With the inception of blockchain technology, each blockchain network functioned autonomously, thereby limiting the transactions that are being carried out within that particular chain.

Following the increase of blockchain networks and their applications, the prerequisite for a communication between these networks became vital.

Factors like diverse blockchain ecosystem, interoperability challenges, scalability and performance, enhanced functionality and use cases, demand for asset interoperability etc. contributed to the rise of cross-chain interoperability.

Various cross-chain interoperability solutions have been established to create standardized protocols, frameworks, and mechanisms aimed at fostering seamless communication and data transfer between distinct blockchain networks.

Cross-chain interoperability materialized as a way out to the challenges posed by the remote nature of blockchain networks. Cross-chain interoperability enabled communication, sharing of valuable information, data and execution of transactions between different networks.

What are the different methods to purchase cryptocurrencies?

Cryptocurrencies are digital assets or tokens that do not require third-party intervention for transactions to be made. There are various different methods to purchase cryptocurrencies, and these methods are made available depending on the location of the interested user and the particular crypto in question.

But generally, there are three ways to purchase crypto and they include: crypto exchanges, brokerages, or payment services. Between these three, exchange platforms are more popular because they proffer lower fees than brokerages and how accessible they are to new users.

A crypto exchange platform promotes the trading of cryptocurrencies. it is basically a kind of online market-place that facilitates trading of cryptocurrencies between buyers and sellers. They offer different rates, fees and regulations.

Some popular crypto exchange platforms include: Kraken, Coinbase, Crypto.com, Gemini, BitMart, Cash App etc. Going further the line, traders must decide to choose between the two types of offering.

There are centralized and decentralized crypto exchange offering, and each has advantages and disadvantages.

What are some of the advantages of centralized exchanges (CEX)?

Centralized cryptocurrency exchanges act as arbitrators between a buyer and a seller. CEX, which organizes crypto trading on a large scale, operates similarly to stock exchanges.

A central authority or entities facilitates the transaction of assets between a buyer and seller. The funds deposited by users in the CEX are held by the exchange, who acts as a custodian to the funds. The exchange further provides an order book that displays the current buy and sell orders from users.

The central authority manages the order book, matching buy and sell orders from several users to foster trades.

Centralized exchanges usually support features such as market orders, limit orders, stop-loss orders, and margin trading. They also provide services like fiat currency deposits, asset custody and withdrawals, permitting traders to convert their cryptocurrencies into traditional currencies and vice versa.

These type of exchange often offer a user-friendly interface that new users find easy to navigate through while trading. Centralized exchanges provide convenience, higher liquidity, functionality in terms of advanced features like the establishment of futures and derivatives, customer support and security techniques such as cold storage, encryption, two-factor authentication etc.

Why aren’t CEXs efficient in their current state?

Despite its popularity and high use cases, it is worth mentioning that CEXs have disadvantages.

They face challenges and short-comings that affect their efficiency in their current state. Their centralized nature makes them susceptible to single points of failure such as hacking, trading halts, internal frauds, limitations on privacy and anonymity. Not to forget security risks given the large amounts of funds stored on their platforms which could lead to massive financial losses for traders.

The level of transparency they offer also raises another cause for alarm towards market manipulation, unfair practices, abuse of user data etc. Centralized exchanges usually function as closed systems, where users have restricted visibility into the inner workings of the platform. Users are expected to trust on the reputation and credibility of the exchange without being able to freely confirm its operations.

Other reasons include regulatory challenges, centralized control, scalability issues etc. These inadequacies have led to the rise of decentralized exchanges (DEXs), which exists to address some of the limitations of centralized exchanges by providing deep security, privacy, transparency, and control over user funds.

What are some of the Advantages of Decentralized Exchanges?

Decentralized exchanges (DEXs) operate on decentralized networks, built on blockchain technology.

In DEXs, the users control and own funds and can make trading decisions themselves without relying on intermediaries. DEXs aims to remove intermediaries and third-parties, it offers a peer-to-peer trading environment in contrast to centralized exchanges which prevents market manipulation.

DEXs operates with a smart contract that can automatically execute and enforce a set of conditions while recording all transactions straight to the blockchain.

Unlike in CEXs, these exchanges are not direct custodians of user’s funds, this makes it less vulnerable to hackers and other malicious attacks, thereby promoting security. Transactions and order books in DEXs are openly visible on the blockchain, which facilitates transparency, ensures trust, reduces risks of price manipulation and enhances auditability.

DEXs also offer users access to wide variety of tokens and cryptocurrencies because they are not limited to listing only the assets permitted by a centralized exchange. This gives user’s better options and allows them to participate in trading for several projects and tokens.

When compared with CEXs, DEXs usually have lower trading fees as there is no need to pay for the infrastructure and operational costs connected with running a centralized exchange platform.

In decentralized exchange platforms, liquidity pool mechanisms are employed, which allows users to contribute their funds to a shared pool in order to facilitate trading. This model allows users to trade directly among themselves thereby eliminating the need for an intermediary.

Also, with this very model, users profit from additional anonymity given that they won’t be required to adhere to Know Your Customer (KYC) or Anti-Money Laundering (AML) protocols, in order words, they don’t exercise censorship.

What are some of the disadvantages of decentralized exchanges?

Decentralized exchanges are not without limitations and disadvantages such as possible liquidity limitations, slower transaction speed due to blockchain confirmation time, less user interface, security risks and limited scalability.

DEXs can be regarded as complex when compared to CEXs. Using decentralized exchanges usually require users to have a reasonable level of technical understanding and expertise with blockchain wallets and dApps. New users might find the process of navigating through various DEX interfaces, managing private keys and connecting wallets quite overwhelming.

Although DEXs supports a wide variety of tokens, cryptocurrencies, including newer and developing projects, they may not have the same widespread selection of assets like CEXs. The problem of limited asset offerings can be seen as a drawback for DEXs.

Some popular tokens and trading pairs may be completely obtainable on centralized platforms due to listing requirements, partnerships, or regulatory considerations. This limitation might restrain the choices available to traders who are looking for specific assets or trading prospects.

Given how comparatively low liquidity is in DEXs, price instability can be more prominent than in CEXs. The impact of larger trades on DEX can lead to potential fluctuation or unfavorable execution price. There is also the lack of Fiat On-Ramps in DEXs.

Basically, DEXs operate with cryptocurrencies, which implies that they often lack direct support for fiat currencies. This can make it difficult for users who do not already hold cryptocurrencies to convert their fiat currency into cryptocurrencies for trading purposes.

Additionally, since these exchanges are still in their infancy as regards development, those who are not so familiar with decentralized blockchain technology have often encountered high obstacles to entry to start using them.

What is the next evolution for cryptocurrency exchanges?

Cryptocurrency exchanges have witnessed a lot of significant evolution in recent years, creating various features and services to address the needs of traders and investors. Considering the limitations in both modern CEX and DEX, some suggested that for an extensive asset adoption, a non-custodial platform that supports assets across many networks is required.

The idea is that this experience would allow users to have total control of their funds round-the-clock without giving up the flexibility of a potential user experience.

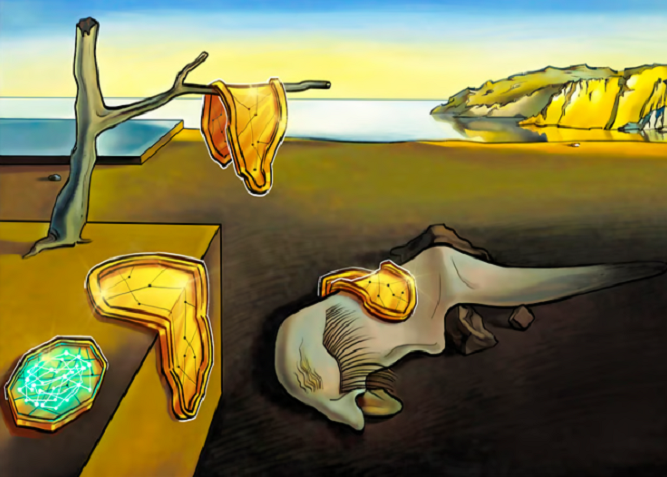

Launched on September 29, 2021, Polkadex (PDEX) is a decentralized P2P trustless cryptocurrency exchange for the DeFi ecosystem that presents a major alternative. The goal of Polkadex is to unite the features of cryptocurrency exchanges and user experience with the benefits of decentralized safety and security.

It has projected this next exchange iteration as a decentralized P2P order book-based cryptocurrency exchange. This project intends to become the trading engine of Web3 by merging the best of DEXs and CEXs while eliminating their disadvantages.

To accomplish this, Polkadex came up with a solution based on trusted execution environment technology (TEE). With this solution, Polkadex eliminates the notion of custody for exchange operators, thereby creating non-custodial exchange platforms that performs as fast as centralized exchanges, introducing delegation where someone else trades on your behalf but you still maintain access to your assets.

Polkadex aims to support assets from across chains in a fully decentralized way, simply put, it is considered to be a DEX that feels like a Cex. Polkadex is also developing THEA, a technology that makes a decentralized token bridge between Ethereum and Polkadex (and other chains in the future) possible.

It is said to potentially, support assets from the entire Polkadot ecosystem, as well as its corresponding parachains. The combination of interoperability layers will bind Ethereum, Polkadot, and later on, other blockchains under one whole decentralized trading space.

Polkadex is making it possible for investors to trade assets from different blockchains while ensuring that user’s funds and smart contracts keys are still kept under the user’s control by using a model that includes a layer-2 execution environment, a parachain, and a decentralized token bridge.

Additionally, the exchange offers supplementary offerings, which includes PolkalDO, a complete decentralized and on-chain IDO Launchpad, which will be effortlessly incorporated with Polkadex Orderbook, Parachains and THEAs cross-chain bridges. THEA remains the basis for interoperability between Polkadex, Ethereum and other chains along the line.