varies depending on the types of transactions and the amounts involved. As a consequence of this, miners will favor transactions that have the highest gas fees, which means that users will compete with one another to validate transactions before anyone else. Because of the competition, prices continue to rise, which causes the network to become congested during peak usage periods.

Congestion in the network is a significant issue, but it is being addressed in Ethereum 2.0, which is a comprehensive redesign that will be covered in a separate section of this article.

To participate in Ethereum transactions, you need to have cryptocurrency, which can be kept in a wallet. This wallet acts as a passport to the Ethereum ecosystem by connecting to decentralized applications (DApps). Anyone with access to that location can engage in virtually any activity available on the conventional internet, including making purchases, playing games, lending money, and borrowing money from others. Only, users don’t have to pay to access the traditional web because they have to hand over their personal information. This information is then sold for financial gain by centralized entities that run websites.

Here, cryptocurrency is used in place of data, which means that users are free to browse and interact without revealing their identities. Because of this, the utilization of DApps is not discriminatory. For instance, there will be no lending or banking. It is possible for DApp to reject someone on the basis of their race or their financial situation. An intermediary is powerless to halt what the intermediary deems to be a “suspicious transaction.” Because users have control over what they do and how they do it, many people believe that Ethereum is Web 3.0, which is the future of user interaction on the web.

What does Ethereum do?

It could be argued that decentralising financial systems are the Ethereum network’s most significant accomplishment. Around 2019 and 2020, a new breed of decentralized applications (DApps) emerged with the capability of carrying out various tasks within the ecosystem. These DApps are gaining popularity by the day. The more decentralized applications (DApps) that are used, the higher the overall usage of the Ethereum network will be. The decentralized application (DApp) scene on Ethereum is currently the largest one out there, largely thanks to the successful DApps developed on the platform in recent years.

By publishing their work on the blockchain in the form of non-fungible tokens, or NFTs, artists, for instance, are able to generate millions of dollars in revenue. Why buy digital art when we can just take a screenshot of it? that is the question that may cross your mind. Collectors pursue ownership for this very reason. In addition to this, NFTs offer a safe method of storage and can act as evidence of ownership. It’s pretty much everything a collector could want in one package, so the appeal isn’t hard to understand.

It’s for the same reason that someone would prefer to have the “Mona Lisa” in its original form rather than a copy of it, even if the copy is indistinguishable from the original. In online games, NFTs also stand in for consumable items and adornments of various kinds. Players are able to adorn their homes and characters with one-of-a-kind assets created by artists, providing yet another source of revenue for those in the creative industries.

Apps for uncensored social media platforms have been developed, and these platforms enable users to pay one another for content. Users are able to invest in assets, play the game to grow those assets, and then sell them for a profit, thereby extracting real value from the time they spend playing the game. There are platforms for making predictions that offer prizes for accurate forecasts, and there are platforms for freelance work that do not deduct a significant percentage from each payment.

Through the use of blockchain technology and smart contracts, all of this is managed automatically, and users of DeFi have a greater degree of control than ever before over their own financial resources.

Ethereum Mining

Mining refers to the process of creating a block of transactions that will be added to the Ethereum blockchain. This process takes place during the creation of an Ethereum block. The Ethereum blockchain is currently based on proof-of-work, but this will change with the release of Ethereum 2.0 to proof-of-stake (PoS) in order to improve scalability and take a more environmentally responsible approach.

Ethereum miners are computers with software installed and used to process transactions and create blocks. They do this by using their time and processing power. In decentralized systems such as Ethereum, the network participants are tasked with ensuring that everyone agrees in the order of transactions. Miners contribute to this goal by generating blocks by successfully resolving computationally challenging puzzles. This protects the network from being taken over by malicious users.

Bitcoin compared to Ethereum.

Despite the fact that Bitcoin is the cryptocurrency with the most widespread use, the community behind Ethereum has aspirations to grow the project. The former is designed to function as a form of digital currency, and it accomplishes this task in a satisfactory manner. However, Bitcoin is not without its restrictions. It’s a proof-of-work network, but it’s having trouble scaling, which has led some people to believe that it’s more of a value storage mechanism, like gold. Because Bitcoin is limited to a maximum supply of 21 million coins, this line of reasoning is strengthened even further by the cryptocurrency.

Ethereum, on the other hand, is working toward the goal of completely replacing our existing internet infrastructure. Utilizing an app store or collaborating with fund managers are two examples of the kinds of activities that the company intends to automate in the near future. ETH is utilized more as a method for interacting with the network than as a method for transferring monetary value, despite the fact that it is capable of doing both.

An Ethereum-compatible token that is unique to each decentralized application (DApp) can be built by developers using something called an ERC-20 token. Even though the process isn’t foolproof, this does mean that all tokens based on Ethereum are technically compatible with one another. Only Bitcoin transactions can take place on the Bitcoin network.

The Benefits of Ethereum

The Benefits of Ethereum

In addition to its decentralized nature and users’ ability to remain anonymous, Ethereum offers a number of other advantages, one of which is the absence of censorship. For instance, if a user tweets something that is deemed to be offensive, Twitter has the ability to remove the tweet and punish the user. On the other hand, if the community of users on a social media platform powered by Ethereum decides that they want that feature implemented, then it will be implemented. Users who hold a variety of perspectives will be able to discuss topics as they see fit, and the general populace will have the ability to decide what should and should not be said.

In addition, the requirements of the community stop bad actors from taking control. A person with malicious intentions would need to control 51% of the network in order to make a change, which is extremely unlikely in the majority of situations. It’s a lot more secure than just having a regular server that anyone can hack into.

Then there are smart contracts, which automate many of the steps that would traditionally be completed by centralized authorities on the traditional web. A freelancer on Upwork, for instance, is required to make use of the platform in order to locate clients and establish payment contracts. According to its business model, Upwork deducts a certain percentage from each contract in order to pay its workers, cover its server costs, and so on. A customer on Web 3.0 simply needs to compose a “smart contract” that specifies the terms of the transaction, such as “If the work is handed in at X time, the funds will be released.” Once the rules are written down, neither party will be able to modify them in any way because they are hard-coded into the contract.

Additionally, acquiring Ether is currently at its most accessible point in history. Businesses such as PayPal and its subsidiary Venmo enable users to purchase cryptocurrency using fiat currency directly within the application. Because there are millions of users on each platform, it is inevitable that they will become involved in the matter sooner rather than later.

Ethereum’s Drawbacks as a Digital Currency

Even though on the surface it seems like the ideal platform, Ethereum has a few significant flaws that still need to be fixed.

The first advantage is one of scalability. Buterin envisioned Ethereum functioning similarly to the web, with millions of users interacting with one another at the same time. However, because PoW is used as the consensus algorithm, this kind of interaction is constrained by the block validation times and the gas fees. In addition, decentralization is a problem that needs to be addressed. Everything is managed by a centralized entity, such as Visa, which has also perfected the process of conducting financial transactions.

The second benefit is the ease of access. At the time this article was written, developing on Ethereum is a costly endeavor, and it can be difficult for users who are not familiar with its technology to interact with the platform. Because certain platforms require particular wallets, an individual will need to transfer ETH from the wallet they are currently using to the wallet that is required. This is not in the least bit user-friendly for newcomers and is an unnecessary step for users who are already ingrained in the current financial ecosystem.

Although PayPal is adding support for cryptocurrencies, users won’t be able to do much with their crypto aside from hold it in their accounts. In order to increase accessibility in a manner that is meaningful, the platform needs to integrate with both DeFi and DApps.

There is some well-written documentation on the subject available on the platform, which is another important factor in attracting more users. However, there is room for improvement in the process of actually using Ethereum. Learning about blockchain and actually putting it to use are two very different things.

What exactly is Ethereum 2.0 (also known as Eth2)?

A proof-of-stake consensus algorithm is anticipated to be introduced into Ethereum once the platform reaches its 2.0 version, which is being upgraded gradually. The traditional Ethereum network is currently working on a merger with the Beacon Chain, which is Ethereum 2.0’s first new feature. This is scheduled to take place between the years 2020 and 2022.

At first glance, the Beacon Chain doesn’t seem to make that many changes; however, it does add the foundational changes that are required for subsequent upgrades, such as shard chains. Do you remember the problem with scalability that we talked about earlier? A significant portion of resolving any scaling issues involves shard chains and the sharding process itself.

The process of spreading transactions across several different blockchain networks of a smaller scale is known as sharding. Users with less powerful hardware are able to successfully operate these more limited networks because they are only required to store the data associated with the particular shard and not the entire network. In its most basic form, sharding helps to alleviate congestion on the primary network by making Ethereum validation more accessible.

Many enthusiasts of cryptocurrencies are feeling bullish as a result of Ethereum 2.0. The use of non-fungible tokens (NFTs) by celebrities and the general public’s growing awareness of blockchain technology go hand in hand. However, as a consequence of all of this activity, transaction fees have increased and validation times have slowed down, which exemplifies the necessity for Ethereum 2.0. Because of this, there is a potential for a problem to arise, as transaction fees can sometimes amount to more than half of the total transaction amount. Thankfully, developers of decentralized applications (DApps) are working diligently to make it more accessible in preparation for the impending mainstream adoption.

The proof-of-stake consensus, which is an essential component of Ethereum 2.0, is one component of the solution. The Proof of Stake (PoS) consensus algorithm will replace the energy-intensive mining process that was previously used by Ethereum 2.0. Validators are users who store the Ethereum blockchain, validate transactions, and do other related tasks. Miners are replaced by validators under the Proof-of-Stake consensus model. They are, in essence, a different kind of node altogether.

At the very least in the beginning stages of Ethereum 2.0, an individual must stake a total of 32 ETH in order to qualify as a full validator. Validators receive ETH as a reward for their efforts if they keep a computer connected to the network and verify transactions. It is presumed that individuals who stake their ETH have nothing but the best intentions for the network and will do everything in their power to ensure that it is successful. In addition, if a validator does not participate in the network or tries to do something malicious, they run the risk of losing their ETH.

Proof-of-stake is a form of blockchain consensus that is argued to have advantages including being faster and more easily accessible. Because it does not require any specialized hardware, unlike mining, anyone who has the financial means and a device to participate can do so. In principle, increased accessibility ought to result in expansion of the network. The greater the number of validators, the greater the number of blocks that are validated. The addition of extra validators not only further decentralizes Ethereum but also boosts its level of security as the role grows.

A Guide to Purchasing Ethereum

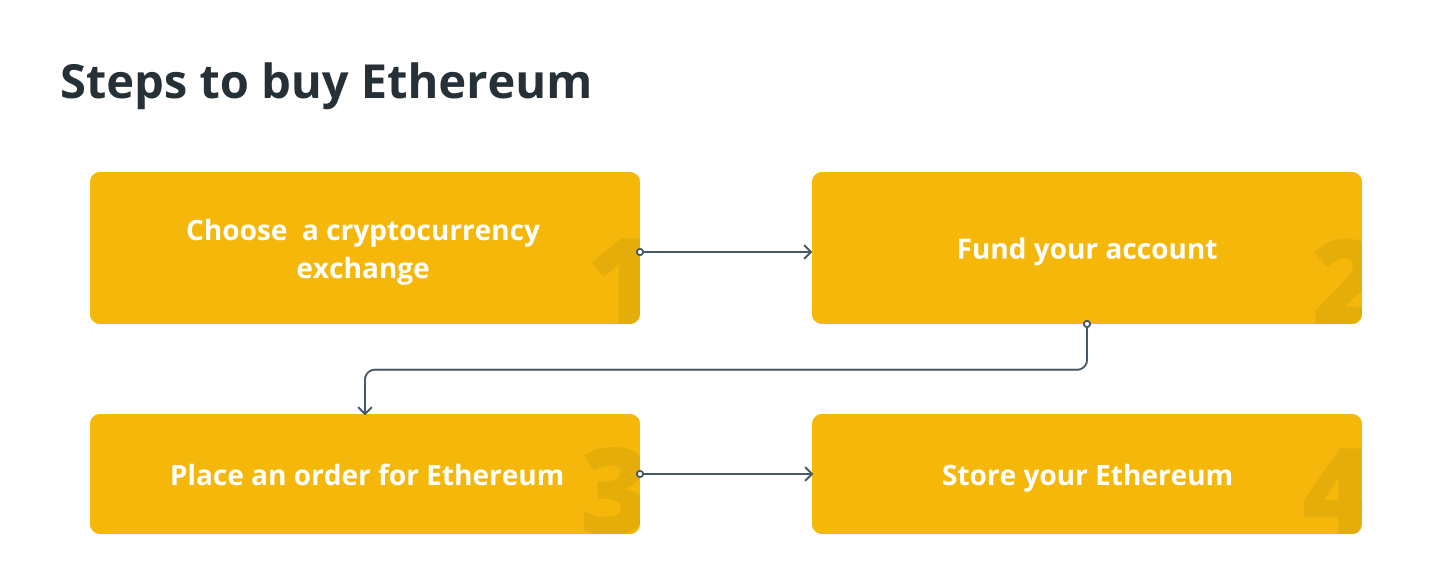

You will not be able to purchase cryptocurrencies from a financial institution such as a bank or from an online brokerage such as Vanguard or Fidelity. Instead, you will need to use a platform that is designed specifically for trading cryptocurrencies. There are a large number of cryptocurrency exchanges available, with dashboards that range from straightforward to extremely complex for experienced traders. It is important to do some research before signing up for a platform because the price, safety precautions, and other features can vary significantly from one platform to the next.

It is almost certain that in order to open an account with a cryptocurrency exchange, you will be required to provide some personal information and have your identification verified. After that, you will be able to fund your account by linking your debit card or bank account to your account. It’s likely that the prices will change depending on which option you go with.

Simply because you have funded your account does not mean that you have acquired Ethereum. As is the case with any investment account, you do not want your funds that are not yet invested to be sitting in a reserve account. At this point, in order to invest, it is necessary for you to purchase Ethereum.

Simply because you have funded your account does not mean that you have acquired Ethereum. As is the case with any investment account, you do not want your funds that are not yet invested to be sitting in a reserve account. At this point, in order to invest, it is necessary for you to purchase Ethereum.

After you have funded your account with United States dollars, you will have the ability to trade those dollars for Ethereum. You just need to enter the number of dollars that you want to trade for ether. You will most likely be purchasing shares of a single Ethereum currency, but this will depend on the price of Ethereum as well as the quantity that you wish to purchase. Your purchase will be represented as a certain percentage of the entire ether coin.

If you only have a small amount of cryptocurrency, it is recommended that you keep it in the exchange account where it was purchased. A digital wallet, on the other hand, can offer an additional layer of protection in the event that you wish to transfer your holdings to a safer storage location. There are many different kinds of digital wallets, each of which offers a different level of protection. Some examples of digital wallets include mobile wallets and paper wallets.

Should you put your money into Ethereum?

Ethereum is the second most valuable cryptocurrency on the market, and it is often compared to the silver that Bitcoin is compared to the gold that it represents. As is the case with any other type of investment, it is possible that the increased risk associated with Ethereum will result in greater rewards. In any case, the year 2009 is no longer current; Ethereum has advanced past the proof-of-concept stage, and the time has come for investors who haven’t investigated this asset class in the past to begin doing so.

Due to the unpredictability and high volatility of the cryptocurrency market, it is important to conduct independent research before putting a significant portion of your retirement savings into Ethereum or any other cryptocurrency. On the other hand, if you have a diversified portfolio, you might want to think about including it as an aggressive growth option. Naturally, you should not put in more money than you can afford to lose.

What lies ahead for Ethereum

In recent months, the Ethereum blockchain has experienced a surge in popularity as a result of the proliferation of decentralized finance projects and NFTs that have been built on top of it by developers. According to proponents, the emergence of new applications such as these — among the first to run on a public blockchain — has already triggered a tremendous network effect, as increased activity attracts more and more developers to Ethereum. These applications are among the first to run on a blockchain that is open to the public.

However, fundamental questions remain about whether Ethereum, which is behind schedule with a complicated set of technological upgrades, will be able to compete with competitors that are more agile, and whether any consensus on its long-term function will emerge as the cryptocurrency world expands. Ethereum is currently behind schedule with a complicated set of technological upgrades.

On the other hand, investors such as Garg are sounding the alarm that because of the long-term significance of Ethereum, the cryptocurrency markets could be on the verge of experiencing a reversal, with Bitcoin regaining its undisputed dominance.