In the year 2020, the concept of staking emerged within the realm of cryptocurrency, ushering in the introduction of new possibilities as alternatives to the instruments of traditional financial markets.

The rise of decentralized finance (DeFi) became a reality in the year 2020, but the concept dates back to the inception of Bitcoin, which sought to replace established intermediaries and trust mechanisms. DeFi was a term that was coined in 2020.

It was the beginning of a new era for the cryptocurrency industry, one geared toward developing a new, internet-native financial system. This new system would use blockchain technology to assist investors in converting the simple ownership of cryptocurrency assets into lucrative passive income through a process known as staking.

Staking in DeFi is accomplished through smart contracts, which are snippets of code representing automated financial agreements between two or more parties. These contracts provide excellent incentives for crypto enthusiasts who are willing to stake (lock-up) their assets and engage in a more active presence within the network.

Staking in DeFi is designed to incentivize participants to remain active in a blockchain for an extended period of time.

You will better understand how you can use your cryptocurrency assets to generate passive income and participate in securing the network, validating nodes, and verifying blocks and transactions with this article’s assistance.

What is DeFi staking?

Staking in DeFi refers to the process of locking cryptocurrency assets into a smart contract in exchange for rewards and the generation of passive income.

Tokens that are fungible or non-fungible (NFTs) are the types of crypto assets that can be staked, and the rewards typically involve earning more of the same.

When combined with high interest rates, this is an excellent method for encouraging cryptocurrency investors to keep their holdings for the long term.

Staking in DeFi is more appealing to investors because it offers higher rewards than traditional savings accounts do. This makes staking more competitive among investors.

However, this comes with increased risks along with more significant challenges that the cryptocurrency markets present. Some examples of these challenges include the well-known volatility across the board and the network security of novel blockchains.

Because it does not require any specific trading or technical skills, this new financial tool is becoming increasingly popular. However, the most significant challenge that investors may face is selecting an appropriate and secure platform.

Staking in DeFi is based on proof-of-stake (PoS) networks, as opposed to proof-of-work (PoW) blockchains, which require significant computational power to verify blockchain transactions. In proof-of-stake networks, transactions are verified by validators, who are the principal stakers of the network.

How does DeFi staking work?

Staking is inextricably linked to Proof-of-Stake (PoS) blockchain networks, which require users to stake a predetermined amount of the native tokens or coins of the platform in order to become validators.

As a result of the fact that PoS blockchain protocols rely on validators to secure the network and verify transactions and blocks, these validators play an important role in the ecosystem.

Validators who risk their assets to protect the network are given the incentive to work diligently and are tasked with validating transactions and blocks in a reliable manner, or else they risk losing some or all of the assets they risked.

There is a possibility that participants won’t be able to afford the high stake deposits that are required for betting. For instance, when Ethereum moves to a PoS consensus mechanism, the amount of Ethereum (ETH) that validators will need to participate in will increase to 32, representing a sizeable financial commitment.

Because of this, validators as a service and staking pool emerged as DeFi staking service providers to enable more people to participate without needing to meet significant financial requirements.

People have the ability to join forces with other cryptocurrency investors through the use of staking pools. After that, participants are able to stake any amount of tokens they choose into a pool and immediately begin earning a passive income that is proportional to the amount of tokens they are currently holding.

Why is DeFi staking used in the crypto world?

Staking is an essential component of proof-of-stake (PoS) blockchain platforms designed to provide network security. It is helpful for reasons that benefit both the staking platform and the participant or staker, and it is an essential component of PoS blockchain platforms.

Staking in DeFi is an essential component of Proof-of-Stake governance, validating or “mining” transactions and blocks. Although the specifics of the PoS consensus mechanism differ from chain to chain, the fundamental concept behind such a system of validators is consistent across the majority of PoS management procedures.

Staking not only assists cryptocurrency exchanges and trading platforms in providing liquidity for particular trading pairs, but it is also an excellent way to bring in new customers. Increasing the amount of cryptocurrency you have can be accomplished through staking in a very effective manner.

In addition, users receive compensation for the tasks their staking carries out in exchange for locking their crypto assets. staking is a form of decentralized proof-of-work.

On the other hand, participating in DeFi staking requires greater engagement in DeFi activities. These activities include securing crypto assets within smart contracts and becoming a block validator for a particular DeFi protocol.

Investing some or all of your assets in DeFi staking can be quite profitable, regardless of whether you choose to become a validator on your own or to participate in a staking pool.

How to earn passive income with DeFi staking?

The Proof-of-Stake (PoS) mechanism is the foundation for the vast majority of newly developed blockchains due to the incentives it provides as well as the less energy-intensive process it provides. PoS blockchains such as Polkadot (DOT), Algorand (ALGO), and Solana (SOL) as well as Cardano (ADA) all offer rewards to users who are willing to “stake” their assets.

Ethereum’s blockchain continues to be the most widely used in DeFi, and the platform is also moving toward adopting a PoS protocol.

The question now is, how do you stake crypto assets? Staking rewards are distributed to users in exchange for users performing various network functions with their crypto funds that have been deposited into a smart contract.

The ownership of the stake provides an incentive for the continuation of the network’s secure operation.

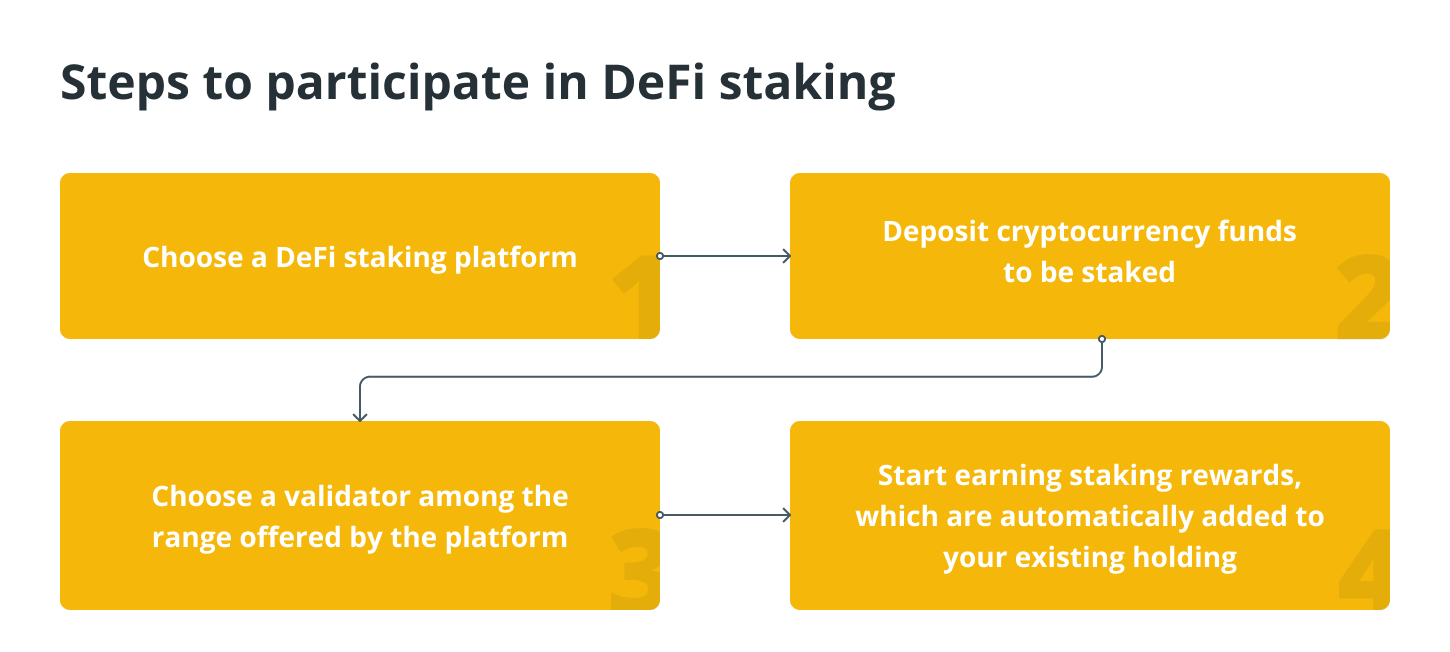

To participate in staking with DeFi, you just need to follow these few easy steps:

- Select a DeFi staking platform.

- Deposit cryptocurrency funds that will be staked.

- Select a DeFi staking platform.

- Begin to accumulate staking rewards, which will then be automatically added to the holdings you already have.

Because most platforms’ staking processes are straightforward and only require following a few simple steps, staking does not require any particular technical skills from its participants.

It is not necessary for the user, as an illustration, to develop a smart contract because this will already have been incorporated into the functionality of the platform.

Types of DeFi staking

Investors in DeFi should always keep the risks associated with relatively new and volatile cryptocurrency assets in mind when making investments.

There is the potential for high returns for those willing to take such risks, but investing in a stablecoin DeFi staking network might be the best and most beneficial solution for investors willing to take on a more moderate level of risk.

Stablecoins have very low levels of volatility, and they typically provide a high level of liquidity, which makes it easier to trade and participate in stakes.

An emerging type of staking network is known as a synthetic token staking platform. These platforms make it possible for investors to trade traditional assets such as stocks, shares, and precious metals using cryptocurrency.

Synthetix is the most prominent platform currently available of this kind. It was built on Ethereum and is based on a system that is comparable to MakerDao. On this platform, the SNX token is staked as collateral to create sUSD (synthetic USD) and potentially any synthetic asset.

In addition to traditional staking, holders of PoS coins can participate in a variety of alternative forms of staking, the most common of which are yield farming and liquidity mining. Pure staking is also an option.

Yield Farming

Yield farming is another type of decentralized finance that aims to maximize returns and functions by enabling participants to move their crypto assets across various DeFi staking platforms. Yield farming is also known as “crypto-asset farming.”

Coins or tokens are not used to verify transactions when yield farming is taking place; rather, they are used to provide liquidity to cryptocurrency exchanges.

These platforms allow yield farmers to lend, borrow, or stake coins in order to earn interest and a percentage of the platform’s overall revenue.

Some people also make bets on the fluctuation of prices. Smart contracts are what make regular staking possible, and the same is true for DeFi yield farming.

When compared to traditional markets, one of the advantages of using DeFi yield farming is the flexibility it produces. This flexibility comes in the form of open markets that are available around the clock, effortless automation driven by smart contracts, and the absence of intermediaries, which gives participants access to many opportunities to define personalized investment strategies.

Platforms that aggregate several other liquidity pools and protocols, such as Ethereum and Binance Smart Chain, into a single location are known as DeFi staking aggregators. The purpose of these platforms is to help users maximize their profits by reducing the amount of time they spend on cryptocurrency trades and increasing the effectiveness of those trades.

Liquidity mining

A practice known as “liquidity mining” is analogous to “yield farming” in that it involves the depositing of crypto assets into liquidity pools in order to facilitate trading on decentralized exchanges without the use of intermediaries (DEXs).

In their most basic form, liquidity miners are individuals who lend their holdings to DeFi platforms in exchange for rewards such as a portion of the platform’s fees or newly issued tokens. This helps the platforms meet the demand for liquidity.

A liquidity pool will typically consist of a trading pair, such as ETH/USDC. The so-called miner or provider (LP) will have the option to stake either asset in the pool, which will make it simpler for traders to enter or exit their positions.

When it comes to mining for liquidity, the goal is to ensure that all parties involved are rewarded in some way for their participation.

Traders get the opportunity to participate and contribute to a decentralized ecosystem with all of its benefits, trading platforms get the necessary liquidity to grow, and limited partners get their share of the fees.

In order to be able to compete in a rapidly expanding environment for the benefit of the participants, DeFi protocols need to provide the best possible incentives for their users.

Benefits of staking in DEFI

We made the point that the advantages and disadvantages of DeFi staking might differ for the staking platforms and the individuals who participate in it.

A straightforward method of earning passive income, higher rewards than a savings account at a bank, and direct participation in the mission of a project as well as the network’s security and advancement, are some of the benefits enjoyed by Stakers.

On the other hand, the ability to rely on stakes (validators) to provide security and the appropriate workflow is one of the benefits that DeFi staking brings to staking platforms.

A substantial quantity of native tokens that have been staked also provides the liquidity essential to a company’s growth. A further advantage of PoS is that it has a smaller impact on the surrounding environment when compared to PoW.

Disadvantages of DEFI Staking

In addition to dealing with the significant challenges that are typically associated with the cryptocurrency industry, such as high volatility and network security, defi staking brings up additional concerns that are unique to the industry.

Even though many people will be enticed to take part by the promise of simple profits, it is easy for them to forget that there is also the possibility of losing their investment.

Your awareness of such dangers will enable you to make a more informed decision about whether or not you should stake and how to do so.

Impermanent loss

One of the problems that liquidity providers may encounter with their money is a loss that is only temporary, and this problem is directly associated with liquidity pools.

This event takes place when you deposit tokens into a liquidity pool and their price changes compared to when you provided the tokens. The possibility of incurring a loss as a result of selling the asset is referred to as an impermanent loss.

The more the value shifts, the greater the possibility that some of it will be lost permanently. This is a very real possibility in the highly volatile crypto space; as a result, liquidity pools need to ensure that liquidity providers are offered incentives that are of sufficient value to motivate their participation.

Gas prices

Because of Ethereum’s scalability issues, there is a possibility that gas prices will skyrocket, which will make it difficult and expensive to conduct DeFi transactions. Due to the fact that Ethereum is still the most popular platform for DeFi, the industry’s expansion may be significantly slowed down by the platform’s high gas prices.

Slashing

There is a potential for slashing to occur with PoS blockchains. It occurs when validators on the PoS blockchain either fail to validate transactions correctly or behave fraudulently by engaging in activities such as downtime or double-signing transactions.

In such a scenario, it is possible for the validator as well as the delegators, to lose some of the tokens or rewards they have staked.

In light of everything that has been said, it is imperative that you keep in mind that the DeFi staking industry is still in its infancy, and as such, it is something that needs to be further practiced and developed.

In spite of the fact that it already demonstrates a significant amount of potential and appears to be a valuable alternative to conventional financial tools, it is still in the early stages of experimentation, which presents a great deal of difficulty.

Despite this, the intense competition among the growing number of platforms around the world can only serve to benefit the industry’s efforts to consolidate while simultaneously luring more users into the cryptocurrency space.

The future of DEFi

Staking promises to become an important part of the cryptocurrency industry and represents a significant benefit that Proof-of-Stake (PoS) blockchains have over Proof-of-Work (PoW) platforms.

The development that DeFi enables, as well as the opportunities it presents, are both plentiful. This is especially true when one considers the fact that various ideas, features, and services can be combined and interconnected to produce a system that enables an infinite number of movements and transactions.

Staking in DeFi will take advantage of this flexibility and provide investors with an increasing variety of income streams in order to attract more investment.