What does interoperability in blockchain mean?

Blockchains, the underlying technology behind cryptocurrencies like Bitcoin, is now widely recognized as having the potential to revolutionize a wide range of industries, including the tracking of supply chains and healthcare (BTC). The phenomenal interest that has been shown in blockchain technology has sparked a great deal of activity in the fields of research and development.

Because of this, the blockchain industry is extremely fragmented, and clients can choose from a wide range of incompatible technologies.

Certain functionalities, such as the sending of tokens from one participant to another and the execution of smart contracts, can only be carried out within a single blockchain because interoperability between different blockchains is typically not anticipated in existing protocols and standards.

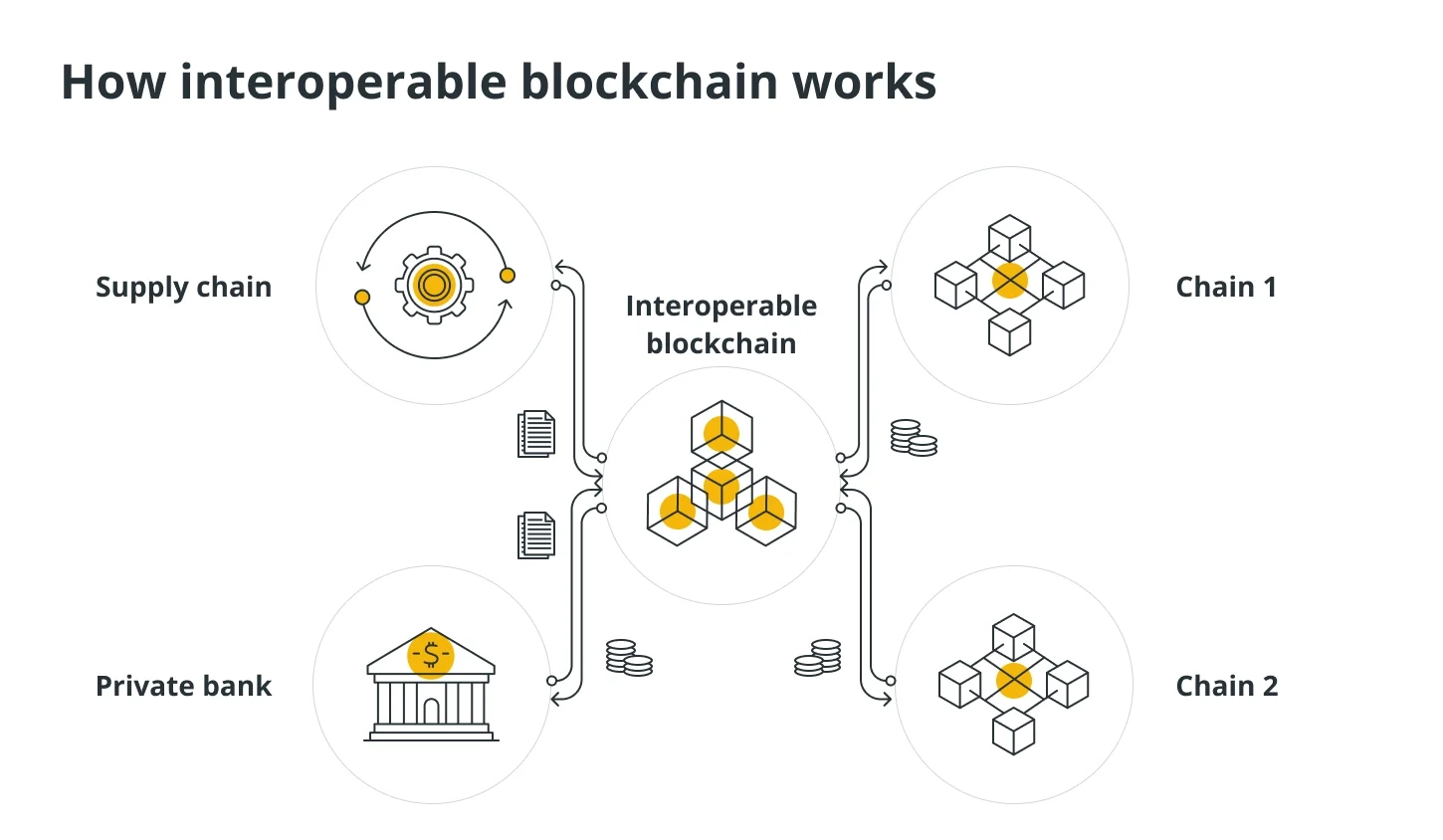

Interoperability is a term that is used when speaking about blockchains. It refers to the capacity of one blockchain to freely exchange data with other blockchains. For example, a particular blockchain keeps a record of every asset that is owned as well as every transaction that is carried out.

Any economic activity that takes place on one blockchain can be represented on another blockchain if the appropriate interoperability solution is implemented. This lends credence to the notion that one of the primary characteristics of blockchain interoperability solutions — namely, the potential for economic activity to spread from one chain to another chain — can be attained.

One of the earliest contributions to the field of blockchain interoperability was the idea of a trustless cryptocurrency exchange, realized in the form of atomic cross-chain swaps, also known as atomic swaps.

Using atomic swaps, users of different cryptocurrencies can exchange their assets in a trustless and atomic way. However, atomic swaps don’t allow the transfer of a token from one blockchain to another in the sense that a certain amount of assets are destroyed on the source blockchain and the same amount is (re)created on the destination blockchain.

As the name suggests, atomic swaps allow for token exchanges rather than transfers across blockchain boundaries. This suggests that an exchange ready to trade tokens is a requirement for atomic swaps at all times. A back door for trading tokens is offered by online markets.

However, up until now, achieving this has necessitated the existence of a trustworthy, centralized body, which runs counter to blockchain’s decentralized nature. Cross-chain technology is now widely regarded as the most effective means of enhancing interoperability between blockchains as a result.

This article will cover the process of achieving blockchain interoperability and its advantages and disadvantages.

What is cross-chain technology?

Interoperability is the ability of a distributed ledger technology (DLT) design to obtain data from or exchange data with external systems. To achieve interoperability, cross-chain technology enables data exchange between DLT designs or external systems. Such data exchanges can increase the DLT designs’ security, increase their flexibility, and fix performance issues.

For instance, sharding can be used to solve problems with low throughput and inadequate scalability. Sharding allows for parallel transaction processing to increase performance and scalability by breaking a distributed ledger into tiny pieces that can be controlled independently.

The potential applications of cross-chain technology include asset transfers, cross-chain oracles, and cross-chain smart contracts. During asset transfers, assets are moved from one distributed ledger to another. Contrarily, cross-chain oracles provide data from one distributed ledger to another rather than transferring assets.

Cross-chain oracles, for instance, can be used to verify that certain events (like a transaction) actually took place on another distributed ledger. Cross-chain smart contracts, which can increase automation, refer to the ability to begin a smart contract’s execution on another distributed ledger.

Cross-chain smart contracts, unlike cross-chain oracles, must be carried out by executing transactions on the destination chain, which changes the state of the distributed ledger.

Some may now wonder who is making use of cross-chain technology. Ripple is one instance of a blockchain project attempting to look into cross-chain transactions. Worldwide, Ripple helps banks settle cross-border payments with fiat money and cryptocurrencies.

How does blockchain interoperability work?

The cross-chain protocol simplifies interoperability between various blockchain networks and allows data sharing across numerous blockchain networks.

The cross-chain protocol enables direct user-to-user communication. As a result, blockchains with similar networks can trade information and value.

It differs from network to network, though, as no one predetermined approach can be applied uniformly across all networks. Each network employs a different approach for blockchain interoperability to enable transactions without the use of third-party interfaces.

As previously mentioned, atomic swaps enable cross-blockchain token exchanges between two parties. Blockchain networks can also keep an eye on what’s going on on other chains, thanks to relays.

As previously mentioned, atomic swaps enable cross-blockchain token exchanges between two parties. Blockchain networks can also keep an eye on what’s going on on other chains, thanks to relays.

They work chain-to-chain, allowing a single contract to act as the central client for numerous other nodes across numerous chains without the need for distributed nodes.

As a result, it can instantly verify a set of central headers as well as the full history of transactions. However, the relay approach’s security requires a lot of money to operate and maintain.

Why is blockchain compatibility crucial?

The problem of assets and data interacting across multiple blockchains can be helped to be solved by interoperability in blockchain technology. When two parties use the same blockchain platform, such as Bitcoin (BTC), exchanging digital data and value is a simple and straightforward process. However, if the parties in question are using different blockchain platforms, achieving the same results is impossible.

The process of digital transfer is made significantly more difficult by the fact that companies all over the world that use blockchain technology operate within a variety of different blockchain networks. It is anticipated that interoperability will significantly reduce these problems, making it much simpler for parties to conduct transactions across blockchains and benefit from blockchain interoperability.

For instance, in the financial services industry, it is impossible for financial firms and their customers to interact, transact, or communicate with one another because different financial ecosystems run on different blockchains. This makes it impossible for financial firms to serve their customers.

However, suppose different blockchains are able to communicate with one another. In that case, it will be possible to move data and monetary value between different economic ecosystems in a way that is efficient, swift, and risk-free.

How is blockchain interoperability accomplished?

The vast majority of layer-1 blockchains do not have any built-in capabilities that would make cross-chain interoperability possible. However, as will be covered in more detail below, a number of methods are being employed to increase the level of interoperability between blockchain networks.

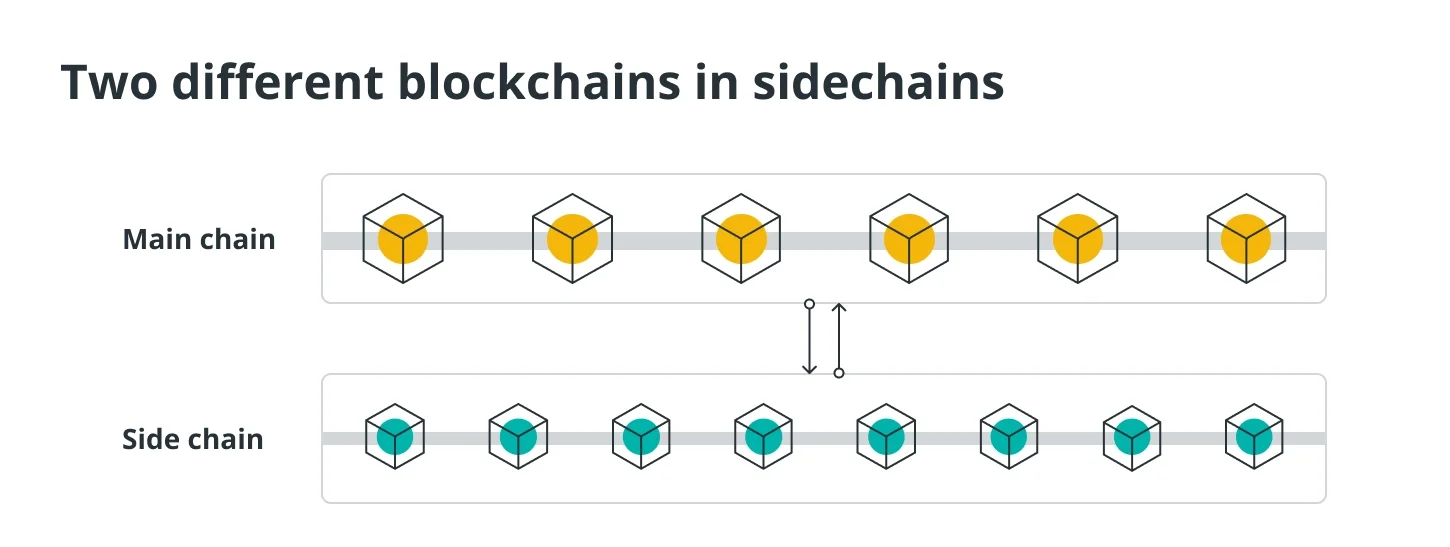

Sidechains

Two active blockchains can communicate with one another using a sidechain. In sidechains, the mainchain and sidechain are two distinct blockchains. The mainchain and sidechain are connected by a cross-chain communication protocol, and each maintains a list of assets.

Sidechains serve as a two-way peg by having a mechanism for transferring assets between the main chain and sidechain. Examples of blockchain interoperability initiatives include Mimblewimble, BTC Relay, Poa Network, and RSK.

Sidechains serve as a two-way peg by having a mechanism for transferring assets between the main chain and sidechain. Examples of blockchain interoperability initiatives include Mimblewimble, BTC Relay, Poa Network, and RSK.

Notary programs

This method depends on a third-party notary for transactions. The lack of trust between the two parties to the transaction is managed by a dependable third party known as a notary.

The notary could be a controlled exchange or a network of exchanges. The notary’s integrity is the only element influencing a notary scheme’s effectiveness.

Another problem with the scheme is that, despite being decentralized by a group of notaries, it still has a centralized component. Notary schemes include centralized cryptocurrency exchanges like Coinbase and Binance.

Oracles

In the context of blockchain technology, oracles close the informational gap between on-chain and off-chain settings. Decentralized oracle services like Chainlink aid in ensuring that off-chain data is fed to blockchain-enabled smart contracts by guaranteeing that multiple ecosystems are referring to a single source of truth.

Blockchain routers

Multiple blockchain networks can communicate with one another thanks to blockchain routers. According to the design of the blockchain router, the various blockchain networks, such as Bitcoin, Ethereum (ETH), and others, are seen as terminal components known as sub-chains in the routing network.

Sub-chains cannot directly communicate with one another; only a blockchain router can be used for this.

A cross-chain communication protocol, for instance, is used by the blockchain router to allow communication between sub-chains. A blockchain stores all of the information registered on subchains. The blockchain router enables the communication between subchains and builds a trust bridge across chains.

Industrial Solutions

A couple of examples of cross-chain interoperability protocols are the Cosmos and Polkadot blockchains. Specialized sidechains can communicate with open blockchains thanks to a system called Polkadot that enables heterogeneous multichain translation.

On the other hand, Cosmos enables the creation of blockchains with or without authorization. The inter-blockchain protocol is used by Cosmos’ hubs and zones to communicate with one another.

Hashed TimeLocks

Among the blockchain interoperability tools used to create smart contracts with the power to change payment channels is the Hashed TimeLock Contract (HTLC). An HTLC essentially implements time-bound transactions in the cryptography world.

If the recipient does not provide a cryptographic proof of payment receipt within a specified window, they will not receive any money, and the transaction is void. According to TimeLock, a certain number of cryptocurrencies will be prevented from being used until a specific amount of time has passed.

The Bitcoin Lightning Network uses the hashed timelock to carry out off-chain transactions. Network routing is a feature of the Lightning Network that enables users to send money even if they are not directly connected through a payment channel.

Benefits and challenges of blockchain interoperability

Having the ability to communicate with other blockchains offers a great number of benefits. Interoperable smart contracts, for example, enable the data exchange between private and public blockchains in industries such as law and healthcare, paving the way for constructing Web3 platforms that were previously unimaginable.

Interoperability between blockchains may also make it possible to use multiple tokens in transactions and wallet systems, which would be a huge step toward simplifying and improving the cryptocurrency user experience.

Interoperability between blockchains allows for application-specific blockchains to communicate with one another through the central decentralized hub.

Imagine, for a moment, that the blockchains being utilized by different types of companies and sectors can communicate with one another. In that scenario, data and value will be able to be transferred between independent businesses in a manner that was previously thought to be impossible between completely separate entities.

However, a blockchain registered on a network cannot be altered after it has done so. As a consequence of this, it is essential to perform data verification prior to submitting a starting node.

In addition, the process of interoperability between blockchains is extremely restricted. In a world where technology predominates, data security during transfer may be ensured by this feature; however, nothing can be absolutely guaranteed in this world.

Each distributed ledger maintained by a blockchain possesses its own one-of-a-kind trust model. There are some that are supported by a hundred miners, while others are supported by just two miners.

When data is transferred from a ledger with a lower level of trust to a ledger with a higher level of trust, the more reliable blockchain may become susceptible to manipulation from the outside as well as other types of inconsistencies.

Blockchain interoperability in the future

The effectiveness, efficiency, and usability of blockchain interoperability solutions will be the determining factors in determining the future of blockchain technology and how it will be utilized in relation to cryptocurrencies. Despite this, there are a number of projects that are currently underway to support interoperability between blockchain platforms.

Commercial operating systems like Cosmos and Polkadot need to be more stable before they can be used extensively. Even if some of these initiatives are eventually successful and are adopted, it won’t be obvious how they can work together to solve the problem.

Consequently, there is a growing need for protocols, application programming interfaces (APIs), and other related technologies that permit extensive blockchain platform interoperability.

In addition, there are a lot of nations that do not acknowledge the legitimate nature of the cryptocurrency ecosystem. Consequently, the regulatory framework must provide the necessary support to facilitate future interchain interoperability applications.

In addition, transactions that are primarily aimed at the financial sector and industries related to it require appropriate legal, regulatory, and interoperability frameworks.